Bitcoin: The Trojans have frolicked (Cryptocurrency:BTC-USD)

salarko

In my October 2021 article, Bitcoin: You Have Been Warned, I said that some of the Bitcoin (BTC-USD) influencers might not be the gods they were proclaimed to be. As the coin suffers another recession, two of the most prominent investors have fled. This is my updated view.

The Trojans have bolted from the Bitcoin paddock

In October 2021 when Bitcoin was trading at $66,000, I warned for the second time that a downturn was coming. The first time saw a 50% pullback, but the second is still down 65% despite the July rally and the outlook for BTC is pretty grim.

In my article during that frothy October, one of the problems I saw in BTC was the weight placed on celebrity influencers. At the time, I doubted their true intentions in the world’s most valuable cryptocurrency, and it has now been confirmed nine months later.

At the time of writing I said:

Many of the professional investors who promote Bitcoin as the future can also lead investors into this trap. Elon Musk showed already this year that he may change his attitude to accept coins for Tesla ( TSLA ) vehicles. That announcement helped fuel the early 2021 rally before Musk changed his mind about energy use. He has since clarified that they are likely to accept it, and the firm is up $1 billion on a $1.5 billion BTC holding, but he may change his mind again for a more energy-efficient coin.”

The big news recently was that Musk’s EV company had now sold 75% of its holdings in the coin. The reason given was that supply chain problems had increased the need for short-term cash. Tesla is certainly experiencing some headwinds, but it may just be an opportune time to exit the BTC investment. The 25% token holding may be a speculative attempt to break even on the investment.

“We’re certainly open to increasing our Bitcoin holdings in the future, so this shouldn’t be taken as a judgment on Bitcoin. It’s just that we were concerned about the overall liquidity for the company,” Musk said on an earnings call.

Investors should make up their own minds about whether the decision is a judgment on Bitcoin. Personally, I don’t see Tesla buying Bitcoin in 2022, and I’d say the chances of them doing so in 2023 are in the low single digits.

The next celebrity Bitcoin influencer under pressure is Michael Saylor, CEO of MicroStrategy (MSTR). Saylor is stepping down as CEO of the software firm after his bets on BTC lost the company $1 billion so far.

Saylor is moving into the role of executive chairman, handing the reins of the company to Phong Le.

“I believe that sharing the roles of Chairman and CEO will enable us to better pursue our two corporate strategies of acquiring and holding bitcoin and expanding our analytics software business. As Executive Chairman, I will be able to focus more on our bitcoin acquisition strategy and related bitcoin advocacy initiatives, while Phong will be empowered as CEO to manage overall corporate operations,” Saylor said in a statement.

This is an apparent end to the Bitcoin debacle at MicroStrategy, and investors may have been hyped by the 2021 rally and thought they had a genius at the helm. Now that losses are mounting and corporate adoption is once again a distant dream, shareholders will be angry, and it’s very possible that they forced this move. Finally, MicroStrategy is a software company and its CEO has spent all his time running around on roadshows promoting Bitcoin. If Bitcoin puts further pressure on the company down the road, there could even be potential lawsuits against the company and its former CEO.

The common theme with Tesla and MicroStrategy is that we have two charismatic CEOs making big speculative bets on cryptocurrency with other people’s money. Unfortunately for many investors, they bought in at $50-60K based on the wisdom of these “gurus”.

In Saylor’s case, I feel he has no choice but to stick to the bullish theme. Abandoning the BTC balance strategy will further destroy the inventory and share price of MSTR.

Saylor has recently said that he is as “enthusiastic as ever” in an interview and is now comparing BTC to Manhattan real estate.

Do you need to move the asset for it to have value? No, absolutely not. For example, real estate in Manhattan does not need to move for it to have value. In fact, you’d prefer Manhattan to be built on granite or slate that hasn’t moved for hundreds or millions of years. It makes the property more valuable. Bitcoin is.”

I recently wrote a book called The Stock Market is Easy and it is heavily influenced by investment psychology and behavioral investing. There are so many comments that are relative to this story when it comes to biases and gurus. Here we have a CEO who is diversifying his company into a speculative balance sheet security, and he has done so on such a large scale that it threatens the entire business. In the book I said:

Don’t get married to a position and don’t get stuck in investments when the weather changes around you. Complex thought requires effort. Your brain will choose the easy way. By making an effort and overriding your brain’s comfort pathway, you can make the stock market easy.

Investors should be wary of the gurus and experts and consider their reasons for being bullish. As Warren Buffett once said, “Never ask a barber if you need a haircut.”

Bitcoin has taken a weak rally from the lows

The recent rally has done more damage to the cryptocurrency market than investors realize. Institutions began to dip their toe in the water and consider copying the moves of Tesla and MicroStrategy, but no CEO is likely to risk following that strategy at the moment.

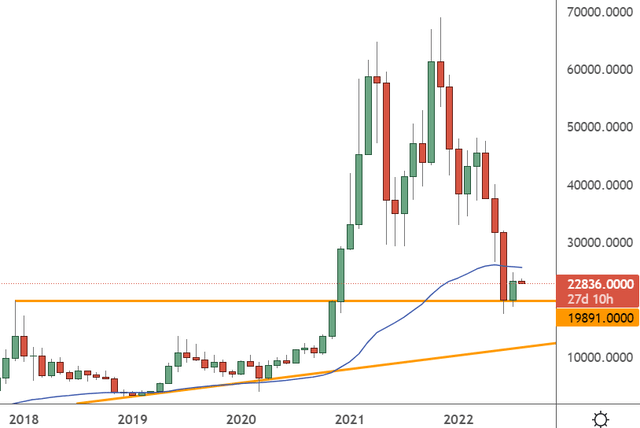

BTCUSD (M) (TradingView)

On a monthly basis, the price of BTC-USD has fallen to find support at the previous key resistance level from the late November highs of $20K. The coin has rallied to $25K but has found some resistance there on a weekly basis. A break of $20 would target $12.5K.

BTC investors should be aware that the coin is a trading vehicle that follows the usual rules of technical analysis. Many people think it’s a mythical creature that can “moon” at any moment, but that’s not what we see in the price action. Retail money is now tight and many are in losing positions above the $50K mark. This period reminds me of the 2018-2020 phase where a price crash scared away institutional money.

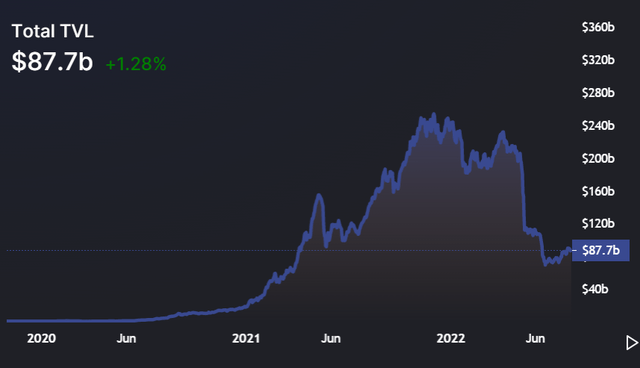

The decentralized financial market has also sucked the wind out of Bitcoin’s sails following the failure of DeFi darlings like LUNA (LUNA-USD). The current Total Value Locked (TVL) in crypto is $87.7 billion, according to DefiLlama, and that’s down from around $260 billion at the end of 2021.

TVL Crypto (DefiLlama)

Aside from crypto developers, there is no real incentive to put money into these projects when interest rates are rising on government bonds and there are good dividends available from the recent market selloff. Again, institutions can’t invest in these projects because of the problems at Terra Luna, and it’s going to be an uphill battle to build real trust again.

Adding to the gloom this week was the International Monetary Fund warning that other projects could fail.

“We could see further selling, both in cryptoassets and in riskier asset markets, such as stocks. There could be further failure in some of the coin offerings – particularly some of the algorithmic stablecoins that have been hit the hardest, and there are others that could fail,” said the group.

The current outlook for cryptocurrency regulation

Ironically, the outlook for cryptocurrency could improve with further regulation. With more oversight of the coins and projects that are on the market, there may be more opportunity for professional investors to get involved. There are currently 20,000 crypto projects listed on CoinMarketCap and there needs to be a cleanup of the sector by regulators. It defeats the purpose of decentralized finance, but the current sector is like the Wild West, as SEC Chairman Gary Gensler once said.

We saw further evidence of that this week with the news that the Securities and Exchange Commission had arrested 11 people over a massive $300M crypto-Ponzi scheme. Forsage organizers convinced millions of investors worldwide to get involved and recruit others.

“Forsage is a fraudulent pyramid scheme launched on a massive scale and aggressively marketed to investors,” said Carolyn Welshhans of the SEC. “Fraudsters cannot circumvent the federal securities laws by focusing their schemes on smart contracts and blockchains.”

According to the FT:

The SEC accused the operators of Forsage of raising $300 million from at least January 2020 through a unregistered securities offerings.”

It’s an interesting choice of words considering that Ripple’s XRP (XRP-USD) and the BNB (BNB-USD) token of the Binance exchange have both been under the SEC’s microscope for being securities, and we could see a crackdown coming. As I have said in previous posts, this lack of confidence in crypto and the impending regulation only brings us closer to central bank digital currencies, or a treasury-issued digital dollar and the majority of crypto projects will likely disappear.

A recent Institutional Investor article on CBDCs noted that Janet Yellen wants clear rules for cryptocurrency by the end of the year. Regarding the recent turmoil in the crypto market, they said:

“According to the Fed, a CBDC would offer refuge from this dire state of affairs by providing a form of digital money that is a direct responsibility of the Fed, firmly tied to the US dollar and the government, as opposed to an offshore, flash-in -the- pan-startup that can lie, cheat, steal, implode or pull a midnight runner.”

That kind of offering will appeal to institutional investors, and today’s banking heavyweights may even offer higher-interest products that will render DeFi projects worthless. At the end of the day, money is about confidence, and I feel that Bitcoin and the cryptocurrency market are now on an uphill battle to regain what was once solid.

Conclusion

I will conclude by saying that I have been a supporter of cryptocurrency since 2018. I advised my Marketplace newsletter subscribers to buy at $8-9K in 2020, before the strong upside rang the bells of speculative profit. I think there is a future for cryptocurrency projects to operate alongside the upcoming CBDCs, but I don’t think Bitcoin will be a winner. However it does, investors should use this opportunity in BTC to learn a real lesson about the experts and gurus in this field. Many of them are bullish on other people’s money, while others are now so deep that the only way forward is through further optimistic talks.

![Bitcoin [BTC]: Is this really the right dip to make money from Bitcoin [BTC]: Is this really the right dip to make money from](https://www.cryptoproductivity.org/wp-content/uploads/2022/08/btc-5019625_1280-1000x600.jpg)