Bitcoin BTC price action turns green, but holders will still experience pain

The The Bitcoin (BTC) price gained some bullish momentum over the weekend, registering a near 2% gain as the bulls appeared to be in control – but only for a moment.

On a short-term basis, the Bitcoin price gained significant momentum on October 23, rising by nearly 2.8% in a few hours. Nevertheless, the new gains saw a quick reversal, with bears pulling back the BTC price to the lower level of $19,300.

Bitcoin price still under control

On October 23, BTC price rose to a high of $19,695 before retreating to the $19,300 mark. The $19,600 level has acted as a crucial resistance on Bitcoin’s short-term chart.

At press time, Bitcoin was trading at $19,332, up 0.75% on the daily chart. The $19,130 mark acts as the next key support.

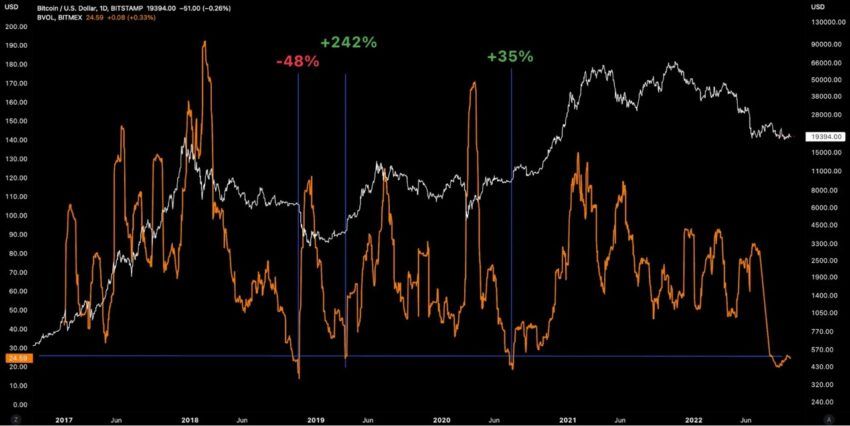

Messari data showed that while the current Bitcoin price action is anomalous, it is not unique. BVOL measures the frequency of fluctuations in the BTC price over time. Interestingly, BVOL made some drastic moves and the last three BVOL bars below 25 have resulted in big moves.

Two of the moves were bullish, and one BVOL drop below 25 resulted in a bearish rollover.

Old Bitcoins Move

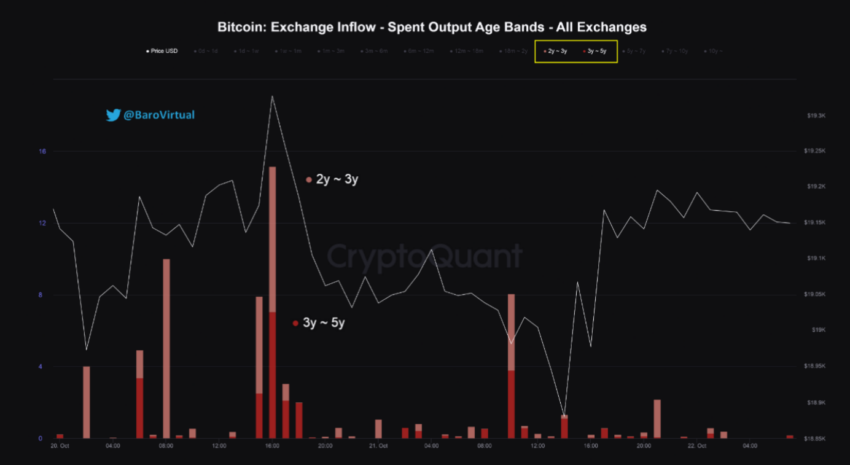

In recent days, old Bitcoins were deposited on cryptocurrency exchanges – specifically coins from the age categories of 2-3 years and 3-5 years. Such a movement generally results in negative short-term price action.

The Bitcoin price trajectory now seems highly dependent on the behavior of the S&P 500. Bitcoin investors from the aforementioned age group expect a further drop in the S&P 500.

According to fractal analysis, the stock market can expect two more big sell-offs on November 22, 2022 and December 23, 2022, according to CryptoQuant analyst.

Sentiment analysis from CryptoQuant highlighted that anxiety was visible in dominance by volume. Notably, after a one-month period where Bitcoin was the most traded coin on exchanges, altcoins began to dominate.

On October 23rd, 50% of trading volume on exchanges came from altcoins.

Interestingly, during periods of time when altcoins traded heavily on exchanges, the following scenarios took place:

- November 2021 – January 2022: BTC price dropped from $67,000 to $36,000

- April 2021 – June 2022: Bitcoin price dropped from $47,000 to $20,000

Whether another price drop will follow is something that is yet to be seen. For now, the next Bitcoin price resistance is found at the $19,600 mark. The $19,000 level acts as the next key support.

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action the reader takes on the information contained on our website is strictly at their own risk.