Bull vs. Bear: Play on the blockchain

Bull vs. Bear is a weekly feature where the VettaFi writer’s room takes opposing sides for a debate on controversial stocks, strategies or market ideas – with plenty of discussion on ETF ideas for both angles. For this edition of Bull vs. Bear discusses Karrie Gordon and James Comtois’ investment case for and against blockchain stocks, in the wake of several crashes in crypto companies.

Karrie Gordon, Staff Writer, VettaFi: Okay, James, I’ve come fully decked out in my fencing gear (took some time to get it tailored to bull size) because I know this is one you’ll be so happy to try and cut into ribbons around me.

I know it exists a lot – and I mean it a lot — for reasons to be cautious about crypto right now, granted FTX collapses and the domino effect that has had on the crypto ecosystem of exchanges and lenders. It’s easy to point to FTX and Alameda Research, but their potentially fraudulent actions are not unique to crypto (see also: Enron, World Com, and Lehman Brothers) or indicates failure in crypto specifically.

While I’m not here to argue for cryptocurrencies, I still believe there are many reasons to be positive about blockchain technology itself and the companies that develop it. And I’m in good company: Major players in the financial industry have been using it for years.

Way back in 2016, JPMorgan, led by renowned crypto-skeptic Jamie Dimon, developed Quorum, a permissioned blockchain used for business applications; the company continues to make big steps in blockchain today. They’re just one of many financial industry giants to commit to blockchain, but I feel it’s remarkable given Dimon’s public contempt of crypto tokens, but believe in the potential of the underlying blockchain technology.

James Comtois, staff writer, VettaFi: Karrie, when you invited me to the VettaFi Parry Club, I was worried that we would be fencing, because this little bear has been terrible at the sport all his life. Maybe because of those giant bear claws? Fortunately, given that I actually have these big bear claws, I feel like I can hold my own in a fight over blockchain.

Being bearish on crypto these days seems like catching fish in a barrel (which, as you know, carries love), but yyou are right that blockchain technology offers the glimmer of a silver lining in the crypto cloud. I agree with that blockchain has potential. Its positive aspects are immutability, transparency, convenience and the ability to leave an irreversible audit trail.

Except that the technology is almost ready for prime time. Not only is it almost impossible fix a bug on the blockchain when it is postedbut it is also still very easy to hackwith often no recourse for the victim. I know I don’t want my entire medical history on that thing! So while there may be potential, there are still too many uncertainties in blockchain to make it a worthwhile investment, in my not-so-humble opinion.

Gordon: While it is not impossible to fix a bug or roll back a significant hack on decentralized blockchains, it is doesn’t happen often. Public blockchains are also constantly evolving, building better security and features all the time.

I agree that the biggest challenge right now for blockchain is its inception, but it is also the biggest opportunity. As we have seen in the technology space historically, with rapid growth comes rapid development: Professor at Northeastern University Ravi Sarathy expected that blockchain for large enterprises (companies with over 1,000 employees that use blockchain in their operations) will be common by 2030. The latest market share estimates for the global blockchain technology market is forecast to grow to $69 billion by 2030, with a CAGR of 68% between 2022 and 2030. That’s up from a forecast of $4.8 billion in 2021.

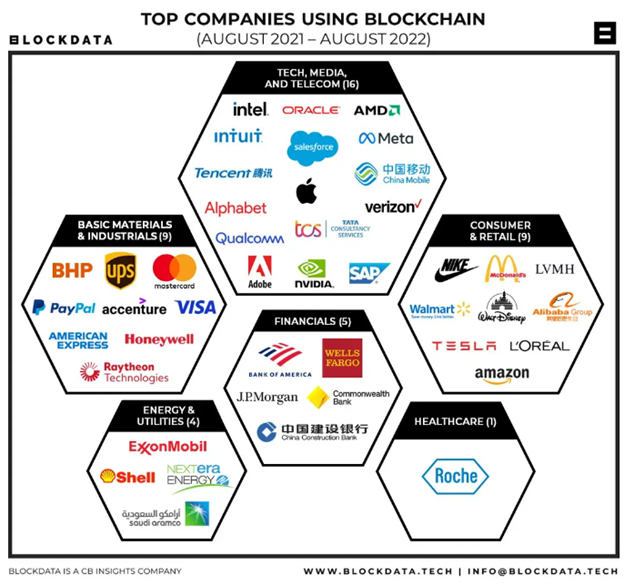

That shouldn’t be a big surprise, given that the 2021 vintage Global Blockchain Survey conducted by Deloitte reported that 81% of 1,280 finance executives worldwide believed blockchain was scalable and had reached mainstream adoption potential. Even more tellingly, 73% said that not adopting blockchain would put them at a competitive disadvantage. Companies recognize this disruptive potential, with 44 of the top 100 public companies by market capitalization already using blockchain technology, according to BlockData.

I am convinced that blockchain will have a fundamental role to play in the digital world which is evolving and will be as disruptive to how we account for and track things, verify transactions and transfer ownership as the internet was to the distribution of information. That’s huge disruption potential, and something you want to make sure your portfolio is on the right side of.

The Siren Nasdaq NexGen Economy ETF (BLCN) appeals to me right now given the price options. This ETF puts more emphasis on the companies that actually use and develop blockchain – so it has a portfolio of mostly well-known financial entities and the like, with minimal exposure to crypto miners and exchanges that tend to show up in higher weights in other crypto- ETFs. Given crypto’s collapse, I think it’s a smarter play right now (although the fund is still down 44% YTD, it’s still more buoyant than other crypto funds).

Comtois: I have no doubt that blockchain will play a significant role in our lives in the future. But it is a question of when that change is taking hold, and what growing pains the technology has to go through to get there.

Blockchain being unregulated and decentralized is ultimately a net negative, I think, and one of the reasons why huge amounts of fraud we see represents a function of the system, not a bug. The anonymous nature of decentralized blockchains can make them the ideal technology for fraudsters and criminals (see “The Silk Road” digital black market scandal). Plus, the lack of a universal standard making interoperability between blockchains a real challenge.

If brave (or rather, foolhardy) investors want to put money into the chain, then I think they should at least wait until there is some form of regulation (which appears to be much easier said than done) so they are protected from bad actors.

A lot of it comes down to whether you see a fund like BLCN that’s down 44% YTD (by comparison, the S&P 500 is down just 15%) as a good opportunity, or as a sign that it’s investing in a rapidly sinking ship. I’m pretty firmly in the latter camp.

Maybe I’m just overly pessimistic about the potential of blockchain’s future. But then again, I’m just a bear with a barrel here.

Gordon: Okay, let me stop you for a moment to clear up a common misunderstanding. Blockchain is a distributed ledger, but it is not inherently decentralized. The type of blockchains that the private sector uses are actually centralized versions most of the time, meaning that the company or an individual has control over them.

So e.g. vanguard uses blockchain technology to retrieve index data from providersbecause it’is faster and more efficient than traditional methods. FedEx (FDX) uses it for manage their supply chain. Another good example closer to our stomping ground: WisdomTree (WT) is leaning into blockchain as the way of the future in a big way with a multitude of blockchain-enabled ETFs and their own pending blockchain-native finance app. (Actually, I recently chatted with Jarrett Lilien about it: WisdomTree president discusses brand evolution and the digital future.)

When it comes to US regulation, I know firsthand what a difficult process it has been to get anything meaningful out of the various US regulatory bodies – it’s a geeky thing I tend to follow and write about sometimes. (See also: Commissioner Hester Peirce wants meaningful crypto action.) Despite FTX’s spectacular implosion, I think taking the time to get crypto regulation right is the right approach by the SEC, lest we drive innovation potential completely out of the US

Comtois: While it’s a good sign for blockchain that established financial firms like Vanguard and WisdomTree are leveraging the technology, I see just as many institutions abandon their efforts to use blockchainincluding the Australian Stock Exchange, IBMand Amazon. As crypto, the blockchain in its current state feels very much like a mirage which disappears the closer you get to it.

You also see contagion in several companies related to crypto and blockchain technology (and as it stands now, blockchain and cryptocurrencies are still inextricably linked) that are not connected to FTX. Crypto lenders BlockFi, Three Arrows Capital, Voyager Digitaland Celsius network has everything filed for bankruptcy.

Investors who are bearish on this technology can express this view via short bitcoin exposure, which they could find in ProShares Short Bitcoin Strategy ETF (BITI). Plus, Direxion have submitted to start Direxion Bitcoin Strategy Bear ETF, which will provide managed short exposure to CME bitcoin futures contracts.

Gordon: I would disagree that they are inextricably linked, but that is a long-winded argument for another time. It is important to note that despite the crypto winter this year that has hit cryptocurrencies and tokens hard, the emerging technology sub-sectors that saw the most private investment in the third quarter via venture capital firms were Web3 (the proposed decentralized evolution of the Internet) and DeFi, both built on blockchain technology, bringing in $879 million in investment and beating out fintech and biotech, according to PitchBook.

Investment is alive and well in blockchain, a disruptive and fundamental building block of the future for many core industries in the US economy, including financial services, healthcare, government, infrastructure, energy and more. If you want a cleaner play on the crypto economy, then I strongly recommend that you consider actively managed funds, given the volatile nature of investing in a nascent industry. For investors interested in companies that have this more direct exposure to the crypto-economy while still focusing on blockchain development and growth, they are actively managed Amplify Transformational Data Sharing ETF (BLOK) might be worth a look.

Now, if you’ll excuse me, I’m going to figure out how to return this clearly unnecessary barrel of fish and also think about why I ever thought hoof fencing was a good idea.

Comtois: Here, let me help you with that barrel. As always, it was a pleasure, Karrie. You have been a wonderfully optimistic bull. I look forward to the next time we spar. Until then, I feel I should remind everyone cryptocurrency is a scam and call it a day.

For more news, information and analysis, visit Crypto channel.