Bitcoin Drops on Hot US Inflation Data, But BTC Bulls Can Take Comfort in These Bullish Options Market Signals

Bitcoin last traded over 3.0% lower on Friday in the low $23,000s, with BTC/USD falling back below the 21DMA for the first time in nearly two weeks in the wake of a warmer-than-expected US Core PCE inflation report that increases the risk that the US Federal Reserve will raise interest rates to higher levels for longer. Price pressure between month and year both rose unexpectedly in January, according to the latest report, to 0.6% and 4.7% respectively.

This has resulted in US money markets pricing in a 40% chance that the Fed will raise interest rates by at least 25 bps at its next four meetings. Before Friday’s data, the money market implied odds of at least four more 25 bps rate hikes over the next four meetings was 30%. A month ago, markets assigned the probability of another 100 bps rate hike to roughly zero.

As a result, the US dollar is rallying, US interest rates are rising and US stocks have come under renewed selling pressure, a bearish combination for the risk-sensitive crypto asset class. Bitcoin traders will continue to monitor upcoming major US data releases and the tone of comments from Fed officials as they continue to assess the outlook for US monetary policy.

But it looks like Fed tightening fears will continue to act as a short-term headwind for crypto. In fact, Fed tightening fears have likely been the main factor behind Bitcoin’s recent pullback from previous monthly highs in the low $23,000s. But as the specter of a dip back toward the 50DMA in the $22,000 area and perhaps even a retest of recent lows in the $21,400 area looms, Bitcoin bulls can take solace in a few recent options market developments that suggest the 2023 bull market is likely remains intact.

Bullish options market signals

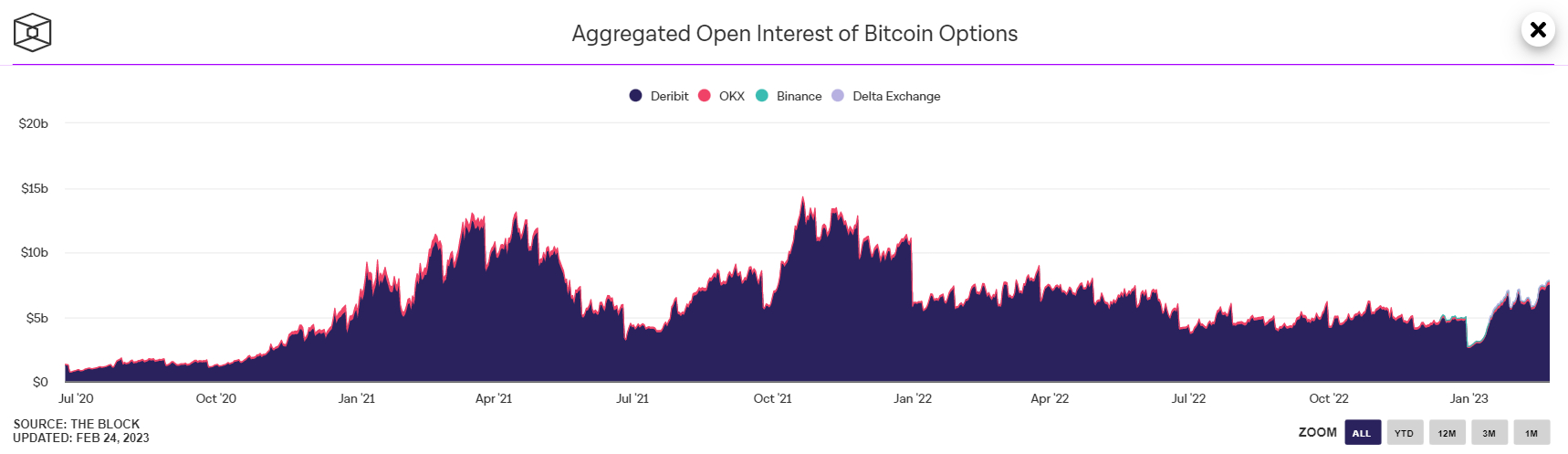

Aggregate open interest in Bitcoin options (ie the aggregate value of existing options contracts) across major crypto derivatives exchanges recently hit a nearly 10-month high of $7.83 billion on Wednesday. Options are a more complex investment tool, typically used by a more “sophisticated” investor base to hedge and make price direction bets.

Therefore, many see an increase in the open interest in Bitcoin alternatives as a sign that institutions are getting involved in the market again. Institutional adoption has been a key narrative in past Bitcoin bull markets, and this narrative could definitely pick up again if Open Interest makes further progress back to the 2021 record highs above $14 billion.

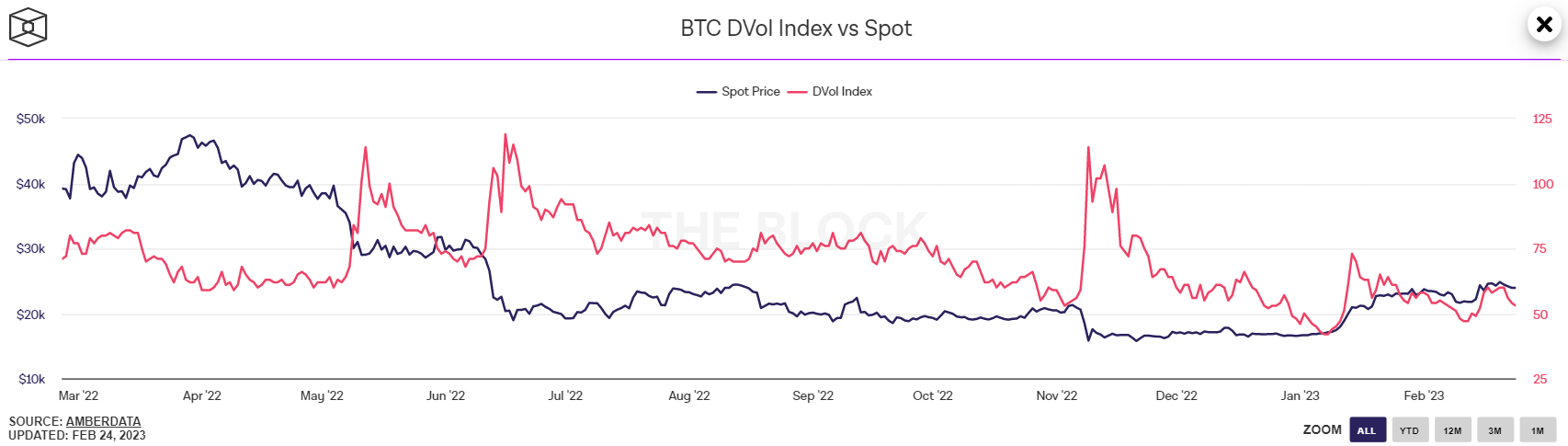

Elsewhere, Deribit’s Bitcoin Volatility Index (DVOL) remains near all-time lows. It was last at 53 on Friday, down from previous weekly highs of 60. It is not too far above the record low it printed earlier in the year at 43. DVOL tends to rise during times of bearishness in the cryptocurrency market. Its ongoing stability is therefore a reassuring signal.

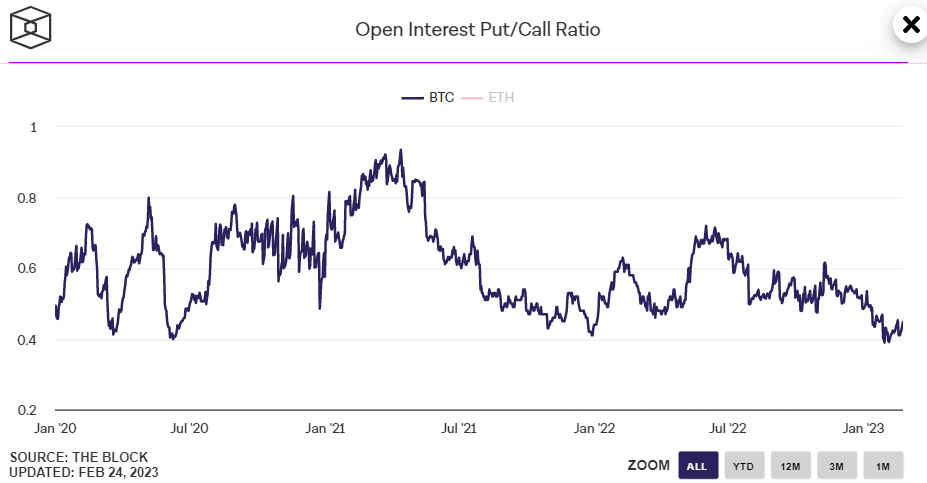

Meanwhile, the 25% Delta Skew of Bitcoin options expiring in 7, 30, 60, 90 and 180 days remained slightly above zero on Friday, suggesting continued modest positive market skew. In fact, the 180-day 25% Delta Skew, last at 2.74, is only just below recent highs (3.28 printed in January) and is thus not far below its highest level in more than a year.

The 25% delta option bias is a popularly watched proxy for the extent to which trading desks are over or underpricing for upside or downside protection via the put and call options they sell to investors. Put options give an investor the right, but not the obligation, to sell an asset at a predetermined price, while a call option gives an investor the right, but not the obligation, to buy an asset at a predetermined price.

A bias of 25% delta options above 0 suggests that desks charge more for equivalent call options versus puts. This implies that there is higher demand for calls versus puts, which can be interpreted as a bullish sign as investors are more eager to secure protection against (or bet on) a rise in prices.

Finally, the ratio of Open Interest Put (betting on a price drop) vs Call (betting on a price increase) Options on Deribit remained near record lows on Friday at 0.45. A record low level was below 0.40 at the end of January.

Elsewhere, as discussed in recent articles, a growing laundry list of chain and technical indicators suggest the bear market is over. So while Bitcoin may not be able to sustain the pace of January’s rally, there are still plenty of reasons to believe that a return to the 2022 lows remains unlikely.