Bitcoin Price Prediction As BTC Volume Rises To $22 Billion – Here’s BTC Heading Forward

On December 10, the BTC/USD pair continued to consolidate in a narrow range of $16,000 to 17,350. Stronger-than-expected US PPI figures from the Bureau of Labor Statistics have kept Bitcoin’s uptrend limited.

US PPI unexpectedly accelerated in November

The producer price index rose 0.3% from October to November, beating the estimate of 0.2%, while the October figure was revised up to 0.3% from 0.2%. The unstable price of food and energy worsened the situation; without these two components, the producer price index’s “core” increased by 0.4%, the most since June.

The cryptocurrency market reacted negatively to the report, which was interpreted as making it more difficult for the Federal Reserve to pause and eventually stop raising interest rates this year. BTC/USD is also falling as a result of the announcement.

Binance and Crypto.com publish Proof-of-Reserve audits

This week, two cryptocurrency exchanges made proof-of-reserves available to demonstrate that their trading platforms support client funds 1:1. Binance published a report on December 7 that included information about the audit’s global auditor, Mazars Group.

On December 9, Crypto.com revealed proof-of-reserve documents, which were also verified by Mazars. Since the demise of FTX in November, the cryptocurrency community has kept an eye on centralized exchanges. Following the promises made by exchange officials after the FTX incident, crypto exchanges issued proof-of-reserves (POR) evidence.

Binance has conducted a detailed analysis of the assets on the Bitcoin, Ethereum, Binance Smart Chain and BTCB networks, including BTC, BTCB and BBTC, available on the Mazars Group website. Throughout the process, “Binance was 101% secured,” according to Mazars.

Following the fallout from FTX, Crypto.com temporarily suspended withdrawals on the Solana network. It positioned the stock exchange in the middle of the crisis.

The Crypto.com team stated that it intends to demonstrate its responsibility as a cryptocurrency manager by disclosing proof of reserves. It also showed that customers’ funds could be trusted to handle any withdrawals. The news is good for cryptoassets because it demonstrates the openness of centralized exchanges. It is also beneficial for BTC/USD.

US lawmakers propose cryptocurrency mining environmental monitoring bill

The Environmental Protection Agency (EPA) has been required to provide data on energy requirements and environmental impacts of cryptocurrency mining under a bill proposed by US lawmakers. On December 8, Massachusetts Senator Ed Markey and California Representative Jared Huffman claimed that Bitcoin miners consumed approximately 1.4% of the nation’s electricity.

Furthermore, they stated that they are “sounding the alarm” about the energy consumption linked to cryptocurrency mining in the country. Senator Jeff Merkley co-sponsored the Crypto-Asset Environmental Transparency Act (EPA).

The Environmental Protection Agency will be asked to monitor cryptomining activity that uses more than five megawatts. The bill includes claims of miner-caused “noise and water pollution”. Climate change concerns were cited by Markey and Huffman as one of the reasons for moving quickly to regulate the crypto industry.

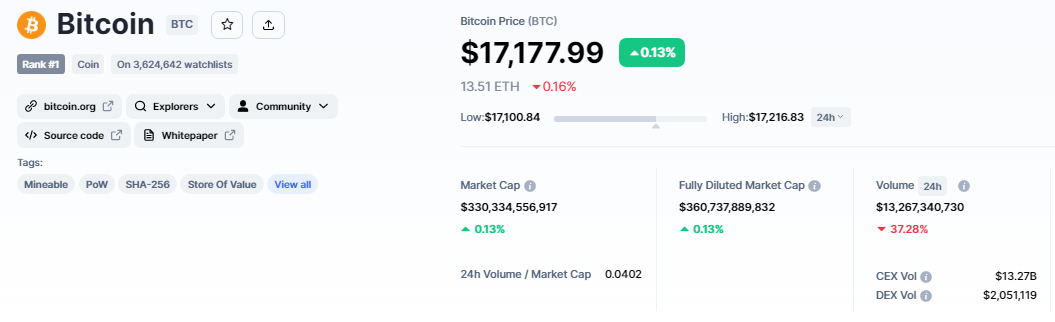

Bitcoin price

Bitcoin’s current price is $17,177, and its 24-hour trading volume is $23 billion. The BTC price has risen over 0.5% since yesterday.

The BTC/USD pair is trading with a positive bias after breaking above the $16,750 barrier. Bitcoin has formed an ascending channel on the 4-hour time scale, which supports the bullish trend. BTC may face resistance near $17,400.

A bullish breakout above $17,400 could take Bitcoin to $17,650, and a bullish crossover above this level could take Bitcoin to $18,150. A bearish crossover below $17,000, a level stretched by the 50-day simple moving average, could initiate a selling trend that could extend all the way to $16,650.

Coins with huge upside potential

Despite the bearish price action, the coins below are going from strength to strength, catching the attention of crypto whales.

IMPT (IMPT) – Only 1 day left of pre-sale

IMPT is a carbon credit marketplace that will reward customers for doing business with environmentally friendly businesses. It will issue carbon offsets as NFTs on the Ethereum blockchain when it launches next year, with users able to purchase such NFT-based offsets using the IMPT tokens they receive as rewards for trading on the platform.

Since its initial public offering in October, IMPT has raised more than $17.8 million, with 1 IMPT currently trading at $0.023. The sale is set to end in less than two days, with listings on Uniswap, LBANK Exchange and Changelly Pro following shortly.

Visit IMPT now

Dash 2 Trade (D2T) – Pre-sale in the final phase

Dash 2 Trade is an Ethereum-based trading intelligence platform that provides investors with real-time analytics and social trading data to help them make better trading decisions. It will go live in early 2023, with the D2T token used to pay for monthly subscription fees on the platform (there are two subscription levels).

Dash 2 Trade’s pre-sale, now in its fourth and final phase, has already raised more than $9.3 million. It has also announced early next year listings on Uniswap, BitMart and the LBANK Exchange, suggesting that early investors will soon be able to lock in some profits.

Visit Dash 2 Shop Now

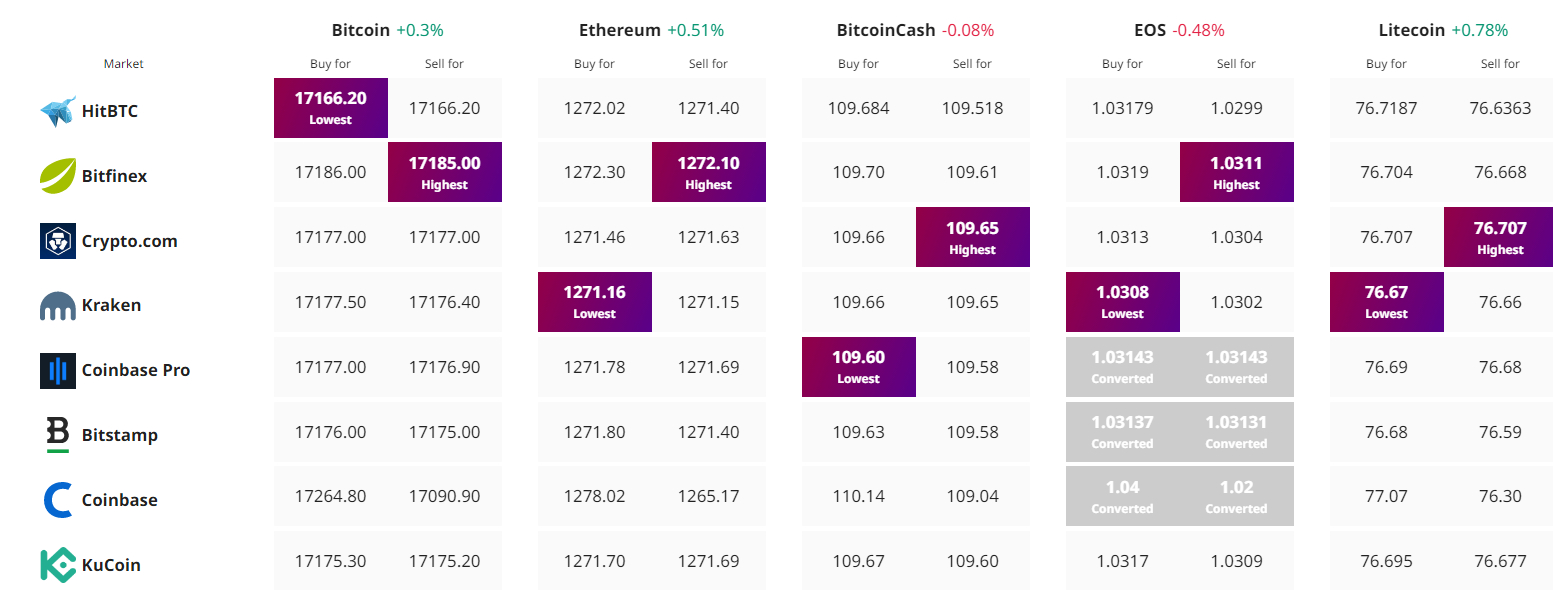

Find the best price to buy/sell cryptocurrency