Blockchain VC investment in a down market is not necessarily a downer

[gpt3]rewrite

Blockchain-based investing has become more difficult thanks to “crypto” crime and a broader economic downturn, but some venture capital figures see undeniable benefits in the current climate.

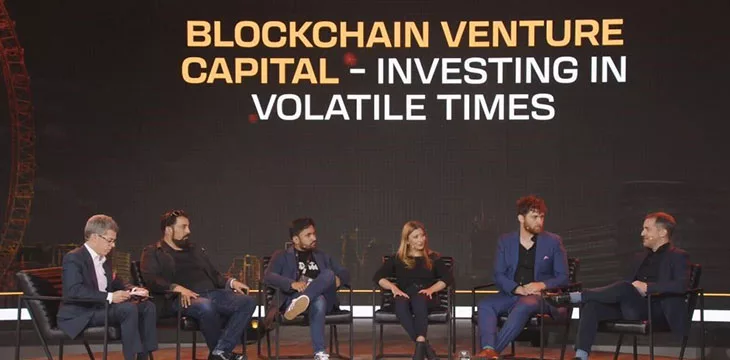

The final panel on Day 2 of the London Blockchain Conference 2023 was titled “Blockchain Venture Capital – Investing in Volatile Times.” Moderated by Ayre Ventures CEO Paul Rajchgod, the panel brought together five prominent VCs with experience in blockchain investing, including many with portfolio companies built on the BSV blockchain.

Rajchgod asked each member to offer their company’s areas of focus and perspectives on the current VC climate. Mona Tiesler, chief investment officer at Tokentus Investment AG, noted that her company went public in Germany, which means anyone can buy shares in Tokentus, “so we’re trying to create a lot of symbiosis within our entire stakeholder network.”

One Tokentus portfolio company that Tiesler was eager to discuss was Transak, a fiat off/on ramp that works with over 160 different tokens and 75+ blockchains, helping customers in over 150 countries go from Web2 to Web3. Tiesler called Transak “a real-world use case that helps people onboard space and helps the industry grow.”

Farid Haque, General Partner at Systema Nova, said his group was focused on B2B applications, “anything that can make businesses more efficient, help them be faster/better/cheaper.” Haque encouraged founders to highlight these kinds of benefits in their pitch deck, calling it “a huge call to action” for any VC who sees promises of 10x cheaper and 20x faster.

Haque’s company takes “a first-to-market approach,” recalling legendary tech VC icon Don Valentine’s strategy of investing “first in very large markets.” Haque said market size was “a big determinant for us.”

Among the companies Haque is excited about is CUR8, which offers curated investments for ethical investors, and for which Systema Nova just announced a funding deal with Google Ventures. CUR8 is a “full-stack decarbonization finance business,” and Haque said, “A lot of the rails for that kind of thing have to be blockchain-enabled.”

Ray Sharma, founder/partner at Extreme Venture Partners, described the company’s interest in Africa, with a current focus on Nigeria and a long-term expansion target into Egypt, Kenya and South Africa. Sharma said that around 80% of startup activity in Africa is in fintech, which is not surprising given that “50% of mobile transactions on the planet happen on the continent.”

Sharma compared Africa’s penchant for innovation to China’s approach to messaging apps. At first, China simply imitated Western products, but soon integrated gaming, payments and other innovations, to the point where the West is now playing catch-up.

However, Sharma urged caution against “overselling” blockchain’s ability to transform business sectors. While there are undeniable benefits to incorporating blockchain technology, Sharma said it was “just one of a checklist of items … maybe one of 10” that companies seemed to use when creating solutions. Blockchain can help, but it is not a magic bullet.

SNGLR is, according to Rajchgod, “the newest kid on the block” in terms of blockchain VCs, having established longevity, smart cities and smart mobility as its key areas of interest. But co-founder and general partner Patrick Sutter said SNGLR was interested in “technologies where we expect the most growth,” and SNGLR identified these as blockchain and artificial intelligence (AI).

SNGLR, which has a partnership with Ayre Ventures, expects to make its first closing this summer, but Sutter detailed SNGLR’s experiences with a couple of companies. One, a drone infrastructure provider, was highly regarded by drone manufacturers, but the preferred revenue model required a micropayment solution (which only a low-fee blockchain like BSV blockchain can offer).

Sutter was less enthusiastic about another company that resisted embracing blockchain to the extent SNGLR believed warranted. In the end, SNGLR decided not to proceed with the investment, saying, “If you’re not going to the blockchain, we’re probably not right for you.”

Unbounded Capital is no stranger to the BSV blockchain ecosystem, and managing partner Zach Resnick was keen to emphasize that his group is looking for projects “where blockchain is not it a tick.” Unbounded is seeking “tech founders who leverage blockchain to do something that wasn’t possible before without blockchain, or something we know is an established market today, but makes it at least 10 times faster or cheaper as a result of using blockchain.”

An example of the former is DXS, which allows individuals to invest or trade US stocks and derivatives “in increments as low as 1¢.” An example of the latter is RF Labs, run by “an incredible 19-year-old from Atlanta who figured out how to produce RFID cards about 8 times cheaper than anyone had before because he needed to make the economics work for his business. “

Currently, RF Labs’ primary offering is a poker table that combines software and RFID to track analytics and automate live streams with the goal of reimagining how live poker is played. The ultimate goal involves incorporating this technology into any game with live players, including chess.

Resnick says the RF Labs Atlanta wunderkind doesn’t currently use any blockchain technology, but he hopes to get his products into casinos, where Resnick says “security is extremely important. We’re very confident he’ll end up having to use blockchain as he scales and grows his business.”

‘Crypto’ luggage

The blockchain sector has suffered no shortage of negative press over the past year or so. A seemingly endless series of high-profile collapses exposed the toxic mix of rampant criminality and downright ineptitude that soured both retail clients and institutional investors. Rajchgod wondered what impact all this negativity was having on the blockchain VC sector.

Extreme’s Sharma took the opposite view, saying, “Criminal activity was important in getting the industry going.” Sharma likened it to the early internet’s first real business model, pornography, which has its own “negative connotations”. But this helped “push the technical envelope and find applications that are useful that then become the basis for more traditional applications.”

Tiesler said there was definitely a loss of institutional confidence in blockchain investments based on “not enough education and knowledge out there about the differences between efficiency-creating blockchain technology and speculative ‘crypto’ or negative actors.” However, she expressed confidence in the survival of companies with real solutions to offer.

Resnick agreed, expressing disappointment that for many investors he talks to, “blockchain and ‘crypto’ are basically synonymous.” But he doesn’t think entrepreneurs will be distracted. “People who want to build great things are going to build great things.”

However, Resnick added a specific observation for the BSV blockchain community, saying there is “often an elephant in the room” when he comes into contact with investors or companies that have yet to integrate blockchain technology. Resnick said he’s had entrepreneurs tell him that other VCs have warned that “if you build on BSV, you won’t get our investment.”

The BSV blockchain’s “bad reputation” is all the more irksome to Resnick given that “empirically speaking, this blockchain is the only one that has gotten faster and cheaper over time — literally the only one.” In the long term, BSV blockchain’s positive aspects outweigh this negative perception, but it is something that BSV blockchain-based startups must keep in mind.

Resnick advised all BSV blockchain founders in attendance not to “worry about explaining the technology” when pitching investors. “We think it’s great, but try to talk about it as little as possible with investors. Do as much showing vs. telling…show what blockchains can enable while abstracting away as much as possible. Maybe it comes up in due diligence, but it’s not a core part of the pitch. I think it will serve people well.”

Half full or half empty?

As for the general climate out there for blockchain-focused VCs, Haque said the “crypto” attacks of 2022 and the broader economic downturn had definitely created problems for new VC managers looking to raise funds as “the number of acquisition wells has dried up a little bit.” However, the funds that were able to collect pre-crash have “a lot of dry powder” at the moment.

Haque also found some positives in the current situation, including “slowing down the pace of deployment… It’s not really a light under my ass to do more than one deal a month.” Haque found the environment to be “less transactional, a lot more about building relationships, getting back to basics, the way VC was … I’m quite comfortable, to be honest.”

Sutter noted another benefit of the downturn, namely that the lack of VC interest forced startups to downgrade their valuations. Tiesler echoed this view, joking about “discount trading” in evaluating target companies.

Sharma suggested that entrepreneurs should stop pushing to maximize valuation from investors. “It sounds counterintuitive, but with great valuation comes great expectations and therefore great responsibility.”

Resnick said there is “always an inverse relationship between how excited people are about an industry and how profitable it is to invest in those industries.” Looking at VC funds that invested in 2010 in the wake of the global financial crisis, Resnick said they drastically outperformed both investments made in the years leading up to the collapse or those made in 2014. Resnick expects similar positives results from investments made in 2023.

Resnick said the current environment is also different in that VCs are investing in fewer companies but taking a larger portion of the equity. Far from being sullen, Resnick called the current situation “the best investment environment I’ve seen since I started Unbounded.”

A delicate dance

Rajchgod concluded by asking the panel about their interest in AI. Sharma praised the ability of AI to do much of the early grunt work of programming. Sharma used the example of a company getting $500,000 from a VC, of which $300,000 would traditionally have gone to software development. With AI, this cost can now only be $30,000, so you can either reallocate the remaining $270,000 to sales or simply raise less money and retain more equity.

Sutter acknowledged that AI was undeniably impressive in terms of productivity gains, but the missing element was trust. “Anything that’s data-driven can benefit from the layer of trust that blockchain can provide. AI needs the blockchain to really achieve that level of trust.”

Tiesler agreed, citing a company that is using “core blockchain technology” to develop a mechanism to verify the data sources that AI uses to produce responses to text requests. Tiesler called this a “very interesting intersection of how these two technologies can dance with each other to make mass adoption more accessible.”

While Resnick also believes AI will benefit from the trust aspects that blockchain can provide, he also believes “micropayments will be at the heart of the future of what AI looks like.” Since the BSV blockchain is the most cost-effective way to transact via the blockchain, intelligence – human or artificial – indicates that BSV blockchain-based investments are still a very good bet.

See highlights of Day 2: Reduce risk and improve trust with blockchain

New to Bitcoin? Check out CoinGeeks Bitcoin for beginners section, the ultimate resource guide for learning more about Bitcoin – originally envisioned by Satoshi Nakamoto – and blockchain.

[gpt3]