Bitcoin Weeks Away From Its First Weekly Chart “Death Cross”

Things could soon go from bad to worse for bitcoin (BTC) traders looking for bullish signals on technical charts.

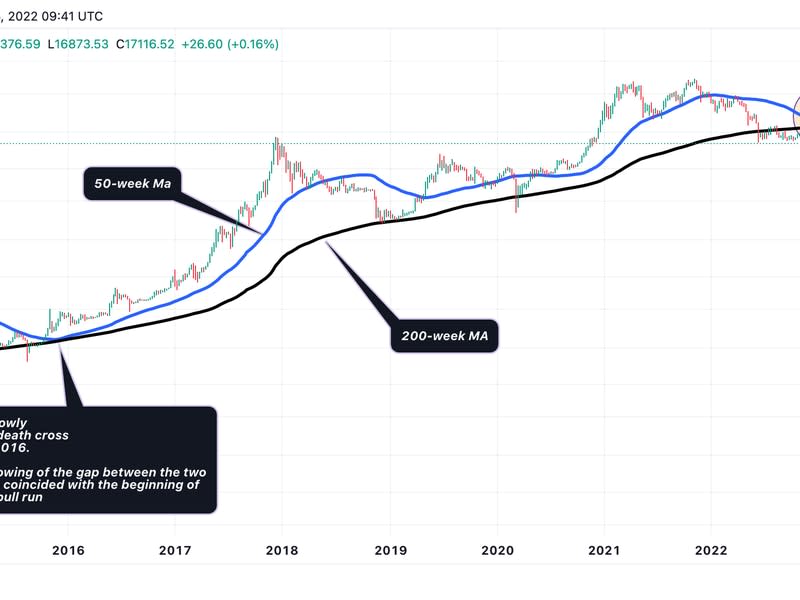

The cryptocurrency’s 50-week simple moving average (SMA) is falling rapidly and looks set to cross below the 200-week SMA for the first time on record.

According to technical analysis theory, the bearish intersection of the two averages, often referred to as the “death cross,” means that the market is about to enter a tail.

Bitcoin has fallen 75% since hitting a record high of $69,000 last November. The bear market has proven to be more intense than the previous ones where sellers failed to establish a foothold below the 200-day SMA.

Critics of technical analysis will point out that the death cross, regardless of whether it occurs on the daily or weekly charts, is a lagging indicator and unreliable. That is largely true, as the indicator is based on backward moving averages and reflects the asset’s past performance.

The death cross has a bad reputation for catching sellers on the wrong side of the market in traditional finance. And it has made it to bitcoin traders in the past. For example, the daily chart’s death cross in March 2020 marked a major price bottom.

Experienced traders therefore read the death cross along with other chart factors and fundamental indicators, which are shared by the next possible move in bitcoin.

Per Delphi Digital, bitcoin’s sideways trading in the $16,500 to $17,300 range in the wake of FTX’s collapse gives bulls little hope.

“We still believe this area does not have much structural support, and in the face of further contagion and uncertainty, we are cautious as we look at the $9k-13k level,” Delphi’s strategists, led by Andrew Krohn, wrote in a note to clients .

More miners or those responsible for minting coins are likely to go bankrupt in the first half of next year, pushing bitcoin to $12,000 and below. Add to that the US Federal Reserve’s persistent anti-stimulus bias, and the path of least resistance appears to be to the downside.

That said, in the past bitcoin has bottomed out to start another rally 15 months before the mining reward halving, a programmed 50% reduction in supply expansion every four years.

The next bitcoin halving is in March/April 2024. If history is a guide, the bitcoin bear market may have ended in November at $15,473 and the cryptocurrency could rise as high as $63,000 before the halving.