A first-of-its-kind study published by the Basel Committee on Banking Supervision shows that the world’s largest financial institutions are exposed to around 9.4 billion euros ($9 billion) in crypto assets. The research paper authored by Basel Committee Secretariat Renzo Corrias further explains that of all banks’ total risk exposure, cryptocurrency exposure is estimated to be around 0.01% of total exposures.

Banks have $9 billion in cryptocurrency exposure, which equates to roughly 0.01% of total risk exposure

A recent study published by the Basel Committee on Banking Supervision (BCBS) explains that the world’s top banks are exposed to around $9 billion in cryptocurrencies. BCBS is a global organization made up of members associated with the world’s central banks and financial institutions from a myriad of jurisdictions.

The study, called “Banks’ exposures to cryptoassets – a new data set,” was written by secretariat Renzo Corrias. The research aims to create a primary global standard for the “prudential treatment of banks” [crypto asset] exposures.”

“Total [crypto asset] Exposures reported by banks amount to around 9.4 billion euros. In relative terms, these exposures represent only 0.14% of total exposures on a weighted average basis across the sample of reporting banks [crypto asset] exposures,” details the report written by Corrias. “When we consider the entire sample of banks included in the Basel III monitoring exercise (ie including those that do not report [crypto asset] exposures), the amount shrinks to 0.01% of total exposures.”

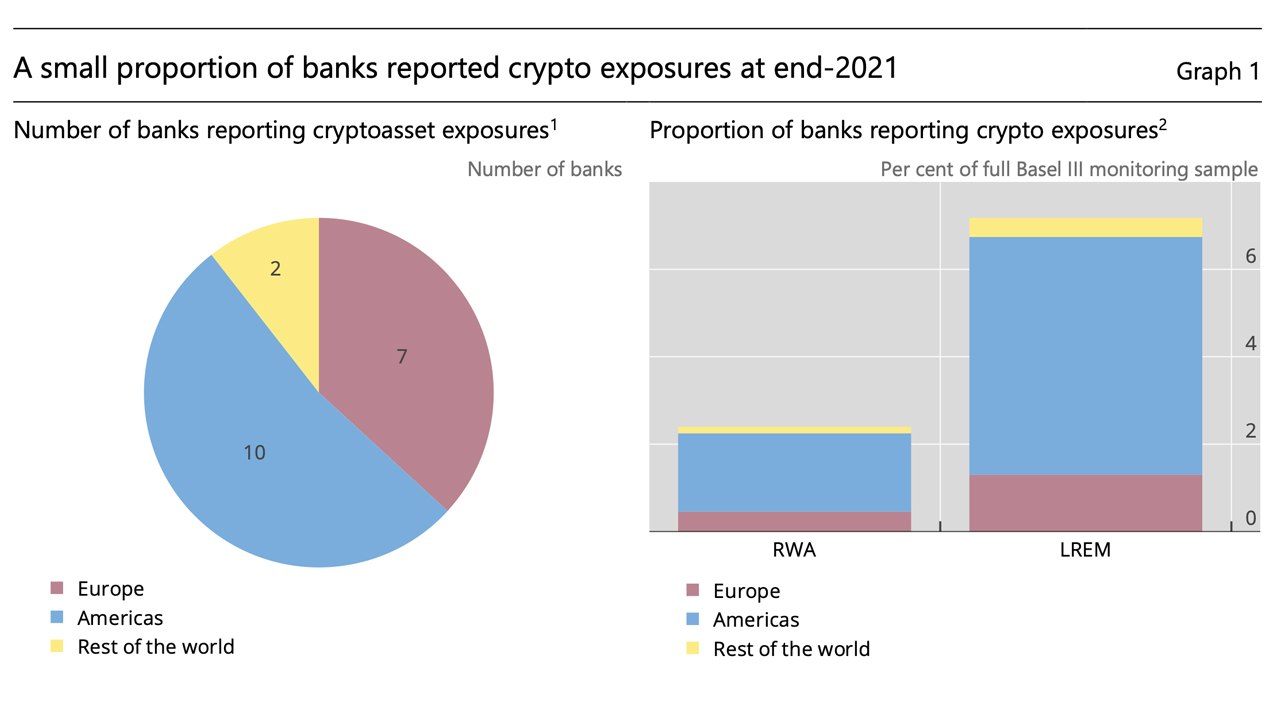

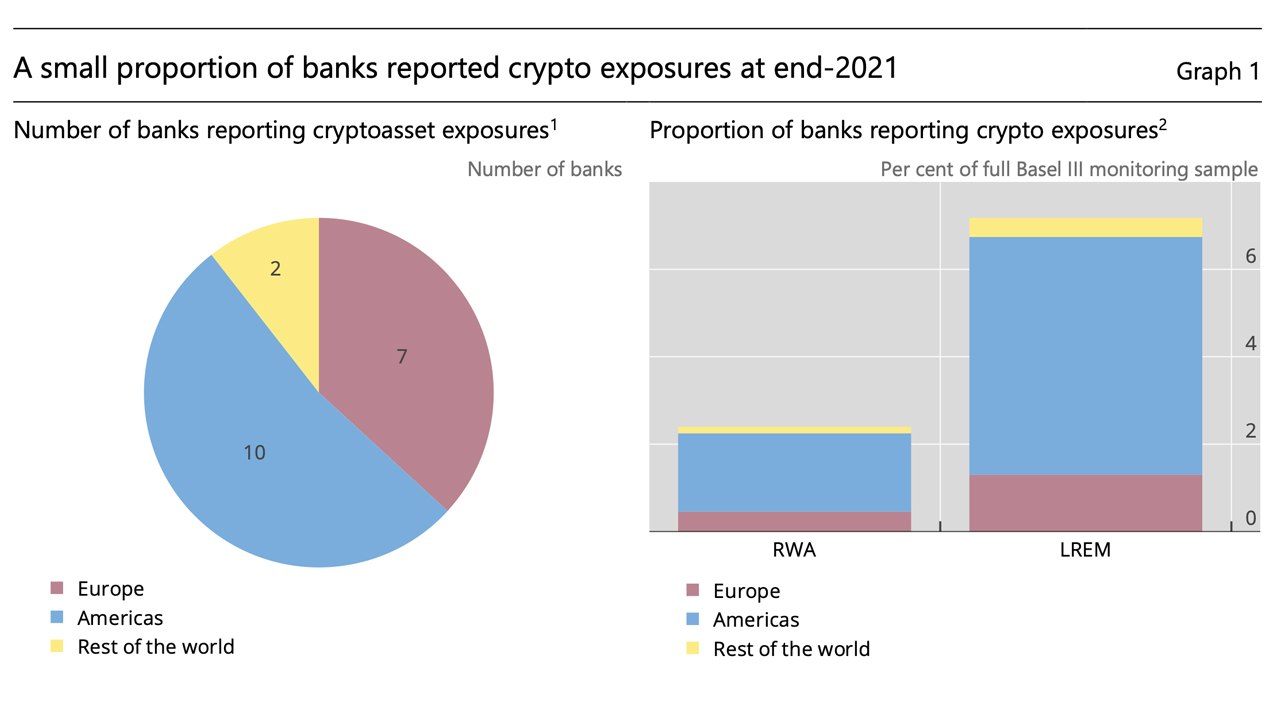

BCBS shows that 19 banks worldwide submitted data for the research, and about ten financial institutions from America. Seven banks originated from Europe, and two banks came from the rest of the world. Corrias notes that the banks represent a small group of financial institutions out of the collective 182 banks BCBS assessed for its Basel III monitoring exercise.

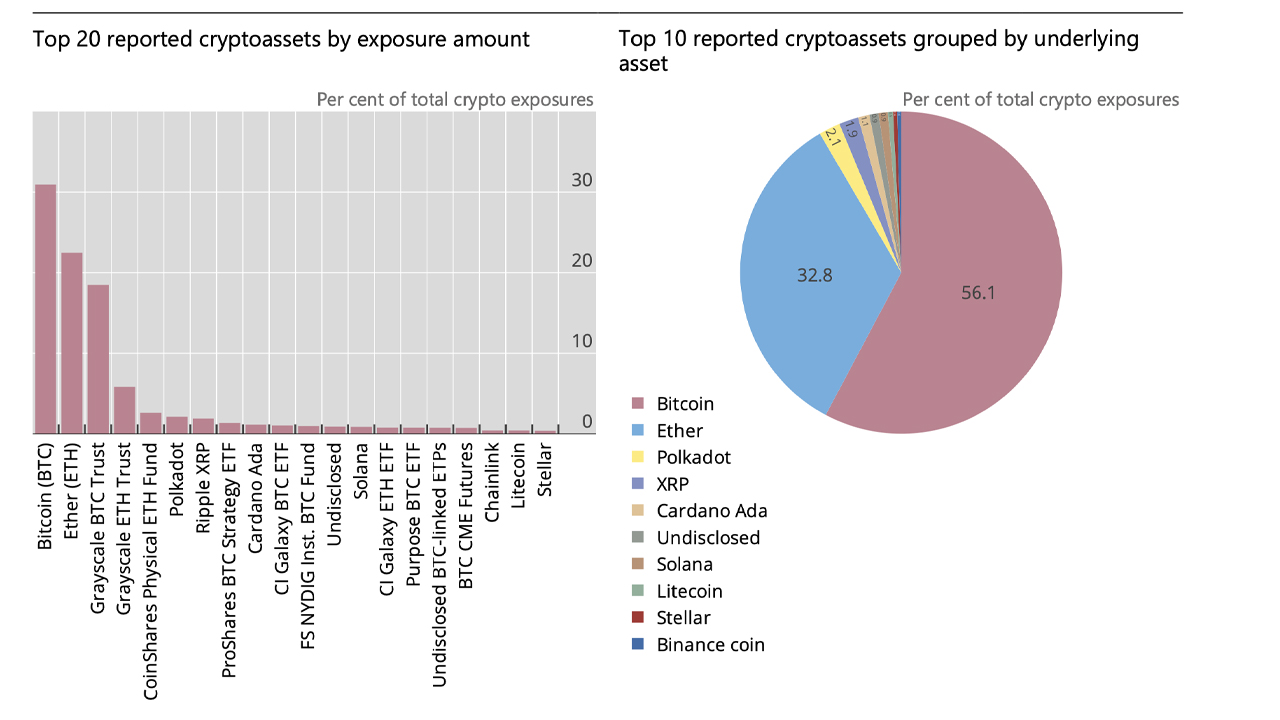

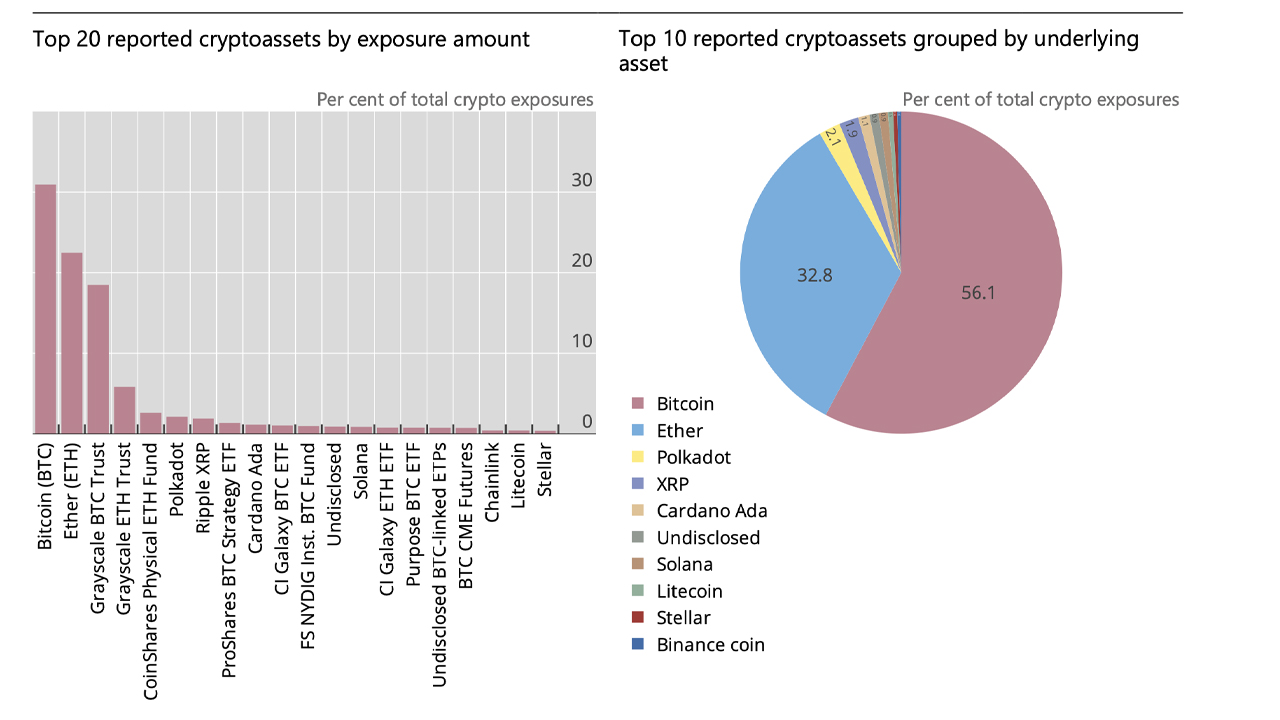

The crypto asset exposure the banks reported consisted mostly of bitcoin (BTC) which was around 31% of exposures, and ethereum (ETH) which made up 22% of exposures. In addition to exposure to USD-backed stablecoins, banks are also associated with crypto assets such as xrp (XRP), cardano (ADA), solana (SOL), litecoin (LTC) and stellar (XLM).

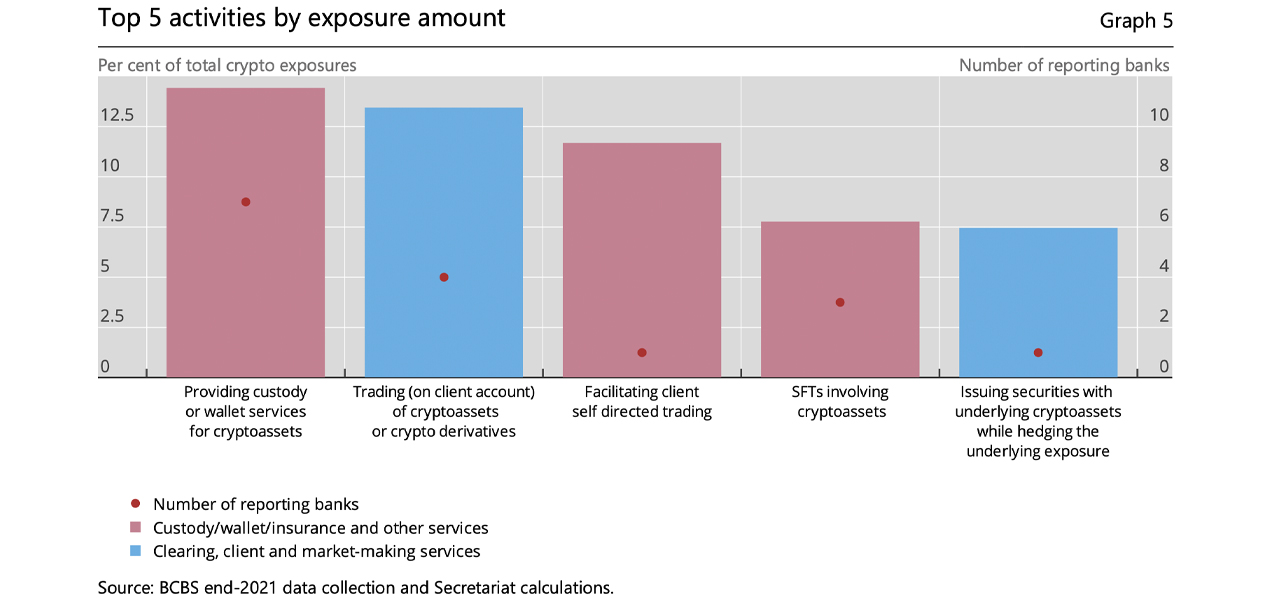

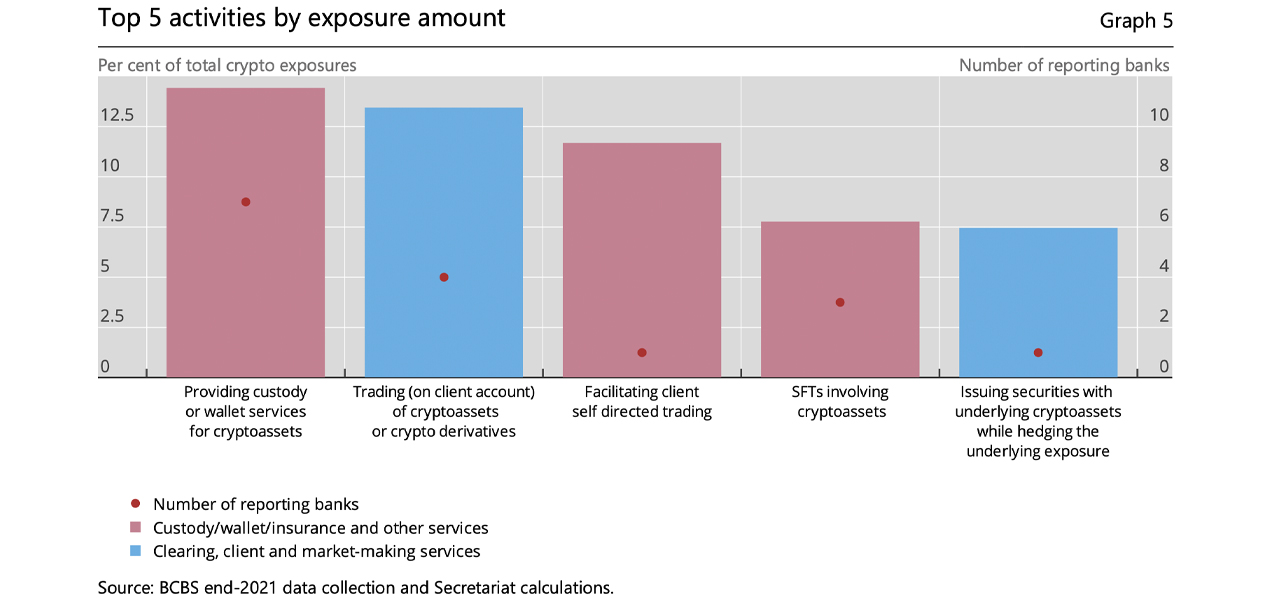

Corrias explains that banks’ exposure to crypto consists of three different categories that include crypto holdings and lending, clearing and market-making services, and custody/wallet/insurance services. Of the top five activities that increase banks’ crypto exposure, the top service is “providing custody or wallet services for [crypto assets].”

Tags in this story

$9 billion, 0.01% of total risk exposure, 182 banks, 19 banks, America, banks, bank crypto, basel committee, Basel Committee Secretariat, Basel III monitoring exercise., BCBS, Bitcoin (BTC), crypto assets, crypto asset exposures, Cryptocurrency exposure, Ethereum (ETH), Europe, Financial Institutions, Secretariat Renzo Corrias, Stablecoins

What do you think of the recent BCBS report on banks’ exposures to crypto assets? Let us know what you think about this topic in the comments section below.

Jamie Redman

Jamie Redman is the news editor at Bitcoin.com News and a financial technology journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open source and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or an endorsement or recommendation of products, services or companies. Bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is directly or indirectly responsible for damages or losses caused or alleged to be caused by or in connection with the use of or reliance on content, goods or services mentioned in this article.