Bitcoin Price Prediction As BTC Spikes Above $24,000 – Where Is The Next BTC Target?

Bitcoin, the world’s most valuable and well-known cryptocurrency, has once again seen a significant price increase, surpassing the $24,000 mark for the first time in history. This recent rise in Bitcoin’s value has caught the attention of investors and traders worldwide, and many are now wondering where the next target for BTC could be.

SEC’s radar for cryptoasset investigation heats up: what to expect in 2023

The US Securities and Exchange Commission (SEC) recently reaffirmed its commitment to protecting investors and ensuring compliance with federal securities laws and regulations. In its list of examination priorities released on February 7, 2023, the SEC identified “Emerging Technologies and Crypto-Assets” as a key focus area for the year. This focus will primarily be directed at broker-dealers and registered investment advisors (RIAs) that use such technologies.

On February 9, 2023, the SEC charged Payward Ventures Inc, operating as Kraken, with failing to register the offering and sale of its crypto asset service. As part of the settlement, Kraken paid a US$30 million fine and stopped offering its crypto-asset staking services to US customers.

SEC Chairman Gary Gensler emphasized the need for intermediaries to provide proper disclosures and safeguards required by securities laws when offering investment contracts in exchange for investors’ tokens, whether through stake-as-a-service, lending or other means.

Kraken isn’t the only crypto company to face SEC enforcement. In January 2023, the SEC charged Nexo Capital Inc US$22.5 million for failing to register its crypto lending product with US investors. Nexo also agreed to stop offering its crypto asset lending product.

These enforcement actions underscore the SEC’s increasing scrutiny of the crypto industry, aimed at ensuring that investors are adequately protected and that market participants comply with securities laws and regulations.

As regulatory frameworks continue to evolve, it is critical for companies operating in the crypto industry to remain vigilant and informed of the latest regulatory developments to avoid potential penalties and reputational damage.

Bahrain’s leading hotel now accepts Bitcoin: A milestone for crypto adoption in the Arab world

Novotel Bahrain Al Dana Resort has reportedly set a pioneering standard by embracing cryptocurrencies as a viable form of remuneration in the country’s hospitality sector. This recent maneuver towards digitizing monetary assets has been echoed by various other hotels located in the Arabian Peninsula, including W Dubai – The Palm and Palazzo Versace Dubai, which have followed suit in recent months.

According to recent reports, Novotel Bahrain Al Dana Resort has teamed up with Eazy Financial Services to allow guests to pay for their accommodation expenses with cryptocurrency. The hotel plans to set up customized terminals across its outlets to facilitate this offering through the Binance application.

This strategic move has been authorized by Bahrain’s central bank, making Novotel Bahrain Al Dana Resort the first hotel in the kingdom where this payment method can be used. General Manager, Amid Yazji, expressed his excitement in the following statement:

“Keeping up to date with the evolution of technology and our continued commitment to provide our valued guests with the best level of service, we are ecstatic to announce that we are the first hotel in the Kingdom of Bahrain and the region to implement cutting-edge digital payment technology through our partnership with Eazy Financial Services.”

As more and more people continue to adopt cryptocurrencies, the prices of popular digital assets, including Bitcoin and other altcoins, have gained attention and support.

Bitcoin price

Bitcoin is currently trading at $24,600, with a 24-hour trading volume of $38 billion and an increase of 3% in the last 24 hours.

Bitcoin has experienced a bullish trend after finding support at the 50% Fibonacci retracement level, which was at $23,325. The close of a recent candle above this mark has induced a buying trend in the market and strengthened positive market sentiment.

Looking ahead, Bitcoin’s next hurdle lies at $25,300. If there is a bullish crossover beyond this level, BTC price could be driven higher to reach $26,000.

The 50-day moving average also supports the possibility of a sustained uptrend in Bitcoin. Investors interested in capitalizing on this trend can keep an eye on the $24,250 level as a potential entry point for a long position in Bitcoin.

Buy BTC now

Bitcoin Alternatives

CryptoNews has released a comprehensive review of the top 15 cryptocurrencies that investors should consider for 2023. The report aims to help investors make informed investment decisions.

Along with cryptocurrencies, there are other investment options with the potential for high returns that investors may want to explore.

Disclaimer: The Industry Talk section contains insights from crypto industry players and is not part of the editorial content of Cryptonews.com.

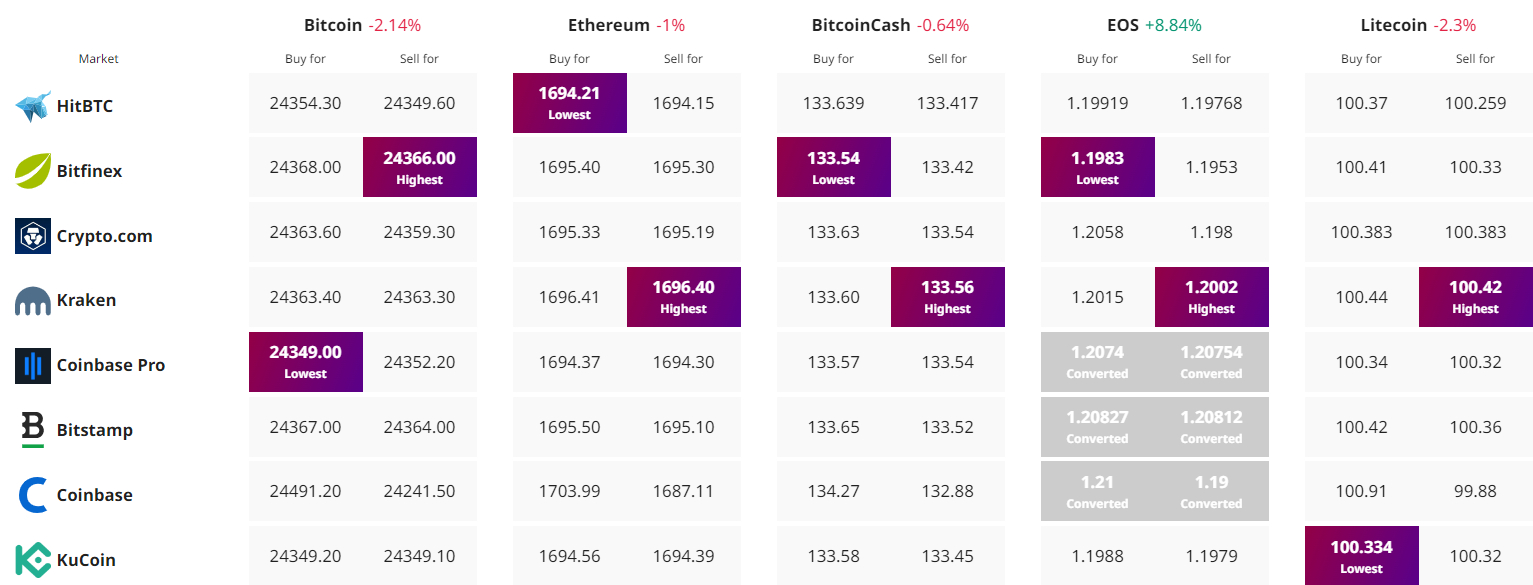

Find the best price to buy/sell cryptocurrency