Bitcoin Surges Above $28.3K Despite Binance Legal Trouble

Join the most important conversation in crypto and web3! Secure your place today

Good morning. Here’s what happens:

Prices: Investors shrugged off worries about the Commodity Futures Trading Commission’s case against Binance sending bitcoin over $28K again.

Insight: The Ethereum Goerli test network has been a testing ground for major upgrades like the merge. Can a small community of supporters keep it going?

Prices

CoinDesk Market Index (CMI)

1219

+35.3 3.0%

Bitcoin (BTC)

$28,380

+1076.9 3.9%

Ethereum (ETH)

$1794

+19.5 1.1%

S&P 500

4,027.81

+56.5 1.4%

Gold

$1,964

-8.0 0.4%

Nikkei 225

27,883.78

+365.5 1.3%

BTC/ETH prices per CoinDesk indices, as of 07:00 ET (11:00 UTC)

What worries crypto? Investors send Bitcoin back over $28K

Despite ongoing tension stemming from Binance’s recent legal troubles, bitcoin and other major cryptocurrencies spent Wednesday in the green.

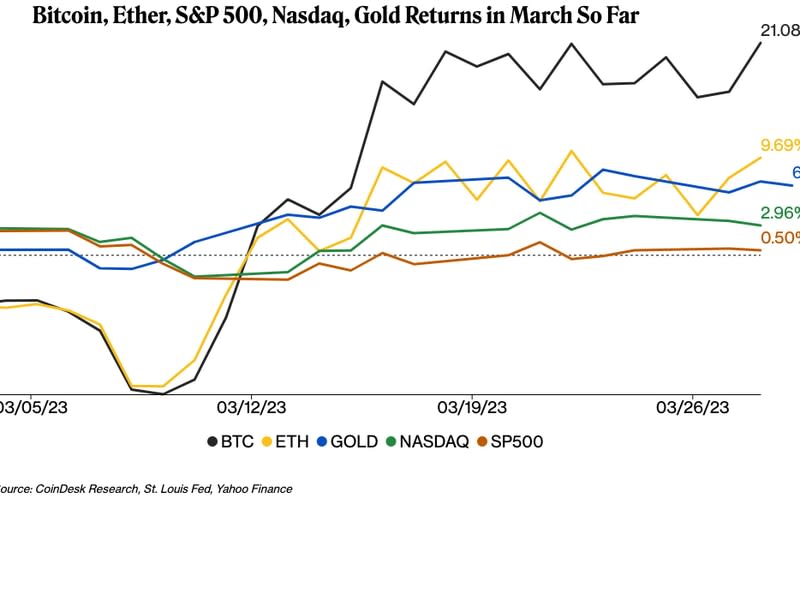

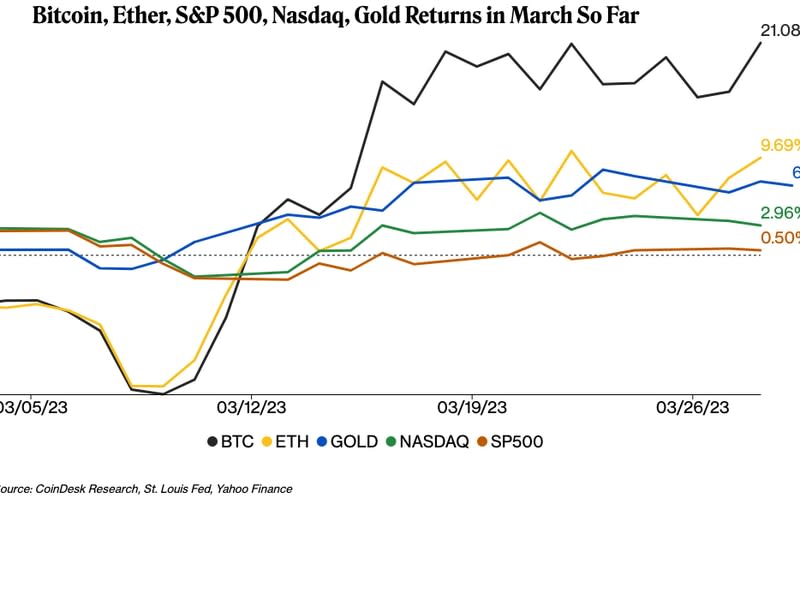

The largest cryptocurrency by market capitalization recently traded at $28,380, up 3.9% in the past 24 hours and well up from lows below $27,000 earlier in the week after the Commodity Futures Trading Commission (CFTC) filed a lawsuit against Binance and accused the exchange giant. for offering unregistered crypto derivatives, among other claims. BTC is up around 21% in March, outperforming other assets such as ether, stocks and gold.

“The market has reacted positively despite the CFTC story, largely because the broader narrative of a return to quantitative easing (QE) and fiat printing remains dominant,” Joe DiPasquale, CEO of crypto asset manager BitBull Capital, told CoinDesk in an e -mail.

Ether (ETH), the second largest cryptocurrency by market cap, recently changed hands at $1,794, gaining 1.1% for the day. Among other altcoins, crypto payment platform Ripple’s XRP token continued its strength from Tuesday, jumping nearly 6% to 54 cents. Cardano’s ADA token and Polygon’s MATIC token were up 3.8% and 3.3% respectively.

The CoinDesk Market Index, which measures the overall performance of the crypto market, recently rose 3.4%.

DiPasquale said the recent performance of coins like XRP is tied to “regulators seemingly questioning even the biggest names in the space,” adding that “the playing field is even for all other coins that were previously considered contentious.”

In the lawsuit filed Monday against Binance in US District Court in Illinois, the CFTC named several cryptocurrencies, including BTC, ETH, litecoin (LTC), tether (USDT) and Binance USD (BUSD). US Securities and Exchange Commission (SEC) Chairman Gary Gensler has previously suggested that proof-of-stake tokens like ETH are securities amid an ongoing feud between the agencies over jurisdiction.

Stock markets rose on Wednesday: the S&P 500 and technology-heavy Nasdaq closed up 1.4% and 1.7% respectively. The Dow Jones Industrial Average (DJIA) was also up 1%.

James Lavish, managing partner of the Bitcoin Opportunity Fund, called Wednesday a “risk-on” day across the board as investors looked to position themselves and their books ahead of several data releases later this week, including Thursday’s latest US GDP numbers for fourth quarter. the release and Friday’s personal consumption expenditures (PCE) inflation data.

“The idea is that if this data comes in weaker than expected, it will give (Federal Reserve Chair) Powell enough evidence to stop further rate hikes,” Lavish told CoinDesk in an email. The CME FedWatch Tool showed that currently over 62% of traders predict that the US Federal Reserve will not raise interest rates at its May monetary policy meeting.

He added that BTC’s price benefited from the recent risk-on move, as well as the announcement that China completed its first yuan-settled liquefied natural gas (LNG) trade with the United Arab Emirates.

“This strengthens the argument that bitcoin could be used as a medium of exchange in large cross-border energy trades in the near future,” he said. “That said, I think this reality, while valid, is still some way off.”

Meanwhile, the US 2-year Treasury yield was almost flat from Tuesday, the same time, at around 4.06% on Wednesday, while the 10-year Treasury yield was also almost flat from a day ago at 3.56%.

Nicholas Colas, co-founder of market research firm DataTrek Research, highlighted in a Wednesday note that the yield on 2-year Treasuries has been higher than the 10-year yield since July 2022 – a sign that “markets saw US monetary policy as restrictive.”

“Monetary policy is essentially pushing the brakes on the US economy, and a recession inevitably follows” based on historical patterns, Colas wrote, adding: “We certainly have the ‘ignition’ for a recession, but the catalytic ‘spark’ is still not quite there obviously for US stock markets.”

Biggest winners

Biggest losers

There are no losers in the CoinDesk 20 today.

Insight

A DAO collection to keep the Goerli testnet alive

The future of the Ethereum Goerli test network remains uncertain, but a little-known Ethereum community is rallying behind the network in hopes that a solution can be found to keep it going.

GoerliDAO, a decentralized autonomous organization, seeks to continue Goerli as an active blockchain network and uses goerli ether (gETH) to stimulate activity on the network.

“Goerli’s historical use makes it an ideal candidate to be Ethereum’s de facto canary network – a pre-testing environment similar to the mainnet,” the newly formed DAO said in a post earlier this week.

“An incentivized canary network like Goerli offers unique benefits to both builders and users, and the concept has seen success on many blockchains – especially with Kusama versus Polkadot,” it added.

It is unclear who is behind GoerliDAO as of Wednesday.

Testnets like Goerli are a testing environment that mimics real-world blockchain usage, allowing developers to find and patch critical bugs for upcoming products or features that are intended to be deployed on the blockchain’s main or live network.

Much of the testing of Ethereum’s major upgrades, such as the merge, was done on Goerli.

Keeping such a test environment alive is what the people behind GoerliDAO are rallying for: “The preservation of Goerli as a canary network will not only fill a crucial need in the Ethereum ecosystem, but also pave the way for future innovation and incentivization in the world of decentralized finance,” they said.

Find the full story here.

Important events.

Metaverse Fashion Week (Decentraland)

20:00 HKT/SGT (12:00 UTC) Germany’s harmonized index of consumer prices (year/March)

20:30 HKT/SGT (12:30 UTC) US gross domestic product on an annual basis (Q4)

CoinDesk TV

In case you missed it, here’s the latest episode of “First Mover” on CoinDesk TV:

Bitcoin on Pace for Best Quarter in Two Years; Nansen data shows that Binance’s chain balance is $64 billion

Bitcoin (BTC) has added nearly 72% to $28,500 this year, its best quarterly gain in two years, CoinDesk data shows. Arca Chief Investment Officer Jeff Dorman weighed in. Also, Binance’s chain balance remains high, despite US regulators charging Binance with violating US federal law this past week. Braden Perry, Kennyhertz Perry partner and former CFTC senior trial attorney, shared his views on the future of crypto regulation. And Journey’s Chief Metaverse Officer Cathy Hackl reacted to Metaverse Fashion Week.

Headings

Shanghai is coming but when can I withdraw my ETH?: Although the Ethereum blockchain’s Shanghai hard fork (also known as Shapella) will go live on April 12, you may not receive your rewards immediately if you have staked ETH with a staking service or staking pool.

AI-focused crypto protocol Fetch.ai raises $40 million to deploy decentralized machine learning: The funding marks another investment from market maker DWF Labs, the sixth this month.

Open interest in XRP rises to $800 million as crypto traders hope Ripple-SEC ruling will bring ‘Alt Season’: If the court rules that XRP is a security, it will mean the same for other alternative cryptocurrencies and subject the wider market to strict oversight.

Arbitrum shows just how messy (and difficult) Crypto Airdrops can be: Bugs, server crashes and scammers continue to plague crypto airdrops. Will regulatory pressure be next?

DeFi platform Lido stops betting on Polkadot, Kusama in August: The service will end on 1 August with automatic suspension in June.