Bitcoin always does this after Federal Reserve FOMC meetings

The Bitcoin (BTC) price action has kept traders and investors on the edge of their seats as macro factors continue to drag prices down.

The Federal Reserve continued its aggressive monetary policy, which, combined with additional crypto market events, impacted Bitcoin price action. As for the price of Bitcoin and other risky assets, however, they did what they usually do after FOMC meetings – swing erratically.

Bitcoin pumps then dump

On November 2, after the FOMC meeting, the Fed’s announcement led to an immediate price pump for stocks and cryptocurrencies. In November, the Federal Reserve raised interest rates by 75 basis points in a row for the fourth time this year to fight inflation.

With inflation currently at a 40-year high in the US, every rise in interest rates has caused the Bitcoin price to react almost nonsensically. Bitcoin is not the only currency or asset to react to Fed hikes, in fact analysts have pointed out interesting deviations in SPY and SPX.

The SPY is an ETF that is backed by the stocks of the companies listed on the S&P 500, while the SPX is a theoretical index driven by the price of the S&P 500 itself. Analyst Gurgavin pointed out that the stock market dumped every month at 2pm EST when the rate hike came out and increased the clock 2:30 PM EST when Jerome Powell spoke.

July and September had similar price developments, while other months also had more or less the same effect.

For Bitcoin, the price pumped and remained positive for over 12 hours after the numbers were released on November 10. The BTC price recorded an increase of almost 14%, but soon started to dump after facing rejection at the $18,120 mark.

It then plunged to a new 2-year low of $15,554 on November 9 following the FTX exchange’s bankruptcy. However, after the CPI report came out, the top crypto gained some ground.

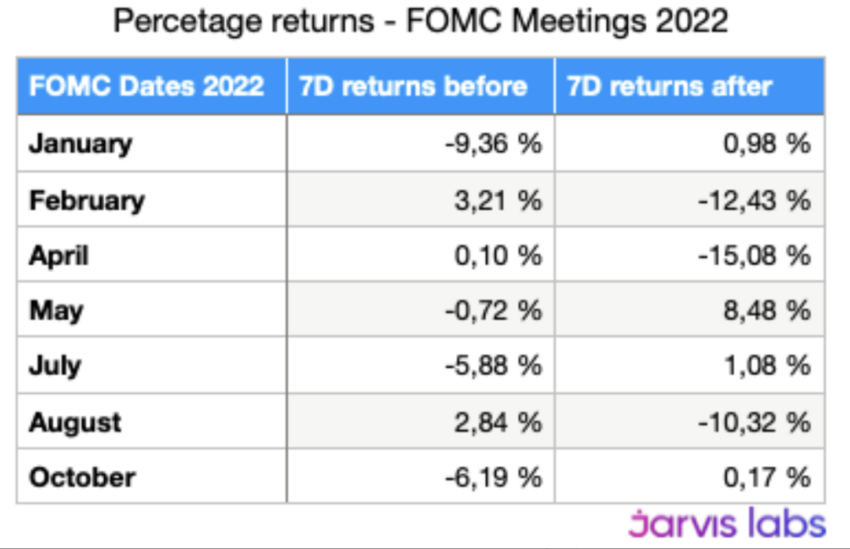

Data from Jarvis Labs shows that BTC price returns in the 7 days before and after FOMC meetings are not exactly predictable. Even if the larger market momentarily moved in the predicted/expected direction, it is not a surefire way to base your trade.

So should investors and traders expect similar returns and price action before the next meeting as well?

Bitcoin self-storage continues

Although macroeconomic conditions significantly affect BTC and its price action, the on-chain outlook has often been key to determining BTC’s trajectory.

With the FTX drama still playing out, there are a few other metrics that better indicate what’s going on with Bitcoin and where the price may be headed.

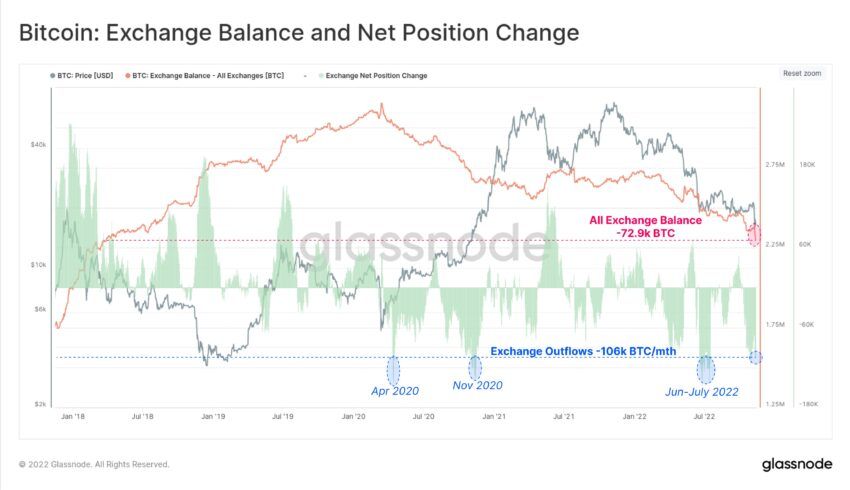

Data from Glassnode shows that after the collapse of FTX, Bitcoin investors have withdrawn coins for self-deposit at a historical rate of 106,000 BTC/month. Similar outflow spikes occurred only three other times in BTC’s history: in April 2020, November 2020 and June-July 2022.

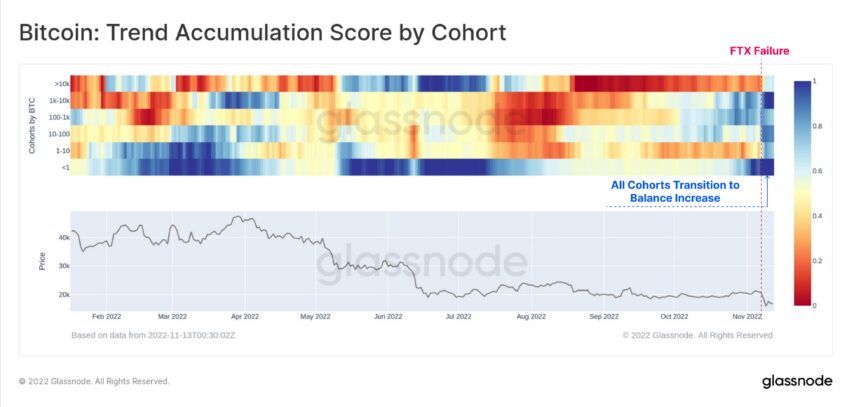

The failure in FTX has resulted in positive balance changes across all wallet groups. From shrimps to whales, there has been a very clear change in Bitcoin holder behavior.

A look at BTC’s balance by group shows that the balance change has been dramatic since November 6. The following groups added BTC:

- Shrimp [< 1 $BTC] increased inventory by 33,700 BTC

- Crabs [1-10 $BTC] increased inventory by 48,700 BTC

- Sharks [10-1k $BTC] increased inventory by 78,000 BTC

- Whales [>1k $BTC] increased inventory by 3,600 BTC

Overall, the macroeconomic conditions together with the FTX failure have led to a transition phase for investor holdings.

As expected by analysts, the December FOMC meeting could be another turning point in BTC price action. Ahead of that, however, the market is still largely unstable as chain measurements show a larger deviation in the investor portfolio.

Disclaimer: BeInCrypto strives to provide accurate and up-to-date information, but it will not be responsible for missing facts or inaccurate information. You comply and understand that you should use this information at your own risk. Cryptocurrencies are highly volatile financial assets, so do your research and make your own financial decisions.

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action the reader takes on the information contained on our website is strictly at their own risk.