A year after its debut, the ProShares Bitcoin ETF has underperformed the market by 1.8%

ProShares’ bitcoin (BTC) futures exchange-traded fund went live on the New York Stock Exchange a year ago, giving investors exposure to the world’s largest cryptocurrency without having to own the coin themselves.

Since its debut, the long BTC futures-based ETF has underperformed bitcoin by 1.79%, according to data tracked by Arcane Research. In other words, the ETF, which trades under the ticker BITO, has bled slightly more than bitcoin, which has fallen nearly 70% since the fund’s launch date of Oct. 18, 2021, according to CoinDesk data.

However, the ETF has performed well compared to market expectations. After its inception, several observers were concerned that BITO would underperform bitcoin by 10% to 13% due to “contango bleed” – the costs associated with rolling or moving the long (buy) position from an expiring contract to the next month’s contract.

“While poor, the underperformance was far lower than estimated based on 2021 data, estimating 13% annualized rolling costs,” Arcane Research analyst Vetle Lunde wrote in a note sent to clients early this week.

Explains the contango bleed

Before diving into what helped BITO beat market expectations, it’s important to understand the fund’s inner workings that make it vulnerable to contango bleeding.

BITO buys bitcoin futures listed on the Chicago Mercantile Exchange instead of the actual cryptocurrency.

The futures market usually trades in contango – a situation where the futures price exceeds the spot price. However, as the expiration date approaches, the settlement contract clears the premium and converges with the spot price, while the next month’s contract continues to trade at a premium.

Therefore, when the fund rolls over long positions, it liquidates expiring contracts at a price lower than the cost the contacts were acquired for, and then buys the following month’s contract at a premium to the spot price. Essentially, the fund sells low and buys high on each expiration date, bleeding money and ultimately underperforming the underlying asset.

Perhaps holding the actual cryptocurrency is the best option regardless of market trends.

The bear market saved the day

The crypto bear market, which began late last year, reduced monthly rollover costs and likely helped the fund beat market expectations, according to Lunde.

The degree of contango bleeding depends on how steep the contango is. It is usually steeper during a bull market when an asset is expected to rise and flattens during bearish trends.

When bitcoin began falling last December, the spread between prices in the futures and spot markets collapsed. The annual premium in three-month CME-listed futures fell in the single digits from nearly 20% in April 2021.

The premium fell as low as 3% in January of this year and has remained largely below 5% since then, barring occasional backwardation – a situation where spot prices are higher than futures prices.

As such, monthly rollovers became cheaper, ensuring that BITO is bleeding less money than previously expected.

“Due to a structural market shift as BTC brutally entered a prolonged bear market following the massive liquidation event on December 4, 2021, CME’s futures have tended to trade in a flat structure with minimal contango and intermittent backwardation,” noted Lund.

“Rolling dynamics have played in investors’ favor in 2022,” he added.

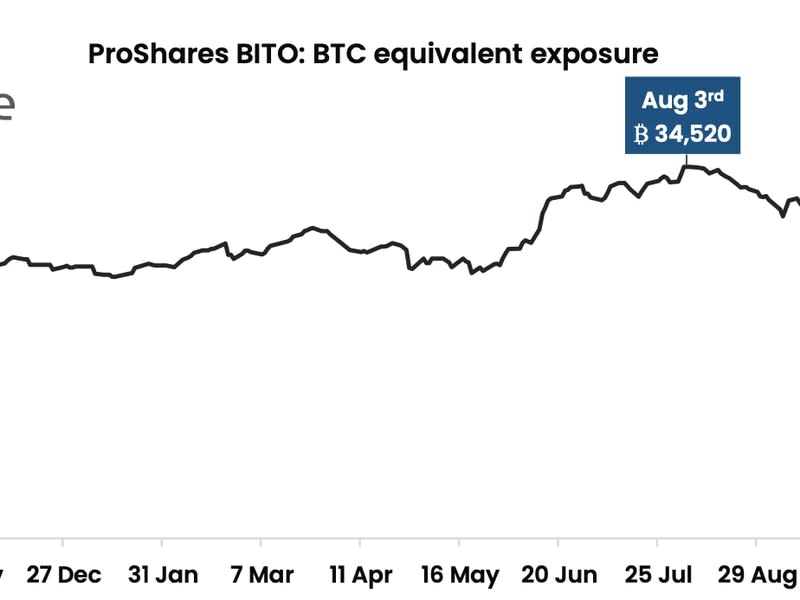

Record exposure

While the contango bleed makes futures-based ETFs look worse than spot-based ETFs, investors seem to appreciate what they got. (U.S. regulators continue to reject spot-based ETFs.)

Early this week, ProShares had a long exposure to CME equivalent to 32,520 BTC ($620 million), matching the August peak. VanEck’s and Valkyrie’s funds, which went live after ProShares’ debut, had bullish exposure of 1,075 and 1,095 BTC respectively.

According to Arcane Research, futures-based ETFs from ProShares, VanEck and Valkyrie account for half of open interest on the CME. Open interest refers to the dollar amount locked in the number of open contracts at a given time.