Bitcoin Flat as US Non-Farm Payrolls Decline

The US non-farm payrolls report for February indicated that 311,000 jobs were added last month, focusing investors’ attention on the terminal interest rate the Federal Reserve (Fed) will use to reduce inflation.

The figure beat analysts’ estimates of 215,000 and is down from 517,000 new jobs in January.

US Nonfarm Payroll shows slowing labor market

Average hourly earnings rose 0.2%, beating estimates of 0.3%, while the unemployment rate rose 0.2% month-on-month to 3.6%. Retail wages rose by 1.1 per cent. Construction jobs increased by 24,000, while people in higher paying jobs were laid off.

The new jobs numbers saw Bitcoin stabilize around $20,190, up 3% from an intraday low of $19,569. Ethereum was mostly flat after the news broke, but fell 1.75% to an intraday low of $1,370 fifteen minutes later.

The jobs report is one of three economic reports the Fed will use to decide its next rate hike.

The other reports on the Consumer Price Index (CPI) and the Personal Consumption Expenditure Index (PCI) will be released next week. The CPI captures detailed changes in the prices of groceries such as breakfast cereals. On the other hand, PCE is an indicator of changes in consumer spending due to high costs.

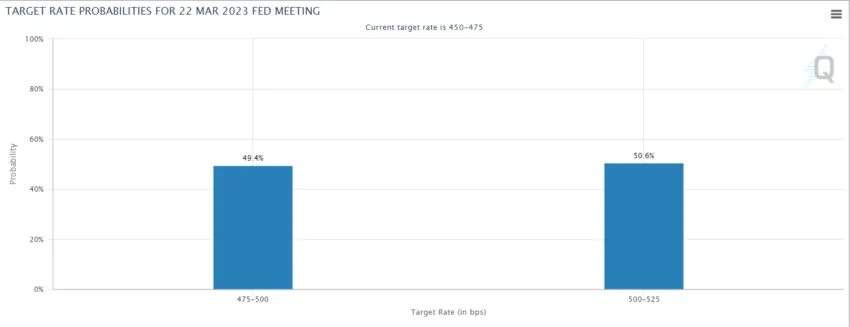

Following the news, the Federal Reserve downgraded odds of a 50 basis point rate hike to below 50%.

Economist Samuel Rines told listeners of Bloomberg’s Odd Lots podcast on March 8 that large and mid-sized US companies used macro events to impose disproportionate price increases unrelated to supply and demand.

Given the Fed’s job of moderating supply and demand through monetary policy, this kind of corporate profiteering means the Fed could be stuck in a perpetual tightening cycle unless it understands what companies are doing.

Analysts say the focus is shifting to the terminal price

After the jobs report, which indicated slowing employment, traders struggled to find reliable clues about the size of the next rate hike.

Earlier this week, traders assumed the Fed would raise the Federal Funds rate, which stands at 4.57%, by 50 basis points at the next meeting of the Federal Open Markets Committee. Chairman Jerome Powell reinforced this line of thinking in speeches earlier this week.

However, Ira Jersey of Bloomberg Intelligence said the focus is shifting from the actual increases to the final or terminal interest rate required to bring inflation down to the Fed’s 2% target.

The probability of the terminal rate exceeding 5% rose from around 35% before the jobs numbers to 50.6% at press time, according to CME’s FedWatch tool.

On Thursday, the Biden administration released its $7 trillion blue-collar budget. If approved, it would impose a 25% tax on citizens with assets over $100 million.

The new bill would repeal tax breaks that allowed crypto traders to sell assets at a loss and reap benefits before repurchasing. MicroStrategy used this strategy towards the end of 2022.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here.

Sponsored

Sponsored

Disclaimer

BeInCrypto has reached out to the company or person involved in the story for an official statement on the latest development, but has yet to hear back.