After FTX debacle, Exchange Distrust among Bitcoin investors grows

On-chain data shows that Bitcoin investors have withdrawn large amounts from exchanges as distrust surrounding them has grown recently.

FTX debacle causes more Bitcoin investors to mistrust exchanges

As pointed out by an analyst in a CryptoQuant post, investors who have become scared of holding onto exchanges are sending their BTC to personal wallets.

There are a couple of relevant indicators here; the first is “Active Recipient Addresses”, which tells us the total number of wallet addresses that were active as recipients during a specific time period.

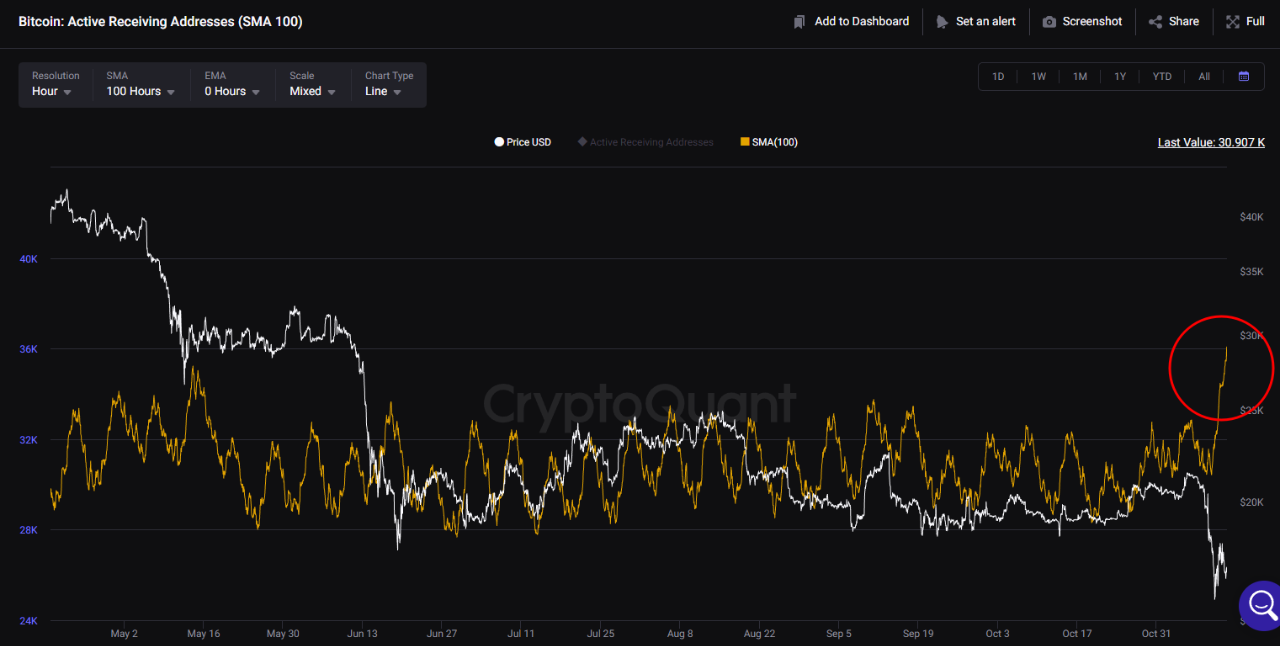

The chart below shows the trend of the 100-day simple moving average of this Bitcoin indicator over the past six months:

The 100-day SMA value of the metric seems to have spiked up in recent days | Source: CryptoQuant

As you can see in the graph above, the value of Bitcoin Active Receiving Addresses has been very high in recent days.

This means that investors have sent coins to a large number of individual wallets since the crash due to the FTX debacle.

The other indicator of interest is the “all exchanges reserve”, which measures the total amount of BTC currently sitting in the wallets of all centralized exchanges.

Here is a chart showing the trend of this Bitcoin calculation:

Looks like the value of the metric has been going down recently | Source: CryptoQuant

From the graph, it is clear that Bitcoin currency reserves had followed a general downward trajectory for more than a year now, but the calculation has plunged particularly hard in recent days.

This plunge in the indicator has also coincided with the collapse of FTX. Typically, currency reserves increase during major crashes as investors transfer their coins to exchanges for dumping.

However, the recent trend in the metric has clearly not followed this pattern. The currency reserve is going down, combined with the fact that a large number of wallets are active right now, suggests that individual investors are withdrawing the coins to their personal wallets.

This shows that the FTX crisis has once again made Bitcoin holders wary of keeping their coins in the custody of centralized exchanges as they prefer to withdraw them to individual wallets.

BTC price

At the time of writing, Bitcoin’s price is hovering around $16.5k, down 20% in the last seven days. Over the past month, the crypto has lost 15% in value.

BTC has been moving sideways in the last few days | Source: BTCUSD on TradingView

Featured image from Kanchanara on Unsplash.com, charts from TradingView.com, CryptoQuant.com