Another ‘Blockchain Island’ pioneer investigated, Malta companies also declared bankruptcy

[gpt3]rewrite

The US Securities and Exchange Commission has filed a complaint following an investigation into one of the cryptocurrency exchanges that flocked to Malta during the initial crypto mania of 2018 and 2019 when such operations went largely unregulated and unmonitored.

Bittrex, then a leading crypto exchange, established itself in Malta in October 2018 and moved to Liechtenstein in October 2019 just as actual regulations for the free-for-all shadow market were announced.

Bittrex Inc. said at the end of October 2019 that it is shutting down its operations in Malta, Bittrex International, which “coincided with the launch of a new exchange”, Bittrex Global about Liechtenstein.

Bittrex Inc. said Monday that it and several affiliates filed for bankruptcy in the wake of the SEC complaint and after its U.S. operations were shut down in response to a regulatory effort.

According to court papers, Bittrex-related entities Bittrex Malta Holdings Ltd and Bittrex Malta Ltd also went bankrupt. They are still registered as active in the Malta Business Registry.

The SEC sued Bittrex in US federal court last month, alleging that it violated the regulator’s rules between 2017 and 2022 while earning at least $1.3 billion in revenue. The time in Malta was in the middle of the period under investigation.

The SEC said Bittrex at times acted as a brokerage, exchange and clearing agency but did not register with the SEC.

The company is also listed on the US Treasury’s Office of Foreign Assets Control as its largest unsecured creditor, to which it owes $24 million from an earlier settlement for failing to prevent customers in Iran, Cuba and other sanctioned nations from using its cryptocurrency platform.

Bittrex was among a number of crypto companies that Malta opened its doors to and that benefited from a so-called ‘grandfathering period’.

Until that “grandfathering” period expired and their applications were processed, such companies were essentially exempt from the need for authorization or even the need to comply with anti-money laundering laws.

This largely explains the rush for large companies to register their interest in setting up in Malta at a time when other governments were focusing on regulating the sector rather than attracting as many players as possible, as Malta did.

A number of them were later investigated by the SEC and others for their actions in Malta and/or after their departure over the untold billions that changed hands and disappeared without a trace.

Many have since been investigated for a variety of crypto crimes.

These include Justin Sun, an early participant in Malta’s Blockchain Island, who was charged by the US Securities and Exchange Commission with the unregistered offering and sale of crypto assets. He was also charged with manipulating the price of TRX, his cryptocurrency.

Justin Sun

They also include the government’s then ‘virtual currency partner’ Christopher Emms, now wanted by the FBI for teaching North Korea blockchain money laundering while operating in Malta.

Emms, who is now seeking asylum in Russia, once claimed to be spearheading Malta’s ‘Blockchain Island’ fever. He is now wanted for violating US sanctions at a conference in North Korea that also led to the highly publicized arrest and indictment of Ethereum developer Virgil Griffith.

Emms is currently wanted in the US where he faces up to 20 years in prison for allegedly teaching North Korean government officials at the conference how to use blockchain to launder money and avoid US sanctions – crimes he allegedly committed while active under Malta’s Blockchain Ordeal.

Emms was subsequently placed on the FBI’s wanted list for teaching the technology to North Korea – has said he is now seeking political asylum in Russia.

Christopher Emms

More light is also being shed on the shady dealings Binance is suspected of running through Malta during its year-long 2018-2019 stay on “Blockchain Island”.

The latest revelation is that Binance had processed close to $346 million in bitcoin for Bitzlato – a digital currency exchange whose founder was arrested by US authorities last week over allegations that the exchange ran a “money laundering engine”.

The US Department of Justice charged Bitzlato’s co-founder and majority shareholder Anatoly Legkodymov, a Russian living in China, on January 18 with operating an unlicensed money exchange business that “operated a high-tech axis of cryptocrime” by processing $700 million in illicit funds.

Binance was among Bitzlato’s top three counterparties by the amount of bitcoin received between May 2018 and September 2022, according to the US Treasury’s Financial Crimes Enforcement Network (FinCEN).

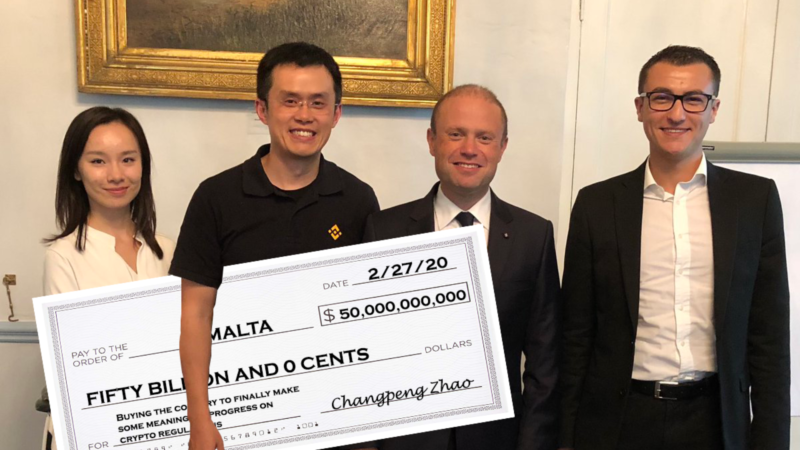

Binance CEO and founder Changpeng Zhao presents then Prime Minister Joseph Muscat and Minister Silvio Schembri with a $50 billion novelty check to “buy” Malta – “Blockchain Island”.

Binance chief strategy officer Patrick Hillmann recently admitted in an interview with The Washington Post that the world’s largest cryptocurrency exchange, which established itself in Malta in 2018, “had flaws in its approach to regulatory compliance in the early years of its rapid expansion.”

The company, he said, has now changed its ways and is trying to make a clean break from its early days of shaky regulatory compliance.

[gpt3]