Bitcoin Price Prediction When BTC Sets New High For 2023 – Here’s Where It’s Heading Now

During the US trading session, there is a positive outlook for Bitcoin’s price prediction as BTC has bounced back from the $23,300 support level. Bitcoin’s price has been on a rollercoaster ride in recent days, with significant price increases followed by steep falls.

Binance CEO rejects claims USDC delisting amid SEC regulatory actions

Binance, which has the most trades of any cryptocurrency exchange, is reportedly thinking of cutting ties with its American business partners. According to a recent report from Bloomberg, Binance is considering removing tokens from all US-based firms due to the Securities Exchange Commission’s (SEC) recent regulatory crackdown.

As the SEC places more emphasis on the crypto industry, Binance is one of several exchanges reviewing its policies and procedures to ensure they meet regulatory requirements.

After the Securities and Exchange Commission (SEC) said that BUSD, a stablecoin pegged to the US dollar, is a security and then sued crypto firm Paxos, the relationship between exchanges and the US regulator has become more tense and uncertain.

In light of these developments, Binance is reportedly reevaluating its investments in the United States. Although Binance is not licensed to operate in the United States, it has operated in the country through its subsidiary Binance.US.

But with regulatory pressure mounting, Binance is just one of many crypto exchanges now reviewing their operations and considering changes to their business models to remain compliant with US regulations.

Binance CEO reacts quickly to accusations

In response to the allegations, Binance CEO Changpeng Zhao (CZ) took to Twitter to refute the claims. Responding to a comment on the social media platform, CZ said:

Binance’s CEO, Changpeng Zhao, has recently been embroiled in controversy. A Reuters report revealed that Binance transferred $400 million from a “secret” account associated with its subsidiary Binance.US, to a trading firm owned by CZ called Merit Peak.

The firm, which was incorporated in the British Virgin Islands in 2019, had previously invested over $1 million in Binance’s US subsidiary. The transaction was facilitated through Silvergate Bank, a crypto-friendly financial institution.

SEC Claims Terraform Labs CEO Transferred 10K+ Bitcoin After Collapse

The SEC has sued Terraform Labs and founder Do Kwon for allegedly transferring millions of dollars worth of Bitcoin to a Swiss bank account after the company’s collapse in May. The lawsuit includes allegations of the sale of unregistered securities.

The defendants are said to have moved over 10,000 Bitcoin from Terraform and Luna Foundation Guard accounts to a non-hosted wallet outside of exchange platforms.

Since then, Terraform and Kwon allegedly transferred Bitcoin to a Swiss financial institution and converted it to cash, resulting in over $100 million in withdrawals since June 2022.

The collapse of Kwon’s business wiped out more than $40 billion in total market capitalization. FINMA, the Swiss Financial Supervisory Authority, refused to comment on the case.

Binance reviews US investments in light of regulatory crackdown

As regulatory scrutiny of Binance continues, the world’s largest cryptocurrency exchange is considering ending cooperation with US firms. Bloomberg reports that Binance CEO Changpeng Zhao is reviewing the exchange’s venture capital investments in the United States and is considering cutting ties with American banks and service providers.

Binance is also reportedly considering removing tokens from US-based projects, including Circle’s USDC stablecoin.

The SEC, CFTC, DOJ and IRS have investigated Binance, which serves US customers through Binance.US. Despite the investigation, Binance.US claims to operate independently and has no plans to leave the US market.

Bitcoin price

As of today, the live Bitcoin price is $24,323 and its 24-hour trading volume is $40 billion. Over the past 24 hours, Bitcoin has experienced a 2.5% decline. Bitcoin has a current CoinMarketCap ranking of #1, with a live market cap of $469 billion. The circulating supply of Bitcoin is 19,293,956 BTC coins, with a max supply of 21,000,000 BTC coins.

Bitcoin has rebounded after finding support around the $23,325 50% Fibonacci retracement level. The uptrend was initiated by candles closing above this level, which led to a buying trend in Bitcoin.

Going forward, Bitcoin’s next resistance level is $24,350. If a bullish crossover occurs above this level, BTC price could potentially rise to $25,300. Additionally, on the 4-hour time frame, a “three white soldiers” pattern could indicate an upcoming uptrend in BTC.

The 50-day moving average also adds to the likelihood of a continued uptrend in Bitcoin. Investors may want to monitor the $23,700 level to take a buy position and do the opposite if the price falls below this level.

Buy BTC now

Bitcoin Alternatives

CryptoNews has released a comprehensive review of the top 15 cryptocurrencies that investors should consider for 2023. The report aims to help investors make informed investment decisions.

Along with cryptocurrencies, there are other investment options with the potential for high returns that investors may want to explore.

Disclaimer: The Industry Talk section contains insights from crypto industry players and is not part of the editorial content of Cryptonews.com.

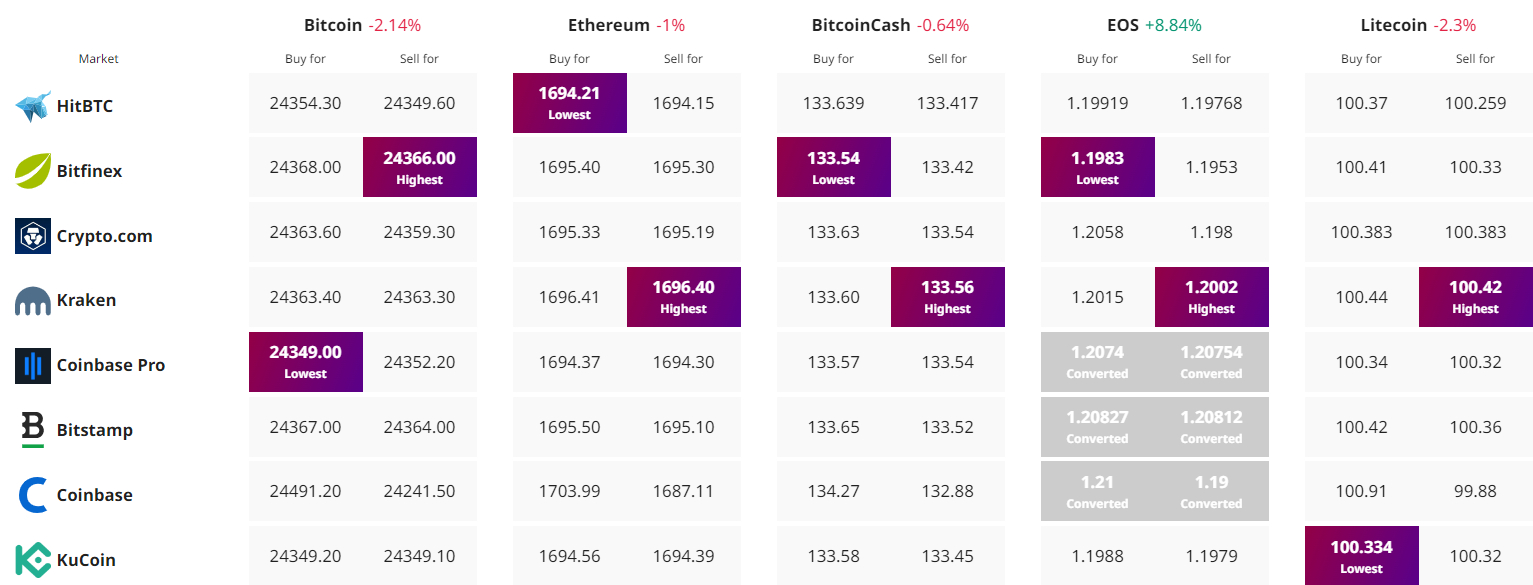

Find the best price to buy/sell cryptocurrency