BitMEX Executive Talks Institutional Crypto Interest

The crypto sector continues to witness support from global institutions despite the many black-swan events. To grow further, the asset class may need time to mature.

The current crypto market is still experiencing the shock waves induced by last year’s black-swan events. Black swan events are rare, unpredictable and severe events that can significantly affect financial markets, including cryptocurrency.

Examples of past Black-Swane events that have impacted the cryptocurrency market include the 2017 China ban, Mt. Gox hack in 2014 and the COVID-19 pandemic in 2020. Last year several crypto institutions collapsed. This year, the fallout from Silvergate Bank caused doubts in the crypto market to skyrocket.

Although it is impossible to predict when and how black-swan events will occur, institutions and individuals can prepare for them by diversifying their investments. They do this by using risk management strategies and staying informed about the latest developments in the market.

Serious market conditions

The price of Bitcoin, the largest cryptocurrency by market capitalization, experienced sharp falls. It was mainly triggered by global markets crashing in response to the above events. However, it quickly recovered towards the end of the year. This was driven in part by the influx of institutional investors and the growing acceptance of cryptocurrencies as a legitimate asset class.

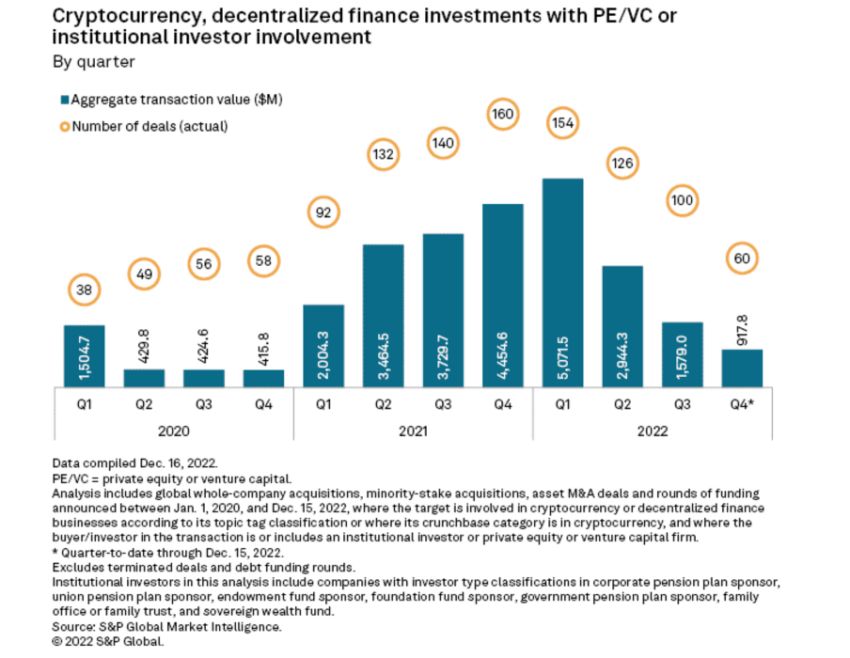

The decentralized finance (DeFi) space also experienced tremendous growth. The total value locked up in these platforms skyrocketed from less than $1 billion in June 2020 to over $47 billion at press time. However, this growth also came with significant risk, as several high-profile hacks and exploits highlighted the vulnerabilities of these platforms. Institutional investment in cryptocurrencies and the DeFi space saw decent funds circulate the network.

S&P Global Market Intelligence published a report to showcase the investments here:

The crypto market remains highly volatile and prone to black-swan events that can cause significant price swings. While one should still expect some level of volatility in the short term, crypto institutions are optimistic about the market’s recovery.

Takes the optimistic approach

Salama Belghali, Global Head of Business Development and Partnerships at BitMEX, talks about this matter. In an exclusive interview with BeInCrypto, Belghali had interesting points to cover.

For example, when asked about the ongoing trend in the struggling market, she stated:

“One of the positive signs we’ve witnessed is that interest from global institutions has not waned amid the market turmoil. The same goes for the growth potential Asian markets are showing as they adopt a more crypto-friendly stance. Just by observing trading activity on the BitMEX platform , we can see confidence growing. With many blockchain projects re-emerging, plus the upcoming Ethereum Shanghai upgrade, we expect the bull market to be just around the corner.”

Despite the recent market volatility in the crypto space, global institutions have had sustained interest in cryptocurrencies. This can be seen in the growing number of institutions, including banks, hedge funds and asset managers, that have started investing in or offering cryptocurrency-related services to their clients.

For example, major investment banks such as Goldman Sachs, JPMorgan and Morgan Stanley have begun offering their clients cryptocurrency exposure through various investment products, such as Bitcoin futures contracts and exchange-traded funds (ETFs).

In addition, prominent asset managers, including BlackRock and Fidelity, have also launched cryptocurrency investment products or are actively exploring the space.

Marching forward despite the storm

Furthermore, several countries’ central banks have also investigated the possibility of launching their own digital currencies. This indicates a growing interest and acceptance of cryptocurrencies at the institutional level.

In addition, firms like BitMEX continue to take steps for further development amid the market meltdown. For example, the crypto exchange, which says it has no FTX or Alameda exposure, even launched a native crypto token (BMEX) for traders. Regardless of market volatility amid the demise of the FTX exchange run by Sam Bankman-Fried.

Needless to say, the token witnessed a roller-coaster start. Over the past 12 months, BMEX has lost approximately 78% of its value. But it started to pick up in 2023, increasing by 16% in the first 45 days of the year. Currently, the 418th ranked token is trading around the $0.53 mark.

Despite the severe price corrections, the team envisioned a bright future for the token in question. This is evident in the strategies made by the team despite the weak start to 2023.

Bullish on Crypto in the long run

The executive is also optimistic about the underlying blockchain technology, which has huge potential to help the crypto sector. In fact, she argued, the capabilities of blockchain technology could improve efficiency in some of the traditional industries, especially in terms of accessibility and transparency.

Speaking further with BeInCrypto, Belghali added:

“For example, we’ve seen an increase in adoption in sectors such as shipping, healthcare, retail and even education. The potential is limitless as technology leaders continue to develop and create innovative products that will help revolutionize the ways we think, work and act . We expect that there will be more use cases of blockchain in the future.”

Like retail, institutional adoption will play a significant role in the coming years. Eric Peters, CEO of One River Digital Asset Management, believes that the next crypto bull run will be compelling as it will be driven by institutional adoption. Despite the prevailing disadvantages, the manager believes that a bull run may have already begun.

Nevertheless, the crypto sector will witness such falls and ultimately rise. As the famous quote from Samuel Beckett says: “Ever tried. Ever failed. Does not matter. Try again. Fails again. Fail better.”

Give Crypto some time

While cryptocurrencies like Bitcoin and Ethereum have been around for over a decade, the industry is still relatively new and constantly evolving.

One of the reasons crypto needs time to grow and mature is that it still needs to be widely adopted by mainstream institutions and individuals. While some large companies started accepting Bitcoin as payment, most businesses and individuals still need to start using cryptocurrencies for daily transactions. This lack of adoption can lead to volatility and uncertainty in the market, as the value of cryptocurrencies can fluctuate based on a few major players.

In addition, the regulatory environment for cryptocurrencies is still evolving. Governments around the world are trying to figure out how to regulate cryptocurrencies while allowing for innovation and growth in the industry. This regulatory uncertainty can create uncertainty for investors and businesses, slowing adoption and change.

Another factor is that the blockchain technology behind cryptocurrencies is still being developed and refined. While blockchain has the potential to revolutionize industries such as finance and supply chain management, it is still a relatively new technology with limitations and challenges that need to be addressed.

While cryptocurrencies have shown promise as an innovative and disruptive technology, they still need time to mature and overcome the challenges and obstacles that prevent their widespread adoption and integration into mainstream society.

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action the reader takes on the information contained on our website is strictly at their own risk.