Best crypto with a base price value

Disclaimer: The text below is an ad item that is not part of Cryptonews.com editorial content.

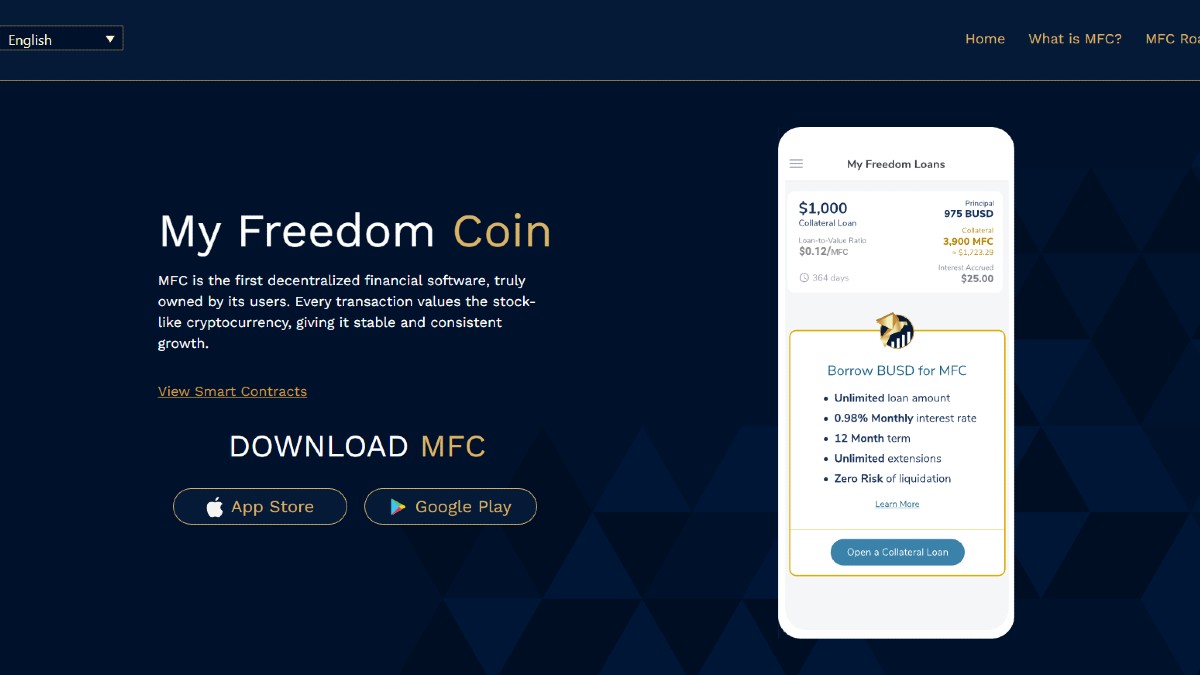

Investing in initial coin offerings (ICOs) or even already launched and listed tokens that have a low market value is becoming increasingly risky as time goes on. A volatile market that is already saturated with different types of projects is not a very forgiving place; For this reason, there are many who cannot afford to lose their investments, who just steer clear of most ICOs. My Freedom Coin is a project that removes many of the concerns that retail investors have when looking at new and upcoming tokens: by introducing a floor price for tokens through an innovative smart contract system, there is no fear that your investment will go to zero.

How does the floor price work?

The smart contract that contains all the funds generated by Coin Offerings is called BUSD Treasury, abbreviated to BUSDT. It also ensures the existence of the Floor Prize, which is calculated as BUSD divided by the circulation figure of My Freedom Coin (MFC). When Peer-to-Peer fees are charged, which are always 0.5% of the transaction amount in MFC, it is taken out of circulation, which ensures that the Floor Price increases as time goes on.

The Peer-to-Peer fees are not the only fees on the platform, but all other types of fees also work in the same way, by having a percentage of them removed from the Treasury to increase the base price. In order to trade on the platform, for example, you have to pay for a trading license, which varies between USD 5 and USD 50, depending on how quickly you got on board – unless you were very lucky and were one of the first 10,000 users of My Freedom Coin, in which case your trading license is free. 10% of the trade license value is also taken out of circulation, while the remaining 90% is added to the community program to enable referral bonuses, making it return to customers.

A third way that fees take MFC out of circulation and ensure that the base price goes up is through secured loans. If you want to provide security for your MFC holdings and take out a loan with the Treasury, you will be charged 0.98% interest per month. The loan period is 12 months, but can be renewed at any time before this deadline expires with a fee of 0.5% for loan renewal.

But does this make the app expensive to use?

In short, no. If you do not intend to trade on the stock exchange within a given month, you have no obligation to pay for the trading license. In addition, if you are among the early users, your trading license actually comes quite cheaply or even for free! The app itself, which is available on both Android and iOS systems, is also free to download.

In addition, it is the unique economy that makes this project less risky than others currently available. With a base price, there is no risk of going to zero. This also ensures that if you take out a loan, there is zero risk of liquidation – which unfortunately is not the case for many crypto borrowers, as recent events have shown.

In addition, with all the contingents you pay either into the value of the coin itself or into a community program, you still win on many levels. This could make MFC your rock in the stormy sea of volatile crypto markets – something not even stack coins have been able to prove on a consistent basis. After all, this is more than most other types of assets, crypto or traditional, can claim for themselves.

To join this innovative new platform, use the QR code CXPMGOSKJT. If you want to stay up to date with everything that happens there, follow Discord, Reddit, Twitterand / or Telegram!