VPNs, Ripple XRP and Beaxy

Crypto News: We give you an overview of what has happened in crypto this week. And the biggest news event of the week came in the form of a bill presented to Congress that could have serious consequences for virtual private network (VPN) users.

The two-part “Restricting the Emergence of Security Threats that Risk Information and Communications Technology (RESTRICT)” law was unveiled in early March.

Virtually no privacy

The bill, if passed, would seek to identify “inventory of information and communications technology products and services that pose undue or unacceptable risk.”

That can include VPNs if they are used to access banned sites like TikTok. But ambiguity in the drafting of the legislation means it could target software used by more than one million users in the US

If passed, the bill carries a potential penalty of 20 years in prison or a $1 million fine. Or both.

At the heart of the case is the US’s belief that China has access to TikTok user data. TikTok is owned by the Chinese technology company ByteDance. And critics highlight the fact that the proposed legislation is similar to that of China, which has some of the toughest censorship laws in the world.

Crypto News – Socially

A ripple of cheers?

Has anyone heard something we haven’t? Last week, Ripple XRP saw social mentions skyrocket, along with its price – up 21% over the previous seven days. Figures from LunarCrush showed that when market and social performance are combined, XRP emerged as the number one digital asset.

Social engagement increased by more than 100%. However, the reason for the tension is unclear as the lawsuit between Ripple and the Securities and Exchange Commission (SEC) does not appear to be any closer to a conclusion.

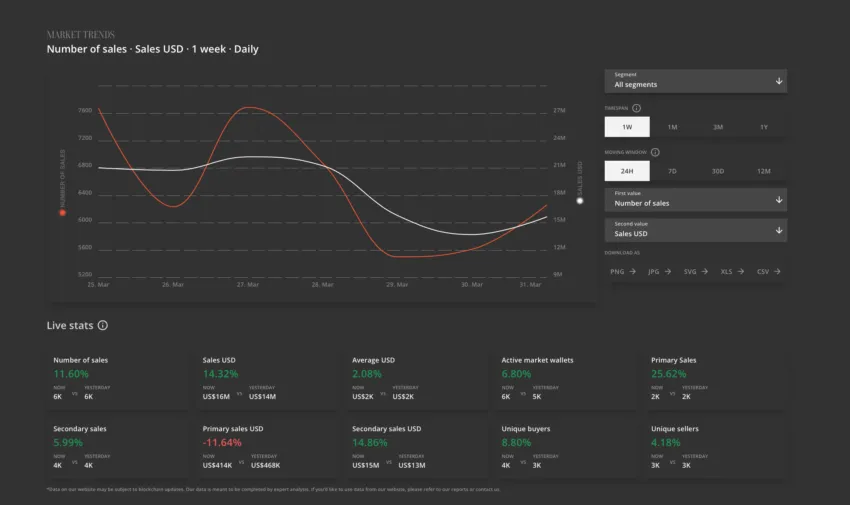

This week in NFT Sales

USD not too big to fail

Former Coinbase CTO, Balaji Srinivasan, has a bit of a downer on the US economy. Last week, he predicted that Bitcoin would reach $1 million in three months due to impending hyperinflation in the United States.

And this week he follows up with a prophecy that Bitcoin will eventually replace the dollar as the global reserve currency. But that’s only after it displaces the Chinese renminbi, which gets there first.

While his view may not be universally accepted, there is evidence that the USD is weakening against other currencies.

The US Dollar Index is down 8.9% over the past six months and has lost 1.34% of its value over the past year. USDX measures the value of the USD against a basket of other major fiat currencies.

The drop in the dollar is due to a heady mix of recession fears, interest rate hikes and the recent collapse of major US banks.

Meanwhile, Bitcoin has woken up from its crypto hibernation and is up 46% in the last six months. Most of these gains are attributed to America’s economic problems

But before we get carried away, experts believe that any growth in the Bitcoin price is unlikely to reach levels predicted by those who believe in hyperbitcoinization.

Another exchange bites the dust

Beaxy has become the latest exchange to incur the wrath of US authorities. The SEC alleges that the exchange operated without registering as a national securities exchange, broker or clearing agency. The announcement forced the exchange to suspend services with immediate effect.

The SEC further accused Beaxy of raising $8 million through the unregistered offering of its initial token, BXY. The regulator also claims that the exchange’s founder, Artak Hamazaspyan, used $900,000 for personal use, including gambling.

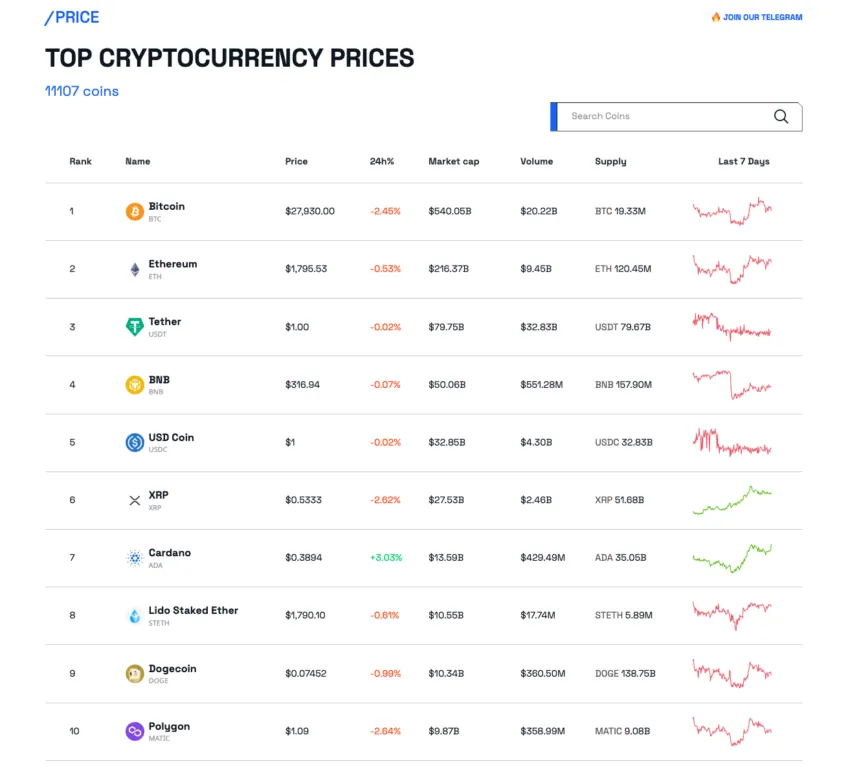

News about crypto coins

It was a big week for Ripple XRP, as described above, up almost 24%. And Stellar (XLM) returned a respectable 20%. Meanwhile, the biggest losers were Stacks (STX), down 20%, and Mina (MINA), down nearly 17%.

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action the reader takes on the information contained on our website is strictly at their own risk.