Bitcoin (BTC) Rebound to $30,000? 3 factors that come into play

The crypto industry hit a rough patch last week as BTC price fell 10% after clearing $30,000 for the first time in 10 months. However, with several on-chain values flashing green signals, it looks like the Bitcoin bulls may soon reverse the retracement. But when will Bitcoin be back above $30,000?

Bitcoin price has fallen 10% in the past week, but several on-chain indicators suggest that a rebound to $30,000 is more likely than a drop below $25,000. As investor confidence in the broader crypto industry contracts, investors are likely to reallocate funds from altcoin sector to Bitcoin in the coming days.

Investor confidence has reached a one-month low.

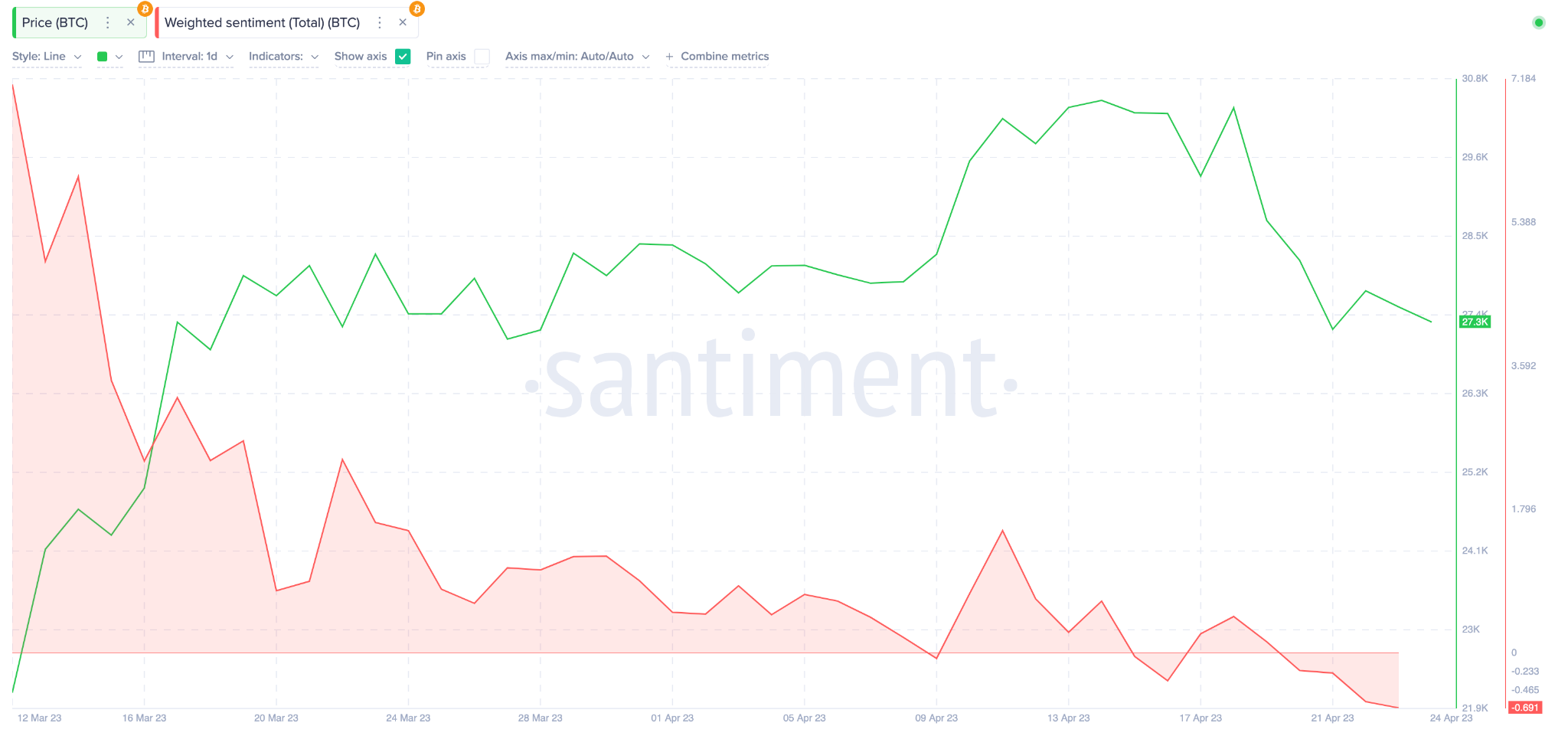

Market sentiment around Bitcoin reached euphoric levels on March 12, in the wake of the US banking crisis. However, since the BTC price crossed $22,000, investor confidence has fallen sharply, causing Bitcoin-weighted sentiment to hit its lowest since March 2.

Weighted Sentiment evaluates investors’ expectations by comparing the ratio of positive to negative mentions of an asset across relevant social media channels.

Looking at the chart below, Bitcoin weighted sentiment turned negative after falling from 1.53 to -0.70 between April 11th and 24th.

Falling social sentiment, combined with increased selling pressure, can lead to a temporary drop in price. But when the negative sentiment reaches a dysphoric peak, it could mean the end of the selling frenzy and the start of a new bullish cycle.

And historically, the price has typically moved in the opposite direction to investors’ extreme social expectations. If this pattern repeats itself here, the Bitcoin price could experience an upswing in the coming days.

Strategic BTC whales buy

On a more bullish note, a cohort of whales whose wallet balances show the highest correlation with BTC price movements appears to be entering another accumulation phase.

The rejection of the $30,000 resistance has sparked a network-wide selloff across the Bitcoin ecosystem over the past week. But on-chain data reveals how crypto whales with 100 to 1000 BTC have been buying the dip.

The chart below shows that they added 20,000 BTC to their wallet balances between April 16th and 24th.

At current market prices of $27,400, the new investment from these price-savvy whales is worth nearly $540 million. When large institutional investors make such a significant influx in a short period of time, it indicates growing confidence.

Considering their history of timing purchases right before a rally and their influence on retail investors, such a significant investment from the above whales is likely to culminate in a bullish reversal for Bitcoin.

BTC Price Prediction: Bitcoin Needs to Reclaim $28,300 to Enter a Bullish Reversal

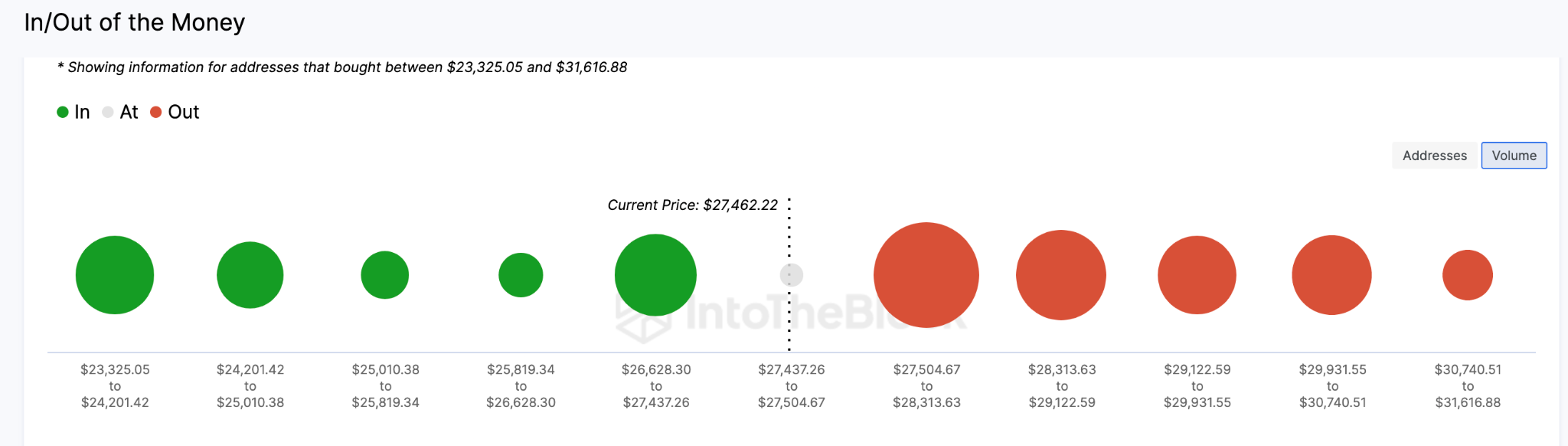

Third, IntoTheBlock’s In Out of Money Around Price data shows that Bitcoin is unlikely to fall below $27,000.

Currently the $27,500 resistance cluster on 61,000 addresses has 13,500 BTC. This zone is relatively weaker than the support of 252,000 addresses that had bought 389,000 BTC for an average price of $27,100.

To enter a bullish reversal, BTC needs to clear the next resistance zone at $28,350. However, the cluster of 1.98 million holders with a bag of nearly 756,000 BTC will present a formidable challenge. However, if the resistance level is broken, BTC could rally as high as $32,000

Nevertheless, the bears may invalidate the positive outlook if BTC falls below $27,000. Although, as shown above, the bullish support of 252,000 addresses that had bought 389,000 BTC for an average price of $27,100 is likely to prevent the fall.

But if that support level doesn’t hold, Bitcoin’s price could fall as low as $24,500 before the bulls can regroup.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, objective reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions.