Alternative investments without Blockchain? It may be the safest option.

Ioana Surdu-Bob, Konvi CEO

See Fractionalization

Convi App

Konvi, the first pan-European platform to protect its customers through a regulatory-first approach, has deliberately chosen to deviate from tokenization.

— Ioana Surdu-Bob – CEO of Konvi

DUBLIN, DUBLIN, IRELAND, Nov. 29, 2022 /EINPresswire.com/ — The wide and diverse world of alternative investments is opening up to retail investors thanks to recent advances in fractionalization and tokenization, which allow one asset to be split into fractions and collectively owned by anyone. This means that any small investor can now invest in watches, art, cars and more. These investments were previously only available to high net worth individuals.

What sets platforms focused on collectibles and exotics apart is not only the variety and quality of their offerings, but also their infrastructure. When it comes to customer security, not all fractionalization methods are created equal. In particular, tokenization, which leverages blockchain technology, is usually considered a regulatory gray area.

Konvi, the first pan-European platform to protect its customers through a regulatory-first approach, has deliberately chosen to deviate from tokenization.

Recent events in the crypto market have brought consumer protection laws and regulations to the forefront of the public discourse surrounding alternative investments. The recent FTX crash alone could wipe out billions in customer deposits, all due to a lack of regulatory oversight. However, it is important to note that crypto is not the only alternative asset class that lacks better regulation.

The main reason why Konvi bet against crypto and tokenization, despite what was once popular opinion, was simple: Tokenized co-ownership is not consistently and clearly protected by regulations across Europe. Companies in the tokenization space generally fail to separate their customers’ assets from their own and from other customers’. There is a risk that their assets are not safe in the event of, for example, bankruptcy. This can also lead to conflicts of interest, with many platforms holding significant ownership and even a majority stake in the underlying assets.

In contrast, the Konvi team wanted to offer a service that gives shared ownership to its customers through share-based crowdfunding. To achieve this in the European market, they follow the new EU-wide Crowdfunding Service Provider regulation. Their platform lists financing projects in holding companies (SPVs) whose sole purpose is to buy, manage and sell a specific asset. The holding companies are not controlled by Konvi and are fully owned by the customers. This process increases customer security as there is a clear legal separation of ownership and interests between each customer and the platform.

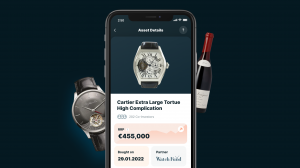

With security and regulation now becoming the main factor when investment decisions are made, Konvi has recorded record sales, despite low activity in crypto and public markets. Their platform showcases investments in watches, spirits and more handpicked by leading asset managers. Their partners have purchased some of the world’s rarest assets, such as the €455,000 Cartier Extra Large Tortue High Complication Platinum, the third most expensive Cartier watch in the world.

Konvi has quickly become a game changer in this market segment by implementing one of the safest and most innovative fractionation processes through the use of cutting-edge technology, market-proof vision and an incredible niche commercial offer aimed at private customers.

Eran Peer

Konvi Holdings Limited

send us an email here

Visit us on social media:

Facebook

Twitter

LinkedIn

Other

![]()