Whales flood exchange with BTC, what’s next?

- Bitcoin worth $290 million recently hit the Kraken as whales dumped their BTC holdings.

- As whales flooded exchanges with Bitcoin, the BTC price continued its decline to below $20,000.

- Analysts predict a bloodbath in Bitcoin as selling pressure on BTC increases.

Bitcoin price may crumble under selling pressure as the volume of BTC on exchanges rises. Analysts reveal a bearish view on the Bitcoin price.

Also read: Bitcoin and Ethereum Holders Alert: Merger Coincides with Creditor Notice Deadline for Mt.Gox

Bitcoin whales dumped inventory, 15,000 BTC moved to Kraken

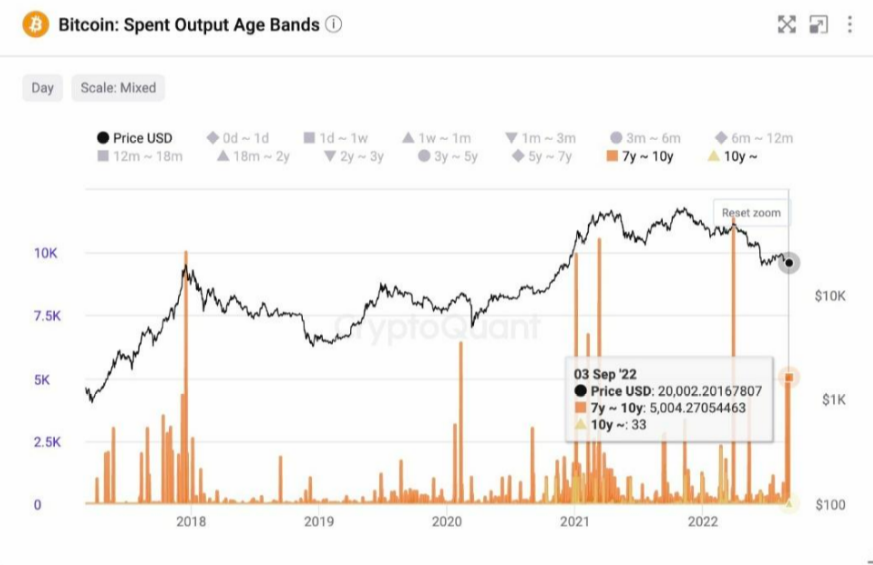

Bitcoins bought by a major wallet investor eight years ago, worth $290 million, have hit exchange wallets. This influx of 15,000 BTC to Kraken from a Bitcoin whale this week is a clear example of BTC outpouring by whales.

Ki Young JuCEO of CryptoQuant, commented on the increasing Bitcoin volume across exchange wallets.

Eight-year-old BTC on the move

Long-term Bitcoin holders are shedding their holdings. Whales have moved their BTC to exchange wallets as the asset’s price falls below the key $20,000 level.

The $20,000 level has significance for Bitcoin as an important psychological barrier for the asset. It is close to Bitcoin’s 2018 high and a price level where most large wallet investors and institutions are pouring BTC.

Selling pressure on Bitcoin is increasing

The Bitcoin price was trading near the $20,000 level on September 6 before the decline. This is close to the asset’s highest price point in the 2018 bull run. After hitting the $20,000 level, the Bitcoin price fell by 5% along with an increase in the exchange whale ratio.

“Exchange Whale ratio” is an indicator that measures the ratio between the sum of the top ten Bitcoin transactions of exchanges and the total exchange inflow. This makes it a key indicator of the Bitcoin price trend.

There was a sharp increase in the exchange whale rate before a 5% drop in the Bitcoin price on September 6th. The sharp increase indicates that whales are actively depositing Bitcoin across exchanges. The ratio is still high, and this is considered typical bear market behaviour.

Change whale ratio

Analysts predict further decline in Bitcoin

Phoenix Ashes, a Bitcoin analyst and trader, believes BTC could fall to the $18,600 level. A recovery of the $19,500 low is key to Bitcoin’s long-term recovery.

Bitcoin-USDT exchange rate chart