Bootstrapping basics, the future of fintech, tech employers benefit • TechCrunch

Planning to play League of Legends during your next investor pitch? (If so, reading this probably isn’t a good use of your time.)

For founders interested in building on their own, maintaining control, and staying off the fundraising treadmill for as long as possible, investor/founder Marjorie Radlo-Zandi lays out five basic principles for bootstrapped founders in her latest TC+ article.

It’s not for everyone: self-funded companies will demand more from their employees than larger businesses that offer free lunches and other perks. At a startup where I worked, I was asked to defer part of my salary – after I was hired.

Full TechCrunch+ articles are available to members only

Use discount code TCP PLUS ROUNDUP to save 20% off a one or two year subscription

Radlo-Zandi covers the basics of hiring, managing expenses and shaping corporate culture, but she also encourages self-funders to temper expectations and take a measured approach:

“Don’t be tempted to jump on a plane at a moment’s notice to meet with potential clients in glamorous locations or for meetings in remote locations,” she writes. “Your start-up business probably won’t survive such large discretionary financial expenses.”

Bootstrapped entrepreneurs face longer odds, but if they can drive growth and reach product-market fit, “fundraising will be so much easier.”

Thank you so much for reading,

Walter Thompson

Editor-in-Chief, TechCrunch+

@yourprotagonist

The pendulum of power is swinging back to the employers, isn’t it?

Image credit: AOosthuizen (opens in new window) / Getty Images

More than 120,000 tech workers have lost their jobs so far this year, according to layoffs.fyi. And with more than a fifth of those layoffs in November, many from well-capitalized public companies, it’s easy to see why Continuum CEO Nolan Church thinks this is the beginning of a wave.

“Over the last 12 years, the pendulum of who has power between employees and employers has swung drastically against employees,” he said last week on the TechCrunch Equity podcast.

“Now we are in a moment where the pendulum is swinging back.”

Answers for H-1B workers who have been laid off (or think they may be)

Group of young adults, photographed from above, on various painted asphalt surfaces, at sunrise.

Sophie Alcorn, an immigration attorney based in Silicon Valley, estimates that 15% of recent layoffs from Bay Area startups are immigrants, 90% of whom are H-1B holders.

If you’re a visa holder who’s been laid off, your first priority is to “find out your last day of work, because that’s when you have to start counting the 60-day grace period,” says Alcorn.

“Either you get a new job, leave, or you figure out another way to become legal in the United States, but you have to take some action within those 60 days.”

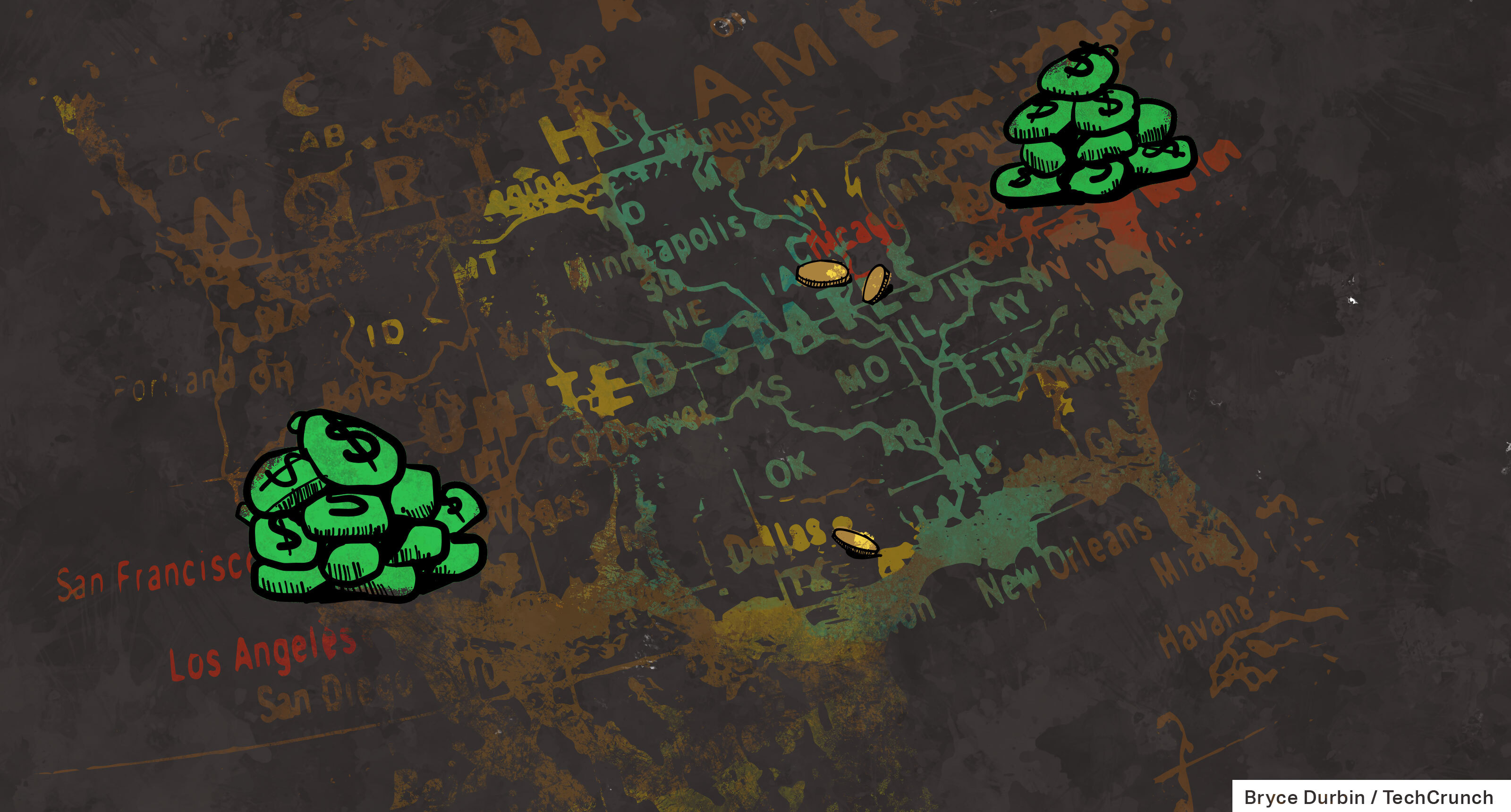

Nearly 80% of venture funds raised in just two states as US LPs retreat to the coasts

Image credit: Bryce Durbin / TechCrunch

After the pandemic began, there was a lot of buzz about how venture capital was moving away from its roots in San Francisco and New York to make inroads into the Midwest.

But after a prolonged downturn in public markets left so many investors on the sidelines, data shows that “most funds outside the two biggest startup hubs … are feeling the chill from would-be LPs,” reports Rebecca Szkutak.

“So far this year, 77% of capital has been raised in California and New York alone. In 2021, these states raised 68% of the year’s total.”

Preparing for fintech’s second decade: 4 moves your firm needs to make now

Image credit: Emilija Manevska (opens in new window) / Getty Images

According to consultant Grant Easterbrook, fintech startups hoping to succeed in the next few years must be prepared to go up against:

- Major banks and financial service providers with loyalty programs and “super apps”.

- New DeFi protocols “that can offer financial products involving real-world assets.”

- Banking, invoicing, lending, payments, accounting packaged as “embedded financial products.”

- Several countries are issuing their own Digital Bank Currency (CBDC).

“Your business will need a very strong value proposition to compete with all four types of competitors,” writes Easterbrook, who shares his ideas for navigating the next decade of fintech in a TC+ guest post.