Bitcoin Turns South Towards $20K, Huobi Cuts Ties With HUSD Stablecoin

This article originally appeared in First MoverCoinDesk’s daily newsletter that contextualizes the latest moves in crypto markets. Subscribe to get it in your inbox every day.

Price point

Bitcoin (BTC) has erased gains from the previous day but remained above $20,000 on Friday. The cryptocurrency is up 5% on the week after hitting as high as $21,000 on Wednesday.

Popular meme token dogecoin continued its rally on Friday, up 7% a day after Tesla ( TSLA ) CEO and DOGE supporter Elon Musk completed his $44 billion takeover of Twitter ( TWTR ) . Crypto exchange Binance also confirmed on Friday that it was as an equity investor in Musk’s acquisition.

Dogecoin has gained 33% in the past seven days, making it the top crypto asset with a market cap of more than $1 billion.

Ether (ETH) was down 3.5% on the day to around $1,500.

Crypto exchange Huobi Global announced on Thursday that it will cut ties with its closely related stablecoin, the troubled asset HUSD. In a message to users, Huobi, the top trading venue for the $219 million market capitalization stablecoin, cited the rules to conduct “regular inspection” of listed assets. In August, stablecoin lost the dollar party shortly and crashed 8% after the issuer closed “several accounts” due to regulatory concerns.

Stablecoin HUSD was down 8% in the last 24 hours, according to data from CoinMarketCap. The price of Huobi Token (HT), an ecosystem token launched by Huobi Global, was also down 7% on the day.

In traditional markets, stocks fell along with US stock futures after some disappointing earnings results from tech giants. Nasdaq-100 futures led the way down 1.1%, and S&P 500 futures fell 0.6%. Amazon’s ( AMZN ) shares fell 13% in premarket trading. Late Thursday, the company gave a sales forecast for the fourth quarter below analysts’ expectations.

CoinDesk Market Index

Biggest winners

Biggest losers

Sector classifications are provided via Digital Asset Classification Standard (DACS), developed by CoinDesk Indices to provide a reliable, comprehensive and standardized classification system for digital assets. The CoinDesk Market Index (CMI) is a broad-based index designed to measure market capitalization-weighted performance of the digital asset market subject to minimum trading and stock exchange eligibility requirements.

Today’s chart

-

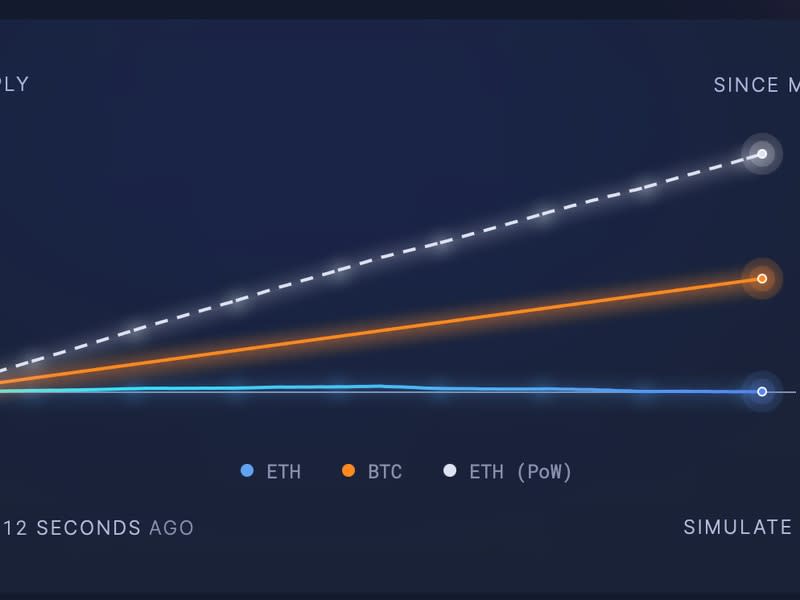

The chart shows changes in ether and bitcoin’s annual issuance rate since the Ethereum blockchain switched to a proof-of-stake consensus mechanism on September 15.

-

The annual issue continues to slide towards 0.0%. Since the technological upgrade, ether’s annual token supply change has decreased from 3.6% to 0.009%, making it more attractive than bitcoin.

-

Therefore, ether may continue to outperform bitcoin.

-

“Any increase in on-chain activity should bring ethereum well into deflationary issuance territory and could have a significantly outsized effect on ether’s price,” said Josh Olszewicz, head of research at digital-asset fund manager Valkyrie Investments.