Bitcoin Accumulation Trend Score and all the latest for your next trade

- Bitcoin accumulation has increased since the collapse of FTX

- New BTC buyers have seen lower losses than the average existing BTC holder

As the general cryptocurrency market took a bite of recovery after the sudden collapse of FTX, Glass nodein a new report, considered about Bitcoins [BTC] continued selling represented a continuation of the bearish trend. Was there a deeper psychological shift among BTC investors?

Read Bitcoin [BTC]its price forecast 2022-2023

From distribution to accumulation

The on-chain analytics platform found that all cohorts of BTC investors have swung towards coin accumulation following the recent price decline.

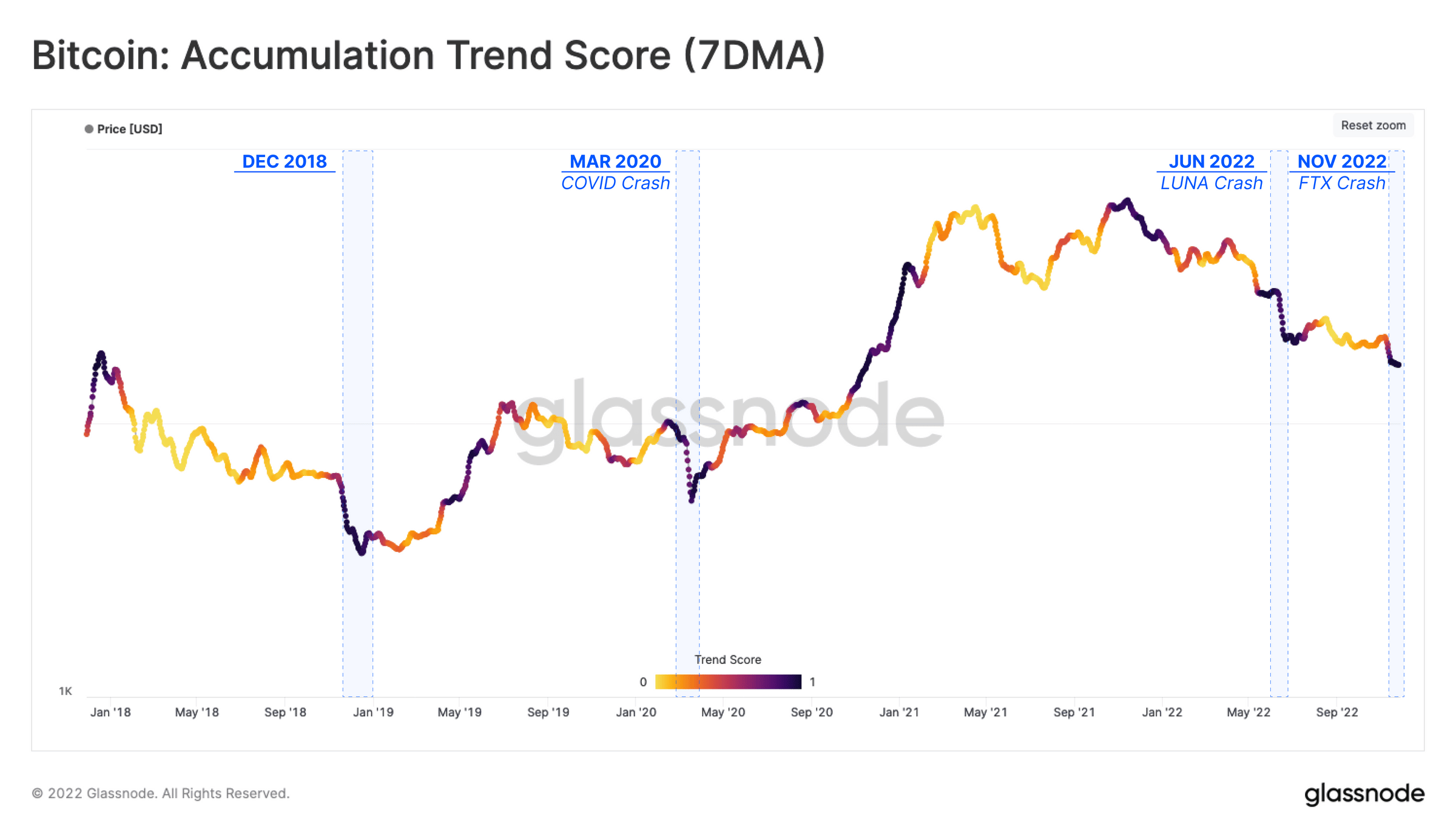

Glassnode reviewed BTC’s Accumulation Trend Score calculations and found that the recent increase in accumulation following the significant sell-off could be linked to 2018.

This change in behavior has also followed many major sell-off events, such as the March 2020 COVID crash, May 2022’s LUNA collapse, and June 2022, when the price first fell below $20,000.

Source: Glassnode

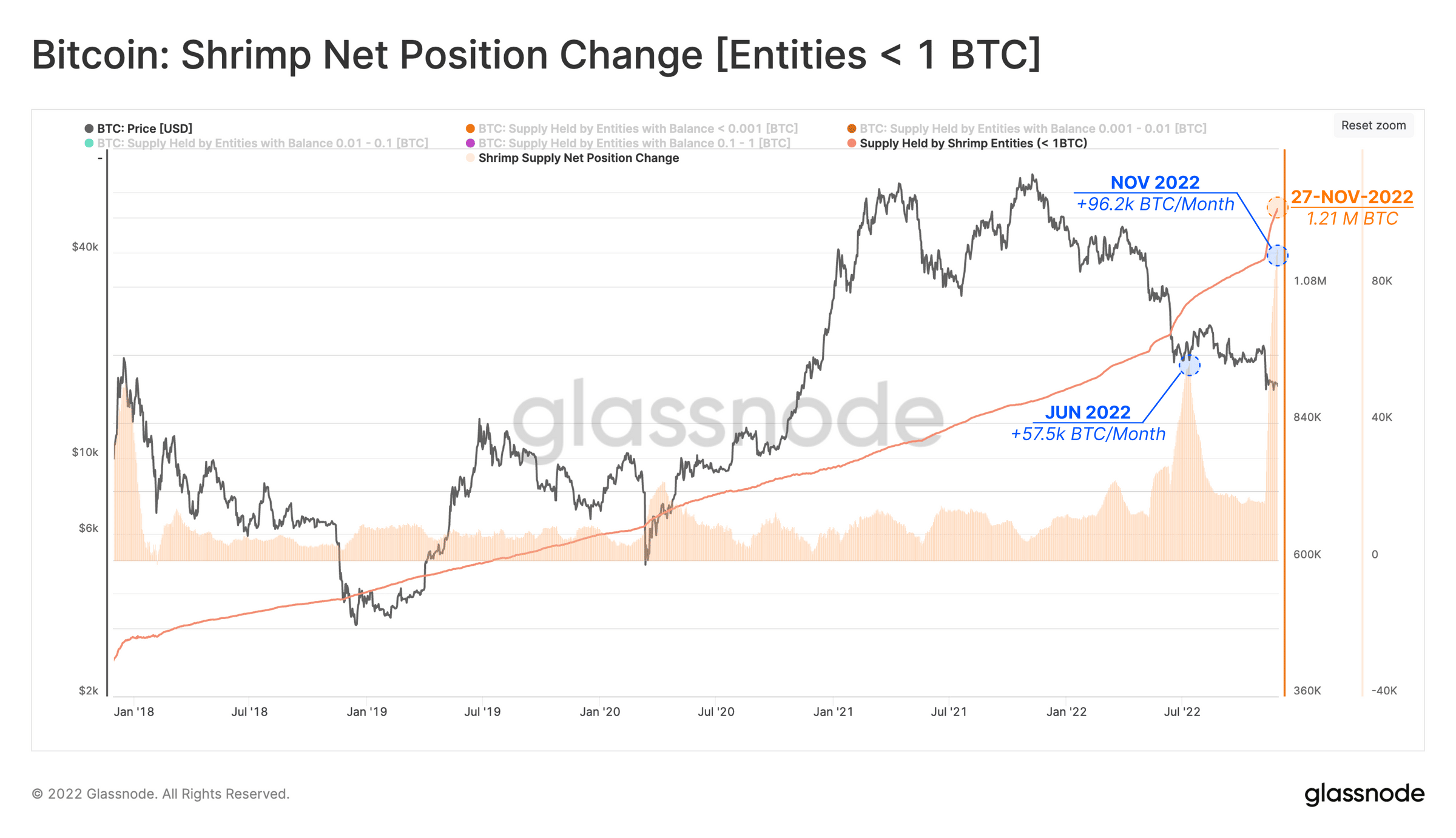

An investor cohort that perfectly exemplifies the accumulation trend are holders of less than one BTC, known as shrimp. According to Glassnode, this category has investors,

“…recorded two characteristic ATH waves of balance increase over the past 5 months. Reker has added +96.2K BTC to his holdings since the collapse of FTX and now holds over 1.21 million BTC, equivalent to 6, 3% of the circulating supply.

Source: Glassnode

The fate of new Bitcoin buyers

Glassnode went further to assess the state of new BTC investments after the FTX debacle. Observing the relationship between the cost basis for short-term owners and the spot price, which was $18,830,000, Glassnode found that “the average recent buyer is under water by -12%.”

While noting that new buyers had a superior entry point to the average owner, Glassnode found that sellers were approaching exhaustion in the current BTC market, and heavy distribution was met with an equal share of accumulation. This, according to Glassnode, drove the STH cost base below the realized price, giving new buyers an advantage.

History along the way

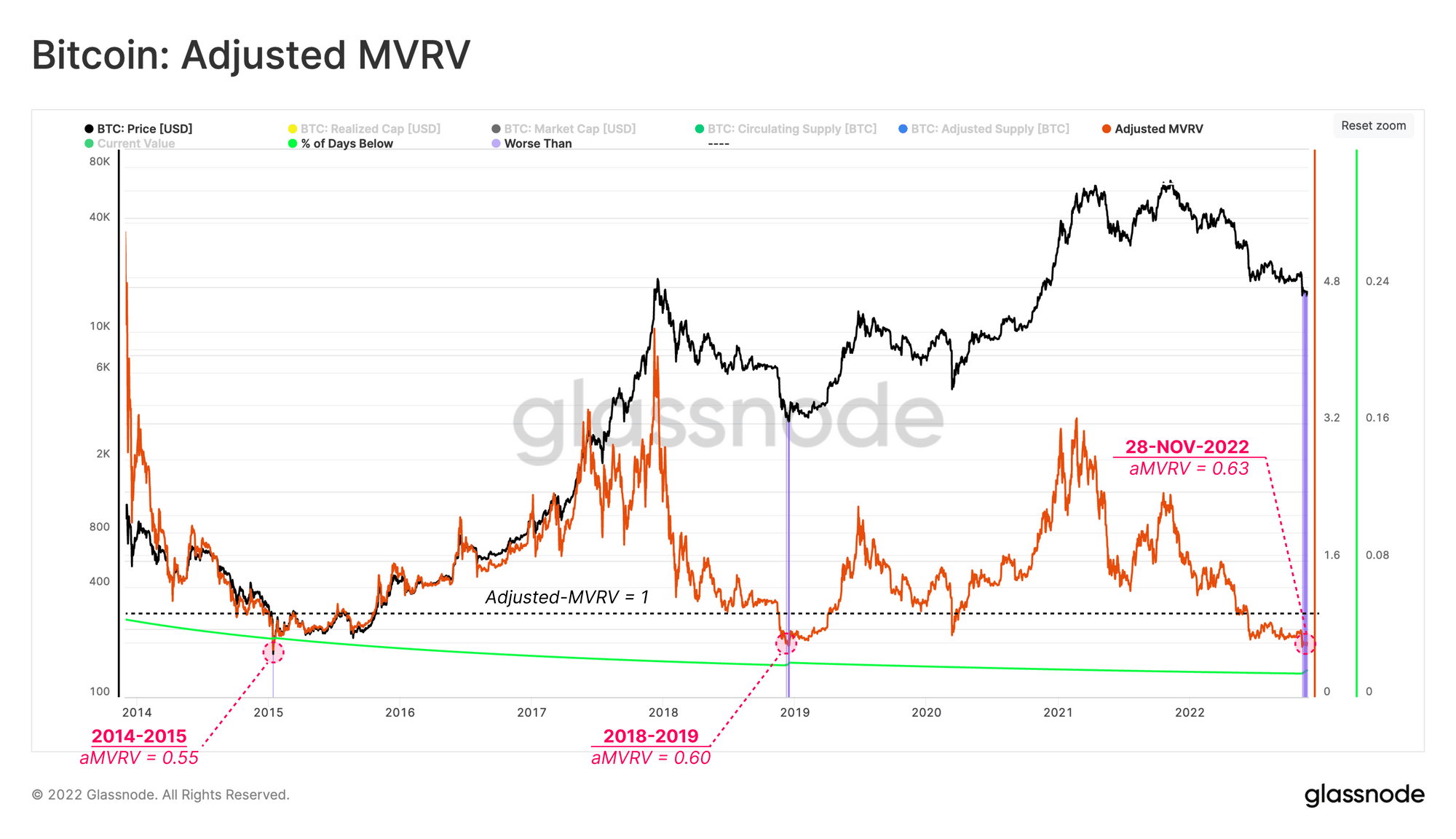

A look at BTC’s adjusted MVRV ratio revealed that the current BTC market was at its lowest “since the near-pico bottom set in December 2018 and January 2015.” When this calculation is less than one, it means that the active market has an overall loss.

Glassnode found that this calculation returned a value of 0.63, “which is very significant since only 1.57% of trading days in bitcoin history have recorded a lower adjusted MVRV value.”

Source: Glassnode

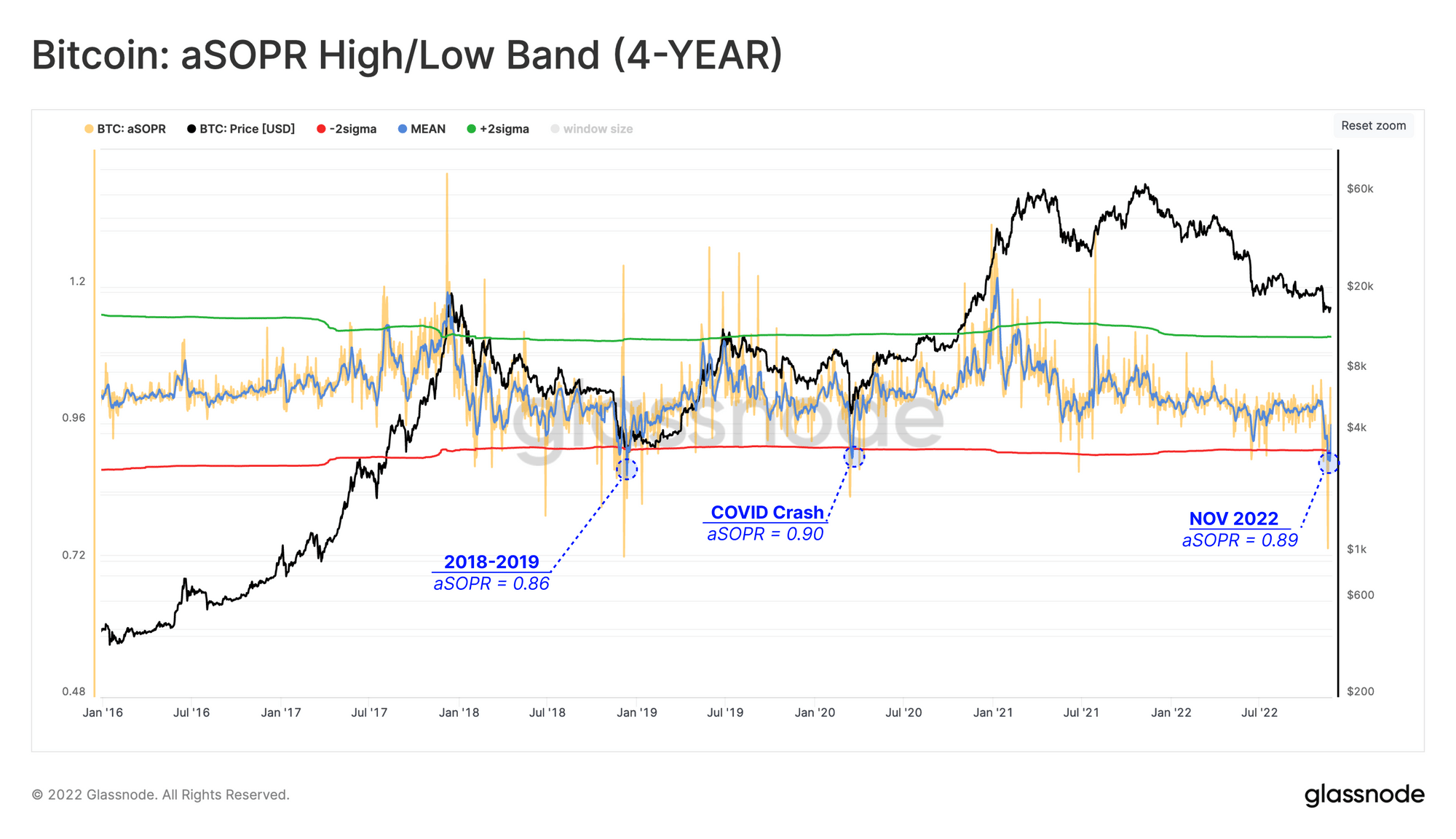

An assessment of BTC’s aSOPR calculation also revealed that “realized losses have also been historic in magnitude.” According to Glassnode,

“The recent market reaction to the FTX selloff manifested as an aSOPR reading breaking below the low band for the first time since March 2020. The significance of this event is again only comparable to the COVID crash and capitulation of the market in December 2018.”

Source: Glassnode