Blockchain games are doing well despite the failure of FTX

FTX’s collapse has shocked the crypto world and taken billions of dollars off the market. Next to the LUNA collapse and some crypto hacks, this year has been the worst year for crypto investors and every trader, investor and crypto related company is somewhat hard hit this year. However, one sector stands out from the rest and that is blockchain gaming.

Ever since it hit the big stage, the gaming industry has been moving in an upward direction and its active users are increasing day by day. In September 2022, of the total blockchain activity, 45% belonged to the blockchain gaming industry. It had 911,720 daily unique active wallets in September. In October, there was no change in the daily unique active wallet and it remains the same. However, November was not the same.

November and gaming

On 6th November Coindest’s report on FTX and Alameda’s balance sheet shocked the crypto world, and within days FTX filed for bankruptcy. This affected the entire crypto market and also the gaming industry. In November, the average daily unique active wallet (dUAW) dropped to 800,875. This is a 12% decrease, but it still represents the most important part of the industry, accounting for 42.67% of all blockchain activity.

Nevertheless, considering the crypto situation, this is not a big drop in dUAW which shows the resilience of gaming activity in the crypto world.

Top gaming protocols

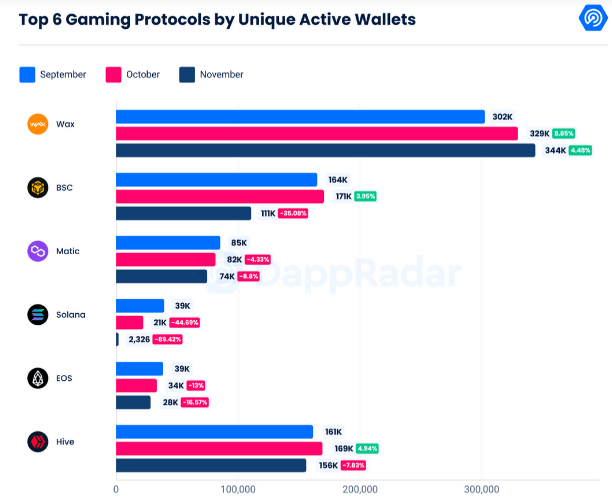

Although there are hundreds of different gaming protocols, six gaming protocols dominate the gaming industry.

WAX gaming protocol

Among them, WAX is a rare gaming protocol that has seen an increase in the number of dUAW in the last three months. In October, it averaged 329,529 daily unique active wallets which is an increase of 8.85% from September. Additionally, the gaming dapp saw a 4.48% increase in November despite the FTX crash. In November, dUAW was 344,284.

Hive game protocol

In October it averaged 169,655 dUAW which increased by 4.94%. However, it saw a 7.83% decline in November, reaching 156,369 dUAW. The activity was the same as in July 2022.

GDP

BNB is harder hit in November, it saw a 35% decrease in activity and the user dropped from an average of 171,269 dUAW to an average of 111,188 dUAW. Just a month ago, in October, BNB was the second most popular gaming protocol after it surpassed the Hive gaming protocol

Polygon

It is one of those gaming protocols whose activity was in a downward trend even before the arrival of the FTX collapse. Its active users have been declining since September, and in October its unique active wallets fell by 4.33% to an average of 82,002 dUAW), while in November it fell by 8.8% to an average of 74,786 dUAW.

EOS

Similarly, EOS activity is also in a downward trend since September. It fell 13% in October, while its unique active wallets fell 16.57% in November.

Solana

If one gaming protocol is hit harder by the FTX collapse than the rest, it’s Solana. It saw a 44.69% decrease in unique active wallets in October, reaching 21,979 daily unique active wallets. While in November the decline was sharper and activity fell by 89.42% (on average 2,326 dUAW). This is the lowest number we have ever recorded for dUAW.

Final thoughts

It is believed that blockchain technology will remain robust despite the failure of FTX, as it lies at the core of other innovative projects that are expected to change our financial system and gaming economy. The technology did not budge, allowing users to store and send assets. The collapse of Alameda and the centralized FTX exchange may not be of interest to those entering the crypto space through gaming or NFT channels.