Bitcoin (BTC), Ethereum (ETH), XRP Price gains limited to short term

Bitcoin led the market gain by 2% at press time. Ethereum rose 2.82%, and the XRP price increased by a whopping 7.16%.

The global cryptocurrency market capitalization stood at $1.03 trillion, recording a 1.76% increase over the past day as major crypto assets traded in the green. Bitcoin (BTC), Ethereum (ETH) and XRP made decent gains with bulls on the price wave.

While BTC, ETH and XRP all posted gains on their short-term charts, on-chain data for the coins shows an interesting view of their price action.

BTC Price: Short Term Increase

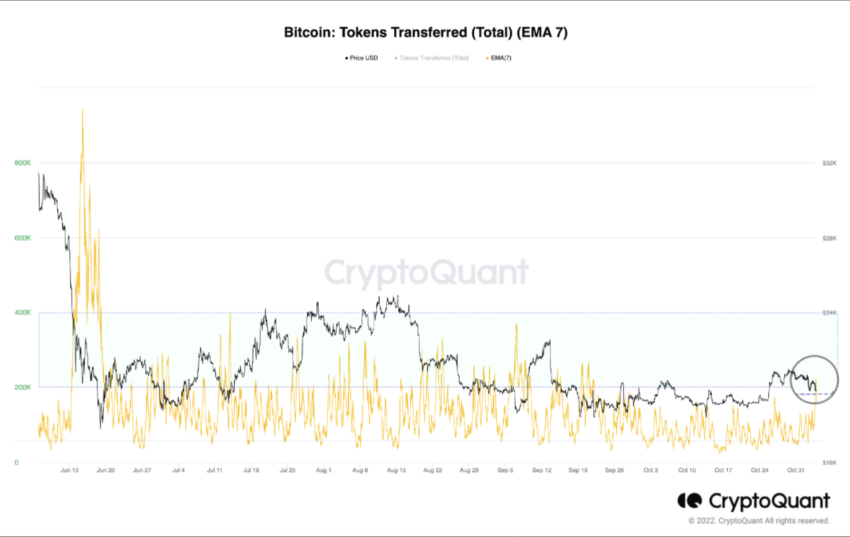

The number of Bitcoin token transactions, or tokens transferred, suggested that BTC is changing hands, according to data from CryptoQuant.

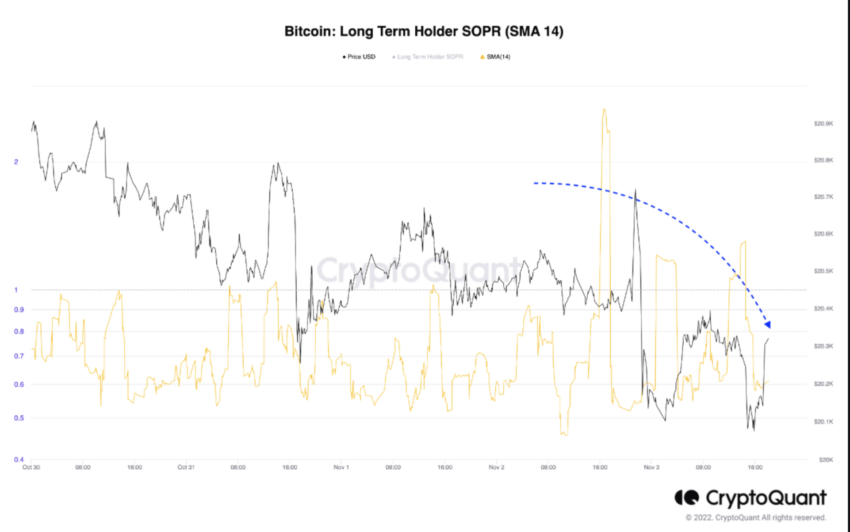

A look at the accumulation trend further suggested that there was a change from weak hands to strong hands as the long-term SOPR moved back to the lows again.

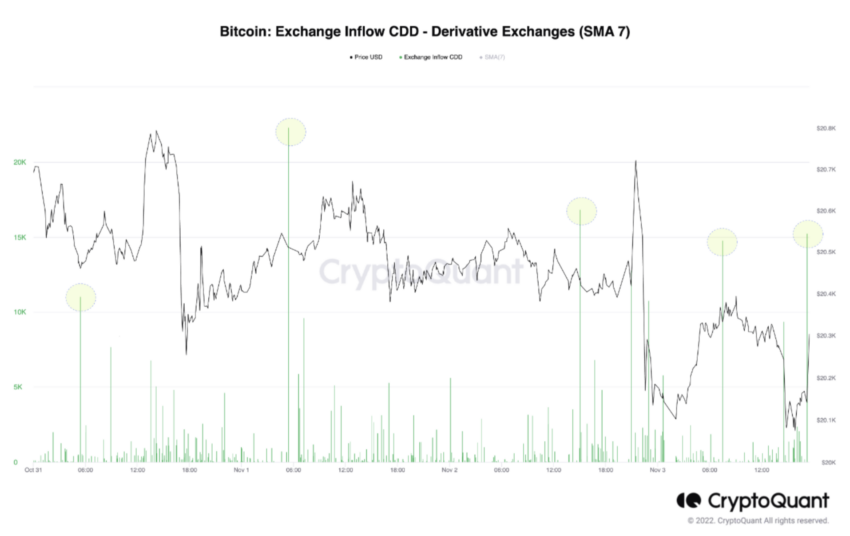

In addition to this, the derivative entry CDD also noted an increase against the long position which supported short-term price increases.

BTC price is holding strong at $20,300

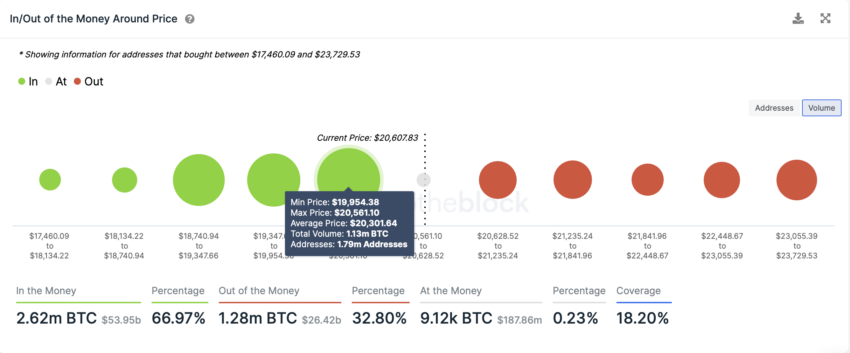

Apparently, BTC’s short-term price action was supported by long position sentiment. The In/Out Of Money Around price indicator suggested strong support for the Bitcoin price at $20,300, where 1.79 million addresses hold 1.13 million Bitcoin.

The $20,900 mark where 627,000 addresses hold 265,000 Bitcoin could act as the next resistance where the price could see some friction.

ETH activity slows down

Ethereum was trading at $1,572.50, at press time, recording 2.35% daily gains. The ETH price had reversed the past three days of losses that brought Ethereum to the $1,525 level. But ETH bulls still had to clear some barriers before the price could chart a recovery.

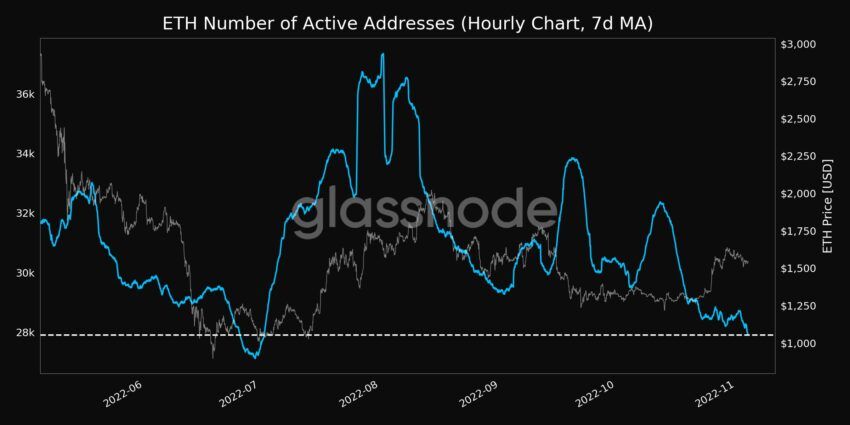

Glassnode data highlighted that the ETH active address count (7d MA) just hit a four-month low of 27,908.

Nevertheless, some positive long-term outlook came from ETH whales. Early Nov. data from Santiment presented that Ethereum’s top 10 largest non-exchange addresses have converged after the merger in September. The whale addresses have added 6.7% more ETH.

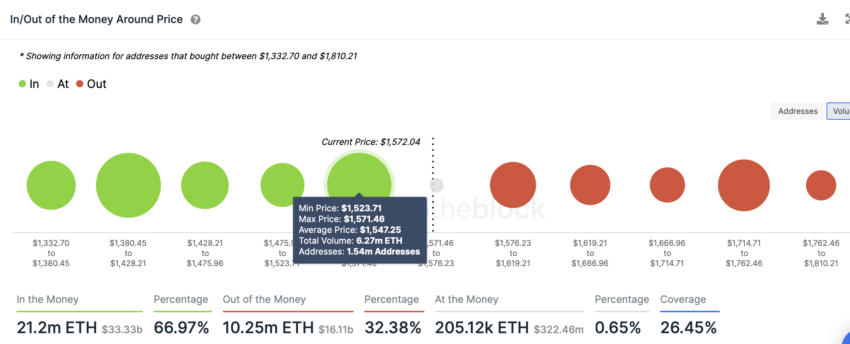

ETH supply held by top addresses has also maintained a healthy increase since mid-September. Data from IntoTheBlock highlighted a significant resistance for ETH at the $1596 mark where over 1.37 million addresses hold 2.7 million ETH.

In the event of a pullback, the $1547 mark will act as a strong support where 1.54 million addresses hold 6.27 million ETH.

XRP Price Breaks Out, What Happens Next?

The XRP price saw a sharp rally at press time, rising nearly 8% in the past day. The sixth-ranked crypto by market capitalization saw daily trading volumes rise to $2.15 billion with over 50% gains.

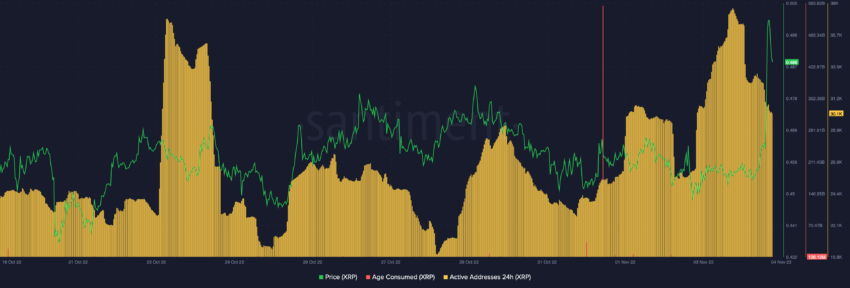

Recent XRP price gains had reversed the coin’s losses in October. Active addresses for XRP were at 30,100, but there was not a large increase at press time.

That said, on November 1st, XRP saw one of the most notable Age Consumed peaks where over 550 billion tokens were moved. One reason behind the recent rise could be the movement in tokens.

A worrying trend for the XRP network was that the number of transactions had fallen to extremely low levels, which could mean that demand was falling despite the price rise.

The XRP price had been in a prolonged downtrend due to the ongoing regulatory battle, but recent gains managed to reverse losses in October. Whether these gains can be sustained remains to be seen.

For, the XRP price the next major resistance will be at the $0.50 mark while the $0.44 mark still acts as a strong support.

Disclaimer: BeInCrypto strives to provide accurate and up-to-date information, but it will not be responsible for missing facts or inaccurate information. You comply and understand that you should use this information at your own risk. Cryptocurrencies are highly volatile financial assets, so do your research and make your own financial decisions.

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action the reader takes on the information contained on our website is strictly at their own risk.