Coinbase Shares (NASDAQ:COIN): Downside Potential Ahead Despite Crypto Rally

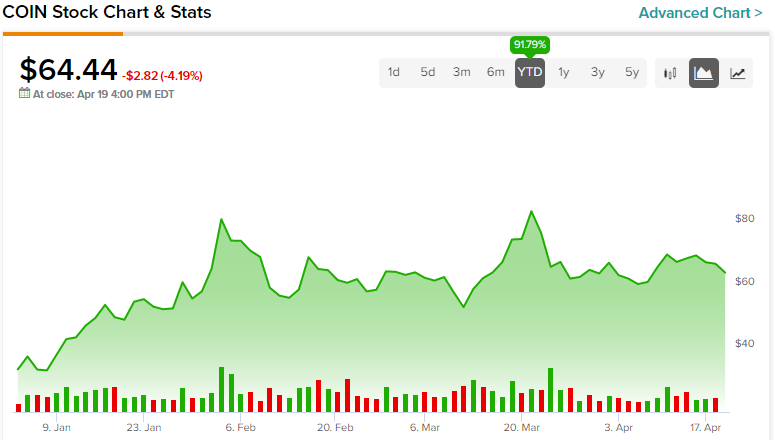

Coinbase (NASDAQ:COIN) the stock has almost doubled so far this year. COIN’s rally can be partially attributed to the general upswing in the market, but most importantly, it is because cryptocurrencies have made significant gains during this period.

That said, Coinbase’s investment case remains opaque, with several uncertainties surrounding its business model. Furthermore, the company has difficulty controlling expenses, which combined with absurd levels of share-based compensation makes it quite difficult to create value for shareholders. At the same time, shares seem overvalued in relation to Coinbase’s cyclical nature. Therefore, I am bearish on the stock.

What’s Moving COIN Stock Higher?

There are currently two factors moving shares of Coinbase higher, namely higher crypto prices and rising interest rates. Let’s break them down!

Crypto Rally

The recent upswing that cryptocurrencies have experienced is undoubtedly benefiting Coinbase, as higher transaction volumes and higher crypto prices directly translate into higher revenues for the company. This could signal a big improvement from Fiscal 2022, when the company reported 57% lower net income as crypto prices and transaction volumes plummeted compared to the frenzy that persisted in Fiscal 2021.

In addition to higher revenues, rising crypto prices are also contributing to the growth of Coinbase’s asset base. Aside from its clients’ assets and custodial funds, which were valued at roughly $80 billion by the end of 2022, Coinbase also has its own cryptocurrencies on the asset side of its balance sheet. Unfortunately, in 2022, the decline in crypto prices caused the value of Coinbase’s own crypto assets to drop by 56% to $424.4 million. However, with the recent rise in crypto prices, the company’s asset base and liquidity are expected to improve significantly this year.

Rising interest rates

Similarly, Coinbase investors are becoming more confident due to rising interest rates, which allows the company to record higher interest income. This is possible in two ways – first, through the company’s participation in the USDC (a digital stablecoin) ecosystem, which allows Coinbase to share any revenue generated from USDC reserves, and second, by generating higher interest on customers’ fiat balances. Despite suffering from the decline in crypto prices, Coinbase was able to achieve a massive 79% growth in interest income from the quarter to $4 to $182 million. This trend is expected to continue due to further interest rate hikes.

Why does Coinbase stock have significant downside potential?

Despite the recent enthusiasm surrounding Coinbase, the stock may have significant downside potential for two reasons. These reasons are the company’s inability to control its expenses, which is going to result in continuous losses and dilution, as well as the stock’s expensive valuation. Let’s take a deeper look.

Continuous losses going forward

One of the biggest challenges facing Coinbase is the company’s ongoing struggle to generate profits due to a combination of declining revenue and rising expenses.

Although rising crypto prices may positively affect the company’s revenue, crypto prices are still significantly lower than in the first half of 2022 (on average). At the same time, while interest income is increasing rapidly, it is only a fraction of total income (just over 10% in fiscal year 2022). Therefore, Coinbase is still going to report a decline in revenue in Q1 2023, which analysts estimate to be around 44% to $652 million.

Furthermore, we already know that Q1 is going to be another money-losing quarter for Coinbase, as management has already presided over absurd spending for the quarter. The firm expects R&D and general and administrative expenses of $625 million to $675 million, sales and marketing expenses of $60 million to $70 million, and restructuring costs of approximately $150 million. Therefore, losses should easily exceed $200 million in Q1 alone when considering the aforementioned revenue estimates.

Continuous losses and a lack of a roadmap for sustainable profit generation will continue to erode shareholder value as the company drains its cash reserves (cash down 47% in fiscal 2022 to $9.4 billion) and dilutes shareholders (the stock is up 16% since IPO). Excessively high levels of stock-based compensation should particularly contribute to the latter.

A more expensive valuation

The other bearish catalyst Coinbase has is the stock’s more expensive valuation. Coinbase is a highly cyclical company and should be valued as one. While there is the potential for significant profits if cryptocurrency prices rise, there is also the possibility of sustained losses if prices remain stagnant or continue to decline.

To price in this risk, I wouldn’t value the stock at more than 1x or 2x sales, suggesting significant downside potential from the current 4.7x sales multiple. This is particularly the case given the company’s general lack of cost control and management’s inadequate protection of equity.

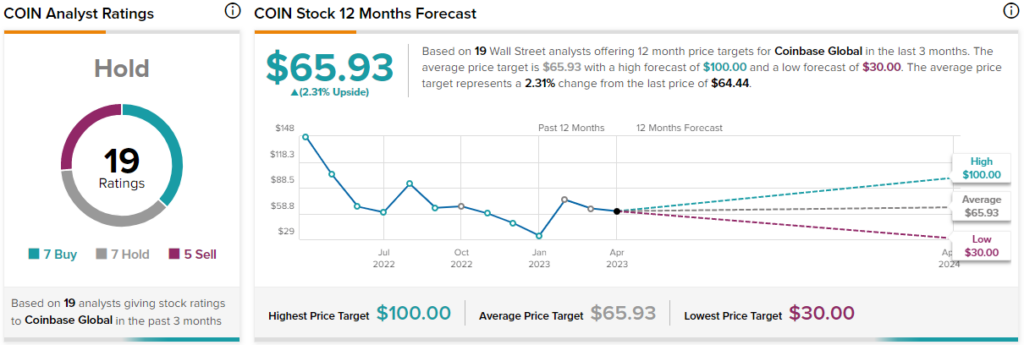

Is COIN stock a buy, according to analysts?

Although not as bearish, Wall Street is not optimistic about COIN. Coinbase stock currently has a Hold consensus rating based on seven buys, seven holds and five sells assigned over the past three months. At $65.93, the average Coinbase stock forecast suggests 2.3% upside potential.

The takeaway

Coinbase is currently enjoying a couple of strong tailwinds, including rising crypto prices and rising interest rates, which are likely to perform relatively better this year compared to Fiscal 2022. Nonetheless, with crypto prices staying below last year’s period and management’s guidance. pointing to heavy spending in Q1, Coinbase is set to continue posting significant losses in its upcoming report and likely throughout 2023.

As the company will need to raise more cash to sustain spending, which will likely include further dilution, equity will continue to deteriorate. Since the stock’s valuation does not seem to adequately reflect these risks, I am bearish on the stock.

Mediation