Bitcoin supply in excess continues to decline, but still not in the historical bottom zone

Data shows that Bitcoin supply in profit has continued its decline, but the calculation has still not reached as low levels as the previous bottom of the bear market.

Around 50% of the Bitcoin supply is currently in surplus

According to the latest weekly report from Glassnode, the current levels of profitability in the BTC market are still above the 40%-42% values observed during historical lows.

The “percent supply in profit” is an indicator that measures the total percentage of the Bitcoin supply that currently has some unrealized profit.

The metric works by checking the chain history of each coin in the circulating supply to see what price it was last moved to. If for a coin this previous price was less than the current BTC value, then the coin in question is currently in some profit and the indicator represents that.

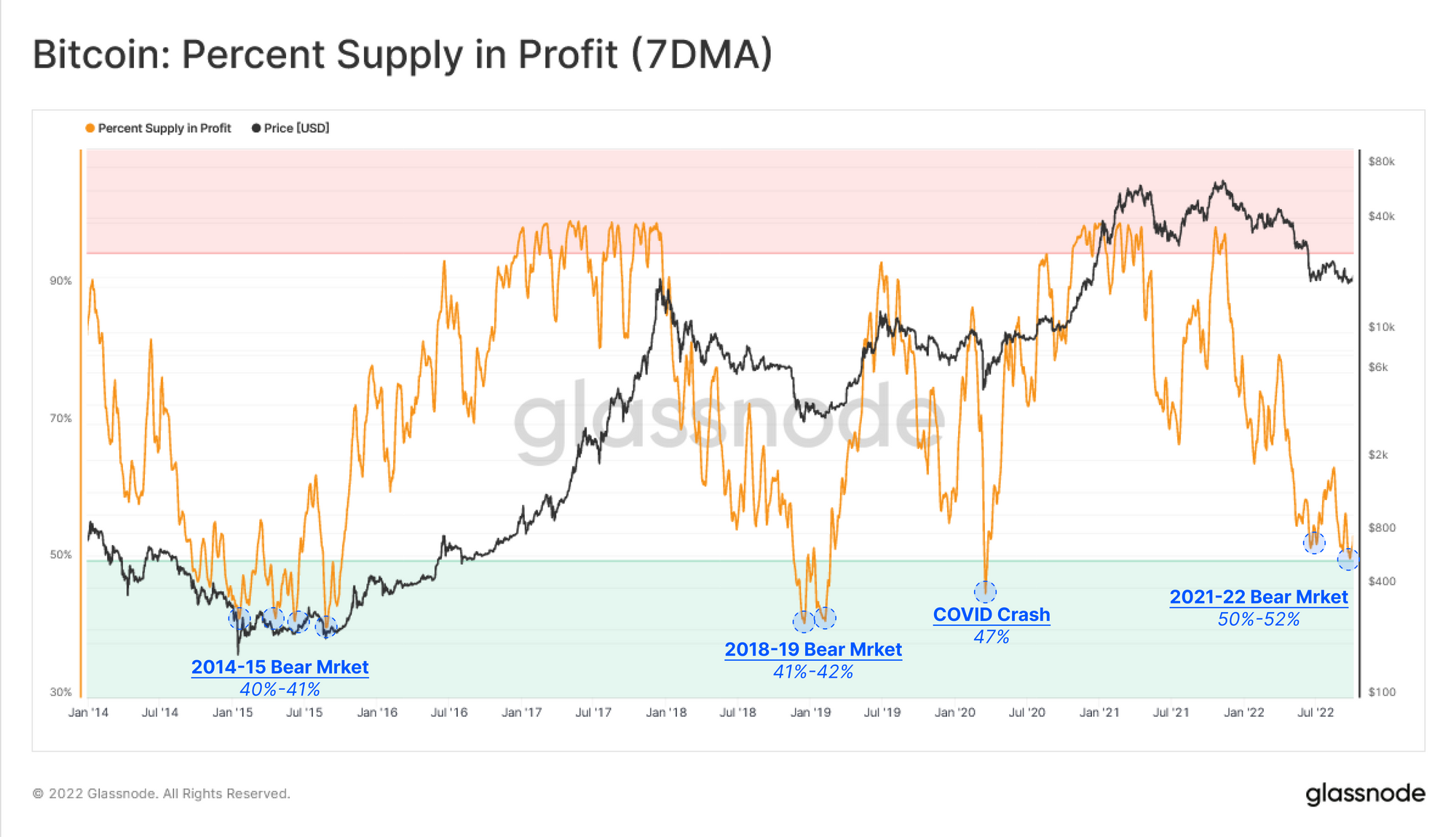

Now, here is a chart showing the trend of the 7-day moving average of Bitcoin percentage in profit since January 2014:

The 7-day MA value of the metric seems to have been declining in recent days | Source: Glassnode's The Week Onchain - Week 41, 2022

As you can see in the graph above, the historical zones of the Bitcoin percentage supply in profit for previous bear markets are highlighted.

It seems that when the calculation has dipped below the 50% mark, the price of the crypto has observed cyclical lows.

More specifically, the indicator’s value was around 40%-41% during the 2014-15 bear, while it was 41%-42% during the 2018-19 bear.

The Covid crash saw the profit in the supply hit a 47% cap, but since the event was not part of a normal cycle, the relatively higher level below this low may not be as relevant.

In the current bear market for 2021-22, the indicator has been declining but has only made a slight touch of the historical bottom zone as far as the value is around 50% currently.

If the 40% to 42% offer in the cyclical low profit target from the previous bear markets holds this time as well, then Bitcoin’s current profitability is still around 10% higher.

This suggests that the crypto may have to go through another flush of unrealized profits before the sellers are exhausted and the bear bottom is in.

BTC price

At the time of writing, Bitcoin’s price is hovering around $18.9k, down 6% in the last week. Over the past month, the crypto has lost 12% in value.

Looks like the price of the coin has been slowly heading downhill since a few days ago | Source: BTCUSD on TradingView

Featured image from Natarajan sethuramalingam on Unsplash.com, charts from TradingView.com, Glassnode.com