Bitcoin value in dollars and the luxury market

Investors, HODLers, crypto traders and analysts of how much Bitcoin is worth in dollars are not the typical profiles seen (up to 20 years ago) on Wall Street in suits and ties. They are the 2.0 version free from the pre-established patterns in everyone’s mind (and that’s a good thing too).

If until a few years ago it was common practice to wear formal clothes that emphasized economic hierarchies, this approach to the so-called “dress code” has changed a lot. The trend towards informality has spread to many sectors, not just technology, driven in part by smart work (remote work) characterized by online meetings that have changed formal work dress “codes” to informally themselves.

The suit doesn’t “make” the man? How much is Bitcoin worth?

People’s perceptions and ideas of managers or investors are difficult to change. in fact, dressing a “certain way” makes it easier (for time immemorial) to fit into a new work environment or, more generally, affects the overall impression you make, because the way you dress “sends a message” about who you are and where you stand or what you want.

Do Does “how you present yourself” still make a difference?

It is a fact that crypto millionaires have “invaded” the luxury market. By realizing a number of expensive purchases and sales of real estate and movable property, they have become the new “whales” in this regard as well.

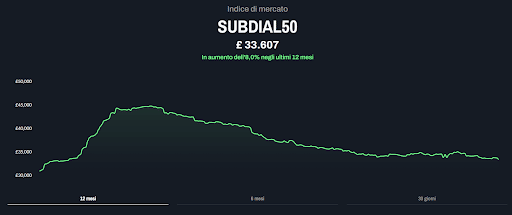

Luxury watches have been an excellent alternative to the usual diversified investments. In fact, according to Bloomberg research, it appears to be the “easiest” and most immediate way to buy Rolex, Patek Philippe and Audemars Piguet over the past year and a half. The Subdial50 index (basket containing the value of the 50 top-selling luxury watches) shows +9% over the past 12 months, but down 4% from 2 months ago.

The index has seen a strong performance following the remarkable rise in cryptocurrencies, but also a steady decline as financial markets and crypto have been going through a difficult period since the beginning of the year. After peaks in March and February 2022, Bitcoin saw a decline of more than 55% while the luxury watch index had two positive peaks and then a loss of more than 20%. As a result, it also sells luxury watches.

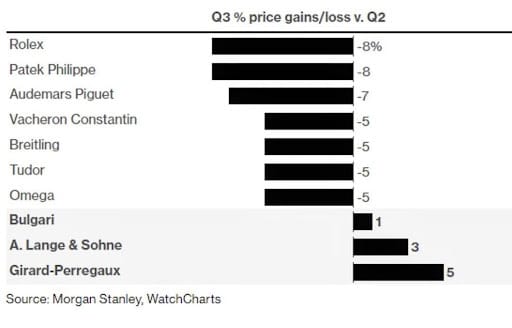

Also, while valuations continued to rise in 2021 and early 2022, even the most “desirable” watches had a turnaround: the Rolex Daytona, saw a 21% devaluation. There was also a decline for the used sector; according to Morgan Stanley (as shown in the chart above), prices fell by an average of 8% last quarter.

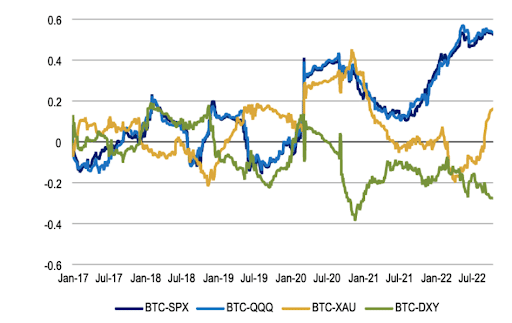

Meanwhile, Bitcoinin addition to the luxury sector, remains positively correlated with the SP500, NASDAQ and GOLD while negative with the dollar (DXY).

Bank of America’s chart highlights this strong positive correlation as a possible “awareness” of investors in the face of macro uncertainty and hopes of getting the actual market low.

Some positive data

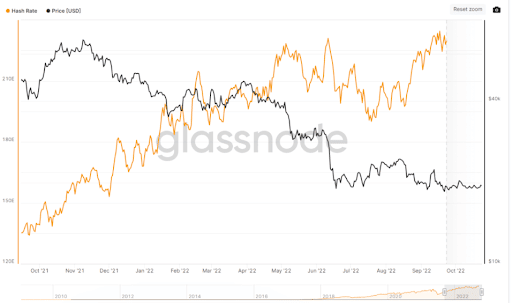

This month we have seen an increase in Bitcoins Hash rate currently at 240 EH/s, although the growth has nevertheless reduced profits for miners.

Hash Rate refers to the processing power of the network, i.e. calculations per second, so from this we conclude that the higher the value, the greater the expansion of mining and the use of increasingly efficient machines. Also, let’s not forget about it Ethereum Merger many miners have switched to Bitcoin, creating further competitiveness.

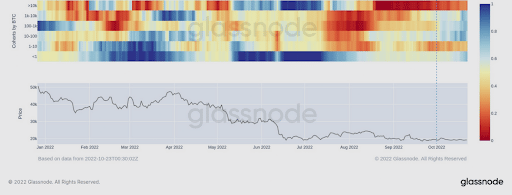

Despite the sideways movement of the price in recent months, the ongoing transactions are strengthening and continue to build important support, marked by the low volatility, which suggests an accumulation trend.

Especially in October, there is evidence of a change in balance shifting behavior of most wallets, from those with less than 1 Bitcoin to the whales (The whales with 10 thousand Bitcoin) have gone from selling (red square) to accumulating and increasing their net balance. (blue square) at prices between $18 thousand and $20 thousand.

But beware, in case the bulls fail to sustain the support at $20k to $19k, any decline could lead to volatility and breach of $18k.

Going back to the past, it can be profitable to adapt the style initially, but what matters over time is skill, nothing more.