Bitcoin: How Low Will It Go?

KanawatTH/iStock via Getty Images

Summary of the assignment

Bitcoin (BTC-USD) has just sold off, going so far as to break below the June low. This can be partly attributed to the recent debacle between FTX (FTT-USD), Alameda and Binance (BNB-USD).

However, this can also be explained by technical analysis, and I personally expected a sale like this.

Another liquidation event

The recent selloff has coincided with heightened concerns that FTX could become insolvent, which became an issue when Binance CEO Zhao announced that Binance would liquidate its position in FTT, the original FTX token. Binance has a large amount of FTT because it used to have a stake in FTX. When the two parted ways, a large part of the payment they received was in FTT.

This announcement led to millions in outflows of the FTX exchange and also a strong sell off of FTT. To make matters worse, it was also revealed by CoinDesk that Alameda Research, a trading company owned by FTX CEO Sam Bankman-Fried, held most of its assets in FTT tokens. This puts Alameda, a company with $14.6 billion in assets, in a precarious situation, meaning it is also at risk of liquidation.

Finally, however, it seems that as the CEO of FTX put it himself, “things have come full circle” as Binance, one of the first investors in FTX, has made an offer to buy the exchange. While this announcement gave Bitcoin some support, the cryptocurrency continues to sell off with the broader crypto market.

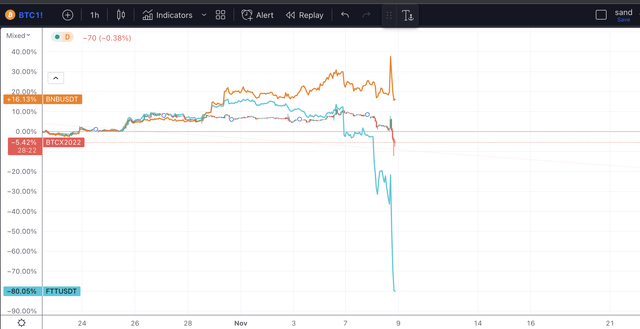

BTC, BNB and FTT (TradingView)

The chart above shows the latest movements in Bitcoin, FTT and Binance Coin. We can see that all of these coins rallied early in the day, coinciding with the takeover announcement. Binance Coin reacted particularly well, rising over 20%. However, the sell-off has now continued, with Bitcoin breaking the June low and FTT losing over 80% of its value. This on a day when the shares are actually up for the day.

The Bitcoin Chart

This recent liquidity crisis could have been predicted, at least when Zhao made it clear that he was liquidating his FTT. However, few could have predicted that this would have such a huge impact on the crypto market.

But for those who have followed my work, you know that I have expected Bitcoin to sell off even more, and I think we would have gotten there with or without a catalyst like this.

The two main drivers of my analysis are Elliott Wave Theory and a study of past bitcoin cycles:

Bitcoin EWT Analysis (Author’s work)

Above you can see my current EW analysis on Bitcoin, which I usually only share with subscribers. Since the high in Bitcoin in November, we have developed a five-wave structure to complete what I see as a C-wave in a major-degree wave 4.

The June low was the bottom of wave III and although I had my doubts initially, this became clear when we saw Bitcoin bounce off this support in a very corrective fashion. We rallied towards $24K in a wave V and then created a 1-2 setup to the downside, which is now filling.

In fact, this recent selloff would be a wave iii within 3, which makes a lot of sense, given its aggressive nature.

Where does Bitcoin fall?

Calling an exact bottom is difficult to do, but my guess is that we will at least get close to the region of the Delta price, which I have talked about before. This calculation on the chain is achieved by taking the realized price and subtracting the average price.

I won’t explain it in full again here. What is important to know is that Bitcoin’s Delta price has traditionally been breached briefly during recent capitulation events in previous bear markets, and that the current Delta price currently sits at around $13,600.

Remove

Trading Bitcoin is not for the faint of heart, but with the right approach it can be done successfully. First, as with any investment, one must understand its fundamentals and why Bitcoin is here to stay, which I did in my previous article, Why Bitcoin is Better Than Gold. Second, understanding Bitcoin’s history can help us understand where the key resistance and support levels are.