Australian women earn more from crypto than Australian men

Australian women reported earnings of $7314, compared to $7089 for Australian men. This is according to a new survey from the crypto exchange Swyftx.

Despite the crypto winter biting hard, 72% of Australians who own crypto reported an average profit of $7152.

This finding may be surprising, but there are some other interesting pieces of information that have come from the survey.

This year, Australians are more keen on the idea of buying crypto. According to Swyftx, “Crypto spending has increased by 10pp over the past 12 months, with 53% of crypto-owning Aussies reporting that they have used crypto to make purchases. The most popular site to buy items with crypto is Amazon (via Purse.io) 27%, followed by restaurants/hotels (23%) and gas stations (21%).

Australian crypto spending is on the rise

Tommy Honan is head of strategic partnerships at Swyftx. “Technically, Australians can use crypto almost anywhere if they have a Mastercard or Visa payment card from a digital asset provider. We believe the use of crypto payment cards is why we’ve seen such a big jump in the number of Australians saying that they have used crypto for purchases. In the long term, the increased use of crypto for spending calls into question the assumption that cryptocurrencies are purely speculative assets. We are getting closer to the long-term thesis of Bitcoin as a currency.

“Less important, but still relevant to the growth of crypto consumption in Australia, is an increase in the number of online and brick-and-mortar stores accepting digital assets as a form of payment. These are places like Zumi, Travala and a number of smaller retailers across areas such as cafes and gas stations .Our expectation is that the introduction of regulation could be a tipping point for many retailers to start offering crypto payment options.

“If you’re a merchant, there are some attractions to offering crypto payment options. Transaction fees are generally lower than credit card counterparts, and because Bitcoin offers irreversible payments, it basically eliminates the risk of people reversing their payments after they’ve received a good or service , which is a problem for sellers.”

Australian beginners are more friendly towards crypto

About one million residents Down Under are estimated to enter crypto markets for the first time in 2022-2023. Millennials and Gen Zedders are the most likely to buy digital assets.

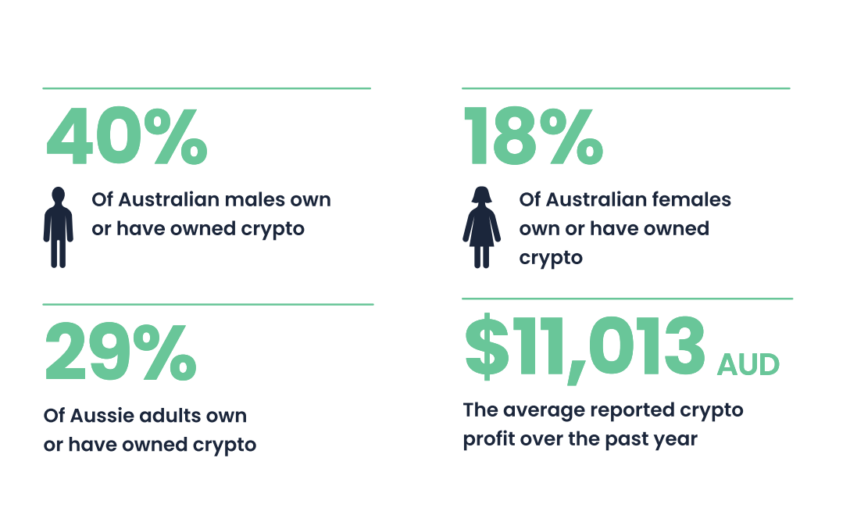

Crypto adoption rates in Australia increased by four percentage points in the past year. 29% of Australians say they own (21%) or have owned crypto (8%).

Says Honan, “We know that Australians are buying crypto for a variety of reasons, but there’s no doubt that the majority of Australians see it primarily as a long-term investment. Your average local investor, to the extent that there is one, is a metropolitan, millennial father with children at home who report a high level of financial knowledge.

“The really interesting question is, will investments be the main use case for crypto in five years? Everyone expects prices to stabilize as the market matures, and that brings you closer to having a more predictable day-to-day price. In the long term, our expectation that Bitcoin and Ethereum will behave more like currencies than securities.”

Australian regulation

The key barrier to market entry for non-crypto users is the lack of effective regulation.

The second annual Swyftx Cryptocurrency Survey was released amid volatility across all markets. While $2tn has been wiped out by global crypto markets, traditional markets have also hit a blizzard. The ASX has fallen around 8% since this time last year. And Australian house prices are falling, although it is believed that this will not be prolonged.

Honan says: “This is the first real sign that Australians are looking at a future beyond the crypto winter. Even in the midst of a bear market, there is belief in the fundamentals of cryptocurrency and blockchain technology, and this is manifesting in a high intention to buy digital assets among under 50. But the crypto winter has taken a toll, and confidence in digital assets in the country has fallen as a result of the failure of some major crypto projects.”

Bear market and trust

The bear market has shaken the confidence of Australians who have never bought crypto. 61% said they have not bought crypto because of trust issues. This is 3% higher than last year.

Despite this, more Australians than ever trust a move to crypto. 53% of respondents said they used digital assets to purchase goods and services in Australia last year. This is an increase of 10 percentage points from last year’s survey.

Says Honan, “It’s interesting to see such a significant increase in the number of Aussies using crypto to shop online because it speaks to where the future of digital assets almost certainly belongs. Over the next five to ten years, we expect to see far fewer cryptocurrencies and far less market volatility. Digital assets and traditional finance are likely to be inseparable.”

Australia’s future in crypto

Says Honan, “Australia is fast becoming one of the crypto capitals of the world. You have a young and affluent population that is generally receptive to new technologies, and that translates into huge enthusiasm for all things crypto and blockchain . People were turned away from the Australian crypto convention during the peak of the bear market, it’s truly astonishing. But it speaks to the fact that Aussies see digital assets as a transformative technology.

“Australia doesn’t have the sophisticated wholesale financial services you find in centers like the US and UK, but it punches well above its weight in blockchain and crypto, with some genuinely exciting and disruptive projects operating from centers including Brisbane, Sydney and Melbourne.”

Got something to say about the Australian crypto landscape or something else? Write to us or join the discussion in our Telegram channel. You can also catch us on Tik Tok, Facebook or Twitter.

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action the reader takes on the information contained on our website is strictly at their own risk.

![Bitcoin Cash [BCH]: Everything you need to know before writing this alt Bitcoin Cash [BCH]: Everything you need to know before writing this alt](https://www.cryptoproductivity.org/wp-content/uploads/2022/10/engin-akyurt-46g_OpI_spA-unsplash-1-1000x600-120x120.jpg)