Bitcoin Price Prediction As BTC Bounces From Support And Heads Higher – Could BTC Rise Past $30,000 Soon?

Bitcoin’s price is showing promising signs as it bounces back from support levels and heads higher. While investors wonder if BTC could soon surpass the $30,000 mark, market analysis helps make informed predictions about its future trajectory.

Bitcoin’s price is showing promising signs as it bounces back from support levels and heads higher. While investors wonder if BTC could soon surpass the $30,000 mark, market analysis helps make informed predictions about its future trajectory.

Bitcoin dominates Q1 with 70% price increase and over 800 million transactions

Core network activity showed a positive outlook amid the broader market recovery. Data compiled for the 1st quarter shows that Bitcoin exceeded 800 million transactions, amounting to over $107 trillion cumulatively since its inception in 2008.

Despite the bear market, active addresses on the Bitcoin network have consistently increased. The distributed supply also increased, with units holding less than 10 BTC accounting for 17% of the total supply.

The Taproot soft fork, which took effect last November, enabled the emergence of Ordinals and BRC-20 tokens on Bitcoin. Although controversial, the adoption and use of taproot has grown significantly. The increase in the number of transactions is expected to generate more revenue for miners through transaction fees.

The increase in total transaction fees and the percentage of miner income from fees indicates Bitcoin’s sustainable security model. The network’s hash rate remains near all-time highs, reaching a record 400 Eh/s, supporting the struggling mining sector.

Bitcoin’s Lightning Network capacity also jumped past $50 million. Although adoption has been slow, recent developments are promising. A report by Valkyrie Investments highlighted growing LN adoption in emerging markets such as South America and Africa, largely due to LN mobile payment app Strike.

Bitcoin outperformed most assets in Q1, reflecting its growing appeal as a digital store of value. According to ITB research, the correlation with gold prices increased from -0.3 at the beginning of the year to 0.9 at the end of the quarter.

Cryptocurrency Market Fluctuations: Binance Lawsuit and Elon Musk’s Influence

The worldwide cryptocurrency market has recently faced volatility, potentially linked to the lawsuit against Binance. As mentioned earlier, the Commodity Futures Trading Commission (CFTC) brought charges against Binance for violating the law.

This development caused investors to offload their crypto holdings, resulting in a drop in Bitcoin’s (BTC) value. Although BTC’s price fell below $28,000, it quickly recovered, climbing back above $29,000 in just a few hours.

Furthermore, Dogecoin (DOGE) value experienced a remarkable 25% increase in a single day. This spike coincided with Elon Musk updating his Twitter logo to resemble the meme-inspired coin’s emblem. As an outspoken advocate for Dogecoin, Musk has significant influence over its price.

His tweets and public comments have consistently had a significant impact on the cryptocurrency’s value.

Meanwhile, Bitcoin has performed strongly this year, with a 70% increase in value. However, some experts predict a potential decline in value within a short time.

Conversely, several experts maintain an optimistic view, expecting BTC to continue appreciating. Investor Balaji Srinivasan believes it will reach $1 million soon, while another expert predicts a value of $100,000 by the end of the year. Consequently, these varied forecasts have a mixed influence on Bitcoin’s price.

Bitcoin price

Currently, Bitcoin’s price is $28,150, with a trading volume of $10.1 billion in the last 24 hours. Bitcoin’s value has fallen by 0.20% in the last 24 hours. According to CoinMarketCap, Bitcoin ranks #1 with a market cap of $548 billion.

The technical outlook remains stable, as Bitcoin trades within a limited range between $28,250 and $28,900. If Bitcoin manages to break the triple-top pattern at $28,900, it could potentially propel the cryptocurrency towards its next resistance level of $29,600.

Conversely, if the market experiences a decline, Bitcoin’s immediate support level is at $27,600. A definite breakout from the trading area between $28,200 and $28,900 will be crucial in determining the future direction of Bitcoin’s price movement.

Buy BTC now

Top 15 Cryptocurrencies to Watch in 2023

Stay updated with the latest ICO projects and altcoins by regularly checking the carefully selected list of the top 15 cryptocurrencies to watch in 2023. This list is compiled by industry experts from Industry Talk and Cryptonews and is guaranteed to show only the most promising and high potential cryptocurrencies available on the market.

Disclaimer: The Industry Talk section contains insights from crypto industry players and is not part of the editorial content of Cryptonews.com.

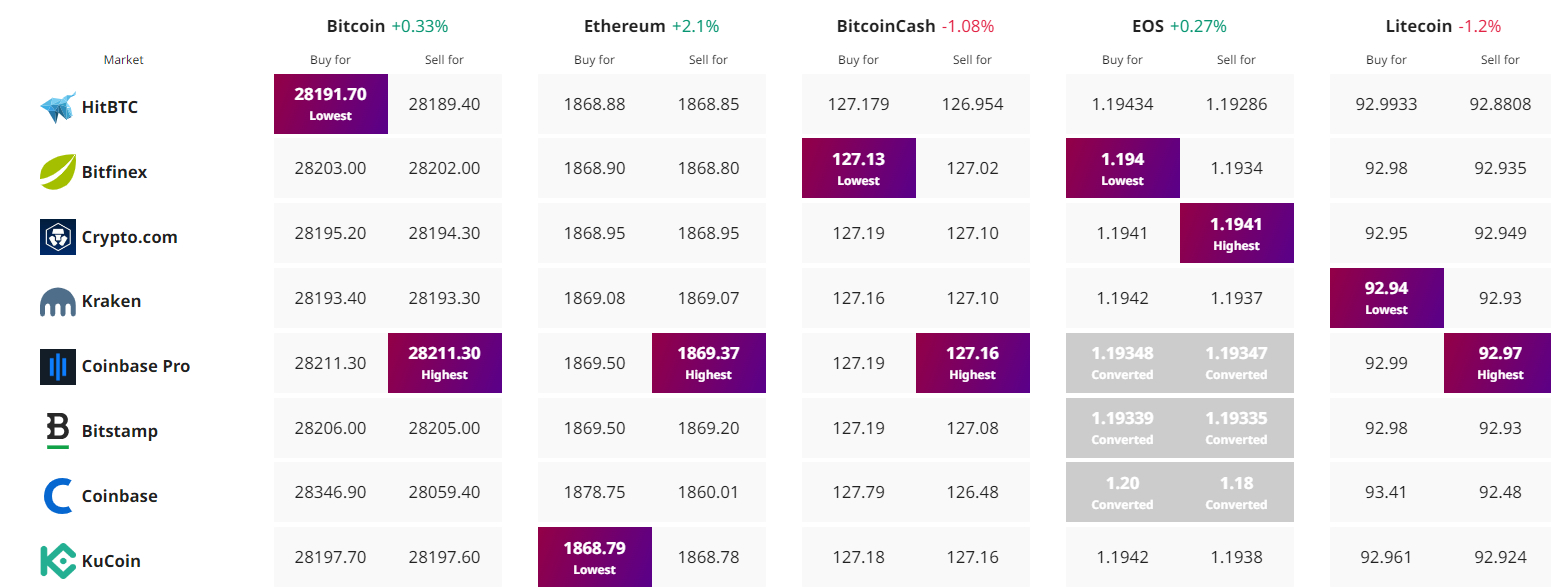

Find the best price to buy/sell cryptocurrency