Backed by Tiger Global, Mayfair comes out of stealth to offer businesses a higher return on their money • TechCrunch

A startup is banking on the fact that businesses are eager to earn as much interest as possible on their money.

Mayfair is a new fintech startup that offers businesses up to 4.02% APY, a figure it claims is among the highest out there. How a startup that is barely two years old is able to offer such a high interest rate to companies going back to its partners. Mayfair itself is not a bank, but rather a fintech company that offers FDIC-insured products through an Arkansas-based bank called Evolve Bank & Trust. The money is actually moved by Stripe via technology to an account with Evolve, with Stripe holding the ledger.

“We’ve tied everything together,” Mayfair’s co-founder and COO said Munish Chopra.

Chopra and Daniel Chan had worked in private equity hedge funds for most of his career and became frustrated at not being able to put any of his own money to work “for decent returnswith an average corporate savings account paying 0.3% in interest.”

“ONEand we didn’t want to take any risks with our money eitherChopra said, who previously worked as CEO of Triton Partners.

The pair teamed up with serial entrepreneurs Kent Mori and Kevin Chan in February 2021 to start a company, exploring different business models before settling on Mayfair’s current offering.

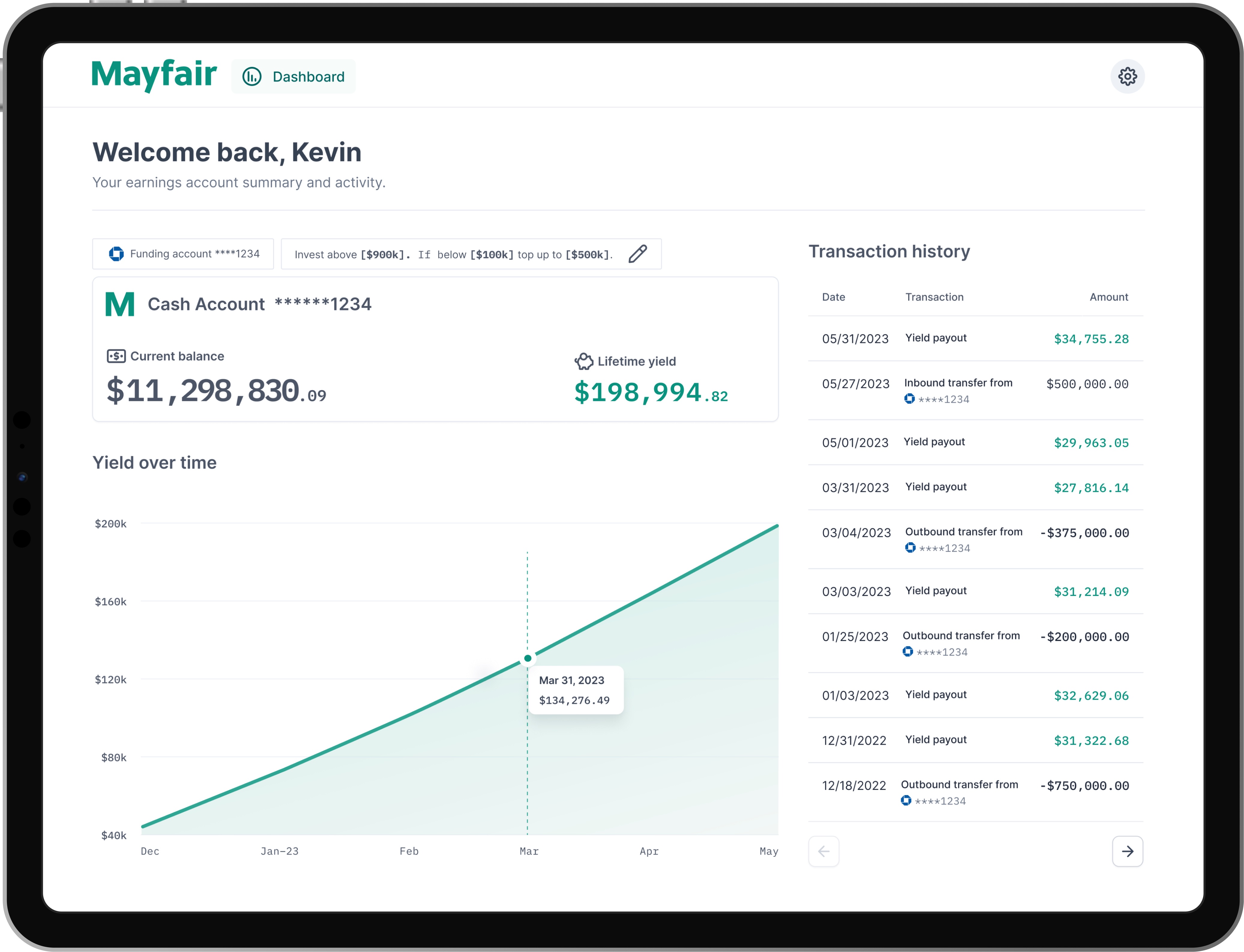

As well as providing access to higher interest rates, Mayfair says its software gives businesses a way to choose how much they need for operations and earn a return on the rest via automated cash management.

“On a daily basis, we will rebalance your accounts to ensure that if you have more than half a million in your operating account, we move it into the cash account so that it can achieve the maximum return,” Chopra said. “And if you fall below that, we’ll top up your account so you always have the half million you need for your operating purposes.”

Notably, Mayfair managed to raise $10 million in venture funding over a $2 million pre-seed round and $8 million seed round before they had even settled on their current concept. The raises took place before the downturn that has hit the startup world began in full, with the seed round ending in April 2022 in conjunction with the closing of a $4 million debt facility. Amity and BoxGroup led Mayfair’s pre-seed funding. Tiger Global, led by John Curtius (who has since left the firm), led the company’s seed raise with Amity and BoxGroup also participating.

“When we went around trying to figure out what our options were, it turned out that if we pushed hard enough and negotiated hard enough, we could be far better [interest] prices, and we can develop far better partnerships,” Chopra told TechCrunch in an interview. “So while we were doing that, it became obvious to us that we should really start a company that makes that price available to others, whether they’re startups or more successful companies … It’s obviously a very sensible thing for people to do with cash, especially now when there’s problems with inflation and everyone’s downsizing and needing to do something with their money.”

Mayfair went live with its offer in late 2022, emerging from stealth with “dozens” of customers including start of freight logistics Factored quality, on its platform.

“Some of them have very small balances, like tens of thousands of dollars,” Chopra said. “Some of them have tens of millions of dollars. And it’s not limited to the US either.”

Image credit: Mayfair

In the short term, Mayfair is keen to line up more partner banks and develop more products. The company believes that it can attract banks as partners by committing to deliver a higher amount of deposits than they would get on their own.

“They don’t have to pay to have a marketing force or for distribution,” Chopra said. “We do it efficiently and then give them a pot of cash. If they had to borrow overnight, they would have to pay more.”

Evolve pays Stripe. Stripe, in turn, pays Mayfair and Mayfair pays its customers, keeping what Chopra described as a small cut. Down the line, the company plans to charge for certain features related to cash management that have not yet been developed. Chopra said the company doesn’t see fellow fintech Mercury as a competitor (that company is also partnered with Evolve), and sees their services as “complementary.”

Mayfair currently has 12 employees. It uses the funding to hire, focusing on engineering, product and design.

Patrick Yang, founder of Amity Ventures, told TechCrunch via email that he was drawn to the caliber of Mayfair’s founding team.

For example, Kevin Chan also founded Headway, which has raised over $100 million from investors such as Andreessen Horowitz, Accel, GV and Thrive. Meanwhile, Dan Chan founded JANDI, who is baptized the Slack of Asia.

“I have known the team for many years prior to investing and was attracted by their ability to execute and the speed at which they have been able to ship quality products that are used at scale. They have a massive vision to be an end-to- end-to-end financial platform for fast-growing companies that includes management and automation around treasury, finance, accounting and operations, Yang told TechCrunch. “As an investor in Carta, I see a similar path for Mayfair to be an important part of any business starting with financial management, as Carta did with cap table management.”

Want more fintech news in your inbox? Sign up here.