Strong growth in the NFT statistics

In Q1 2023, the general statistics of the NFT market increased greatly compared to Q4 2022, consolidating the strength of an industry that until a few months ago had been given up for dead.

Let’s take a look at what the main drivers behind this growth were and which NFT pools had the highest volumes.

All the details below.

Market statistics: NFT volumes are growing strongly

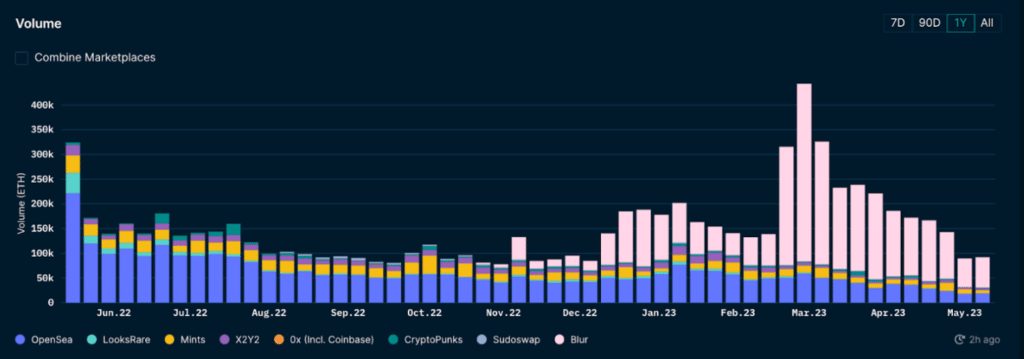

In Q1 2023, we saw an increase in NFT sales volumes compared to Q4 2022, confirming that the non-fungible token market is more vibrant than ever.

The data shows an increase in both ETH and USD volumes: specifically, in the last months of 2022 there were sales of more than 9 million NFTs, equivalent to 1,525,471 ETH or approx. 1.97 billion dollarswhile in the first three months of 2023, sales were just under 11.5 million with a volume of 2,839,354 ETH or 4.54 billion dollars.

The number of users also increased from 11.23 million in Q4 to 14 million in Q1which indicates not only that the collections are more popular, but also that public interest in this market has increased.

The main reason for this growth seems to be the launch of Blur, the NFT’s marketplace for professional traders, which has attracted the engagement of the crypto community.

In this sense, it signaled the beginning of 2023 end of OpenSea’s unchallenged hegemony as the industry’s leading platform, in favor of the newly formed Blur, which was more popular both for its user-friendly dashboards and for the rich data available for each marketplace collection.

Currently, the two marketplaces compete for the majority of the NFT sector’s sales volume.

However there was a short dip in April and the downward trend appears to have continued into the first days of May, although the forecast for the 2nd quarter of 2023 is positive.

It remains to be seen whether interest will match or surpass this Q1 2023 level in the coming months, and whether Opensea in particular will be able to regain some of the market share lost to Blur.

It will also be interesting to see if NFTs on Bitcoin, enabled by the rise of Ordinals, become mainstream and “steal” some of the volumes currently flowing on Ethereum and other compatible EVM chains.

Which NFT collections have the highest sales volume?

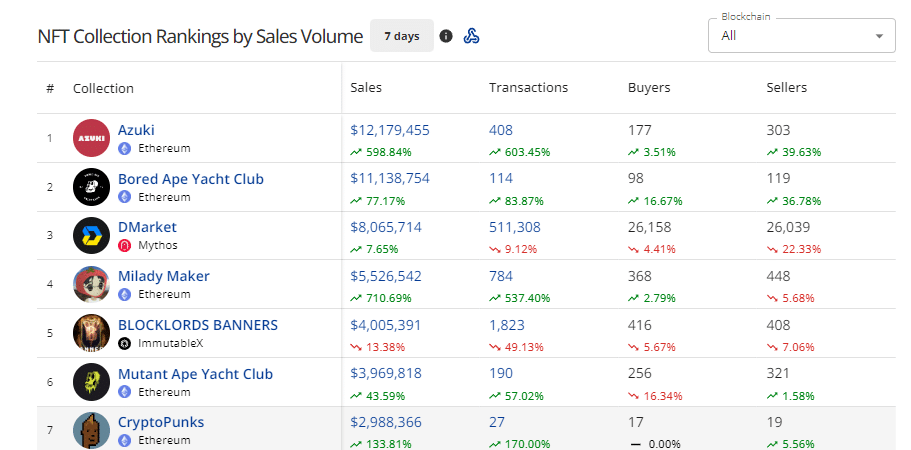

After this brief overview of the NFT market, let’s analyze which collections have the highest sales volumes by distinguishing 3 precise moments: the last 7 days, the last month and all-time data. All data is taken from the CryptoSlam platform.

As for the last 7 days, the top 3 collections with the highest volume were those of Azuki, Bored Ape Yacht Club, and DMarket.

The first two belong to the Ethereum blockchain, while the last one belongs to the Mythos chain.

In total, the 3 collections generated a combined volume of 31.3 million dollars.

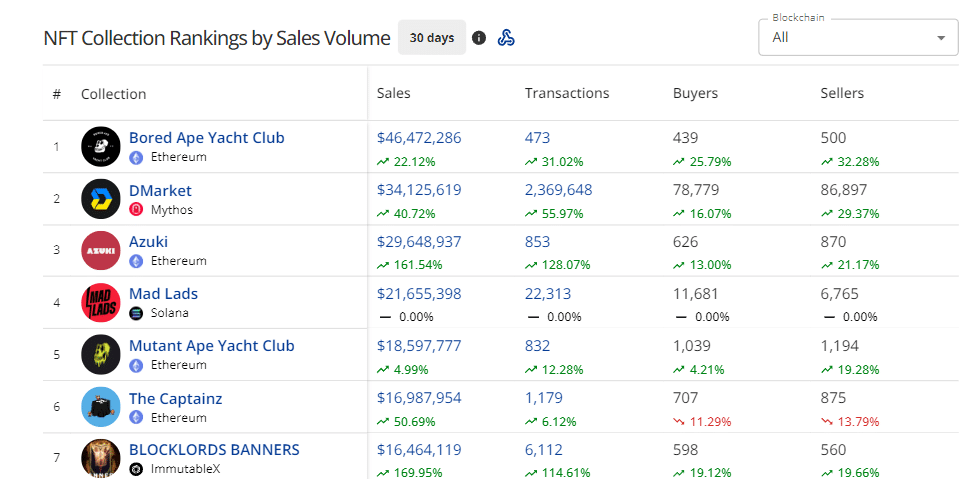

For the last 30 days, the same collections are present on the podium, but in different positions.

In fact, Bored Ape Yacht Club is in first place with $46.47 million in salesfollowed by DMarket collection with $34.1 million and finally Azuki with $29.6 million.

Also notable is the entry of Mad Lads, a collection developed at Solana, in the top 5, while Blocklord’s bannerspart of the ImmutableX network, appeared in the top 10.

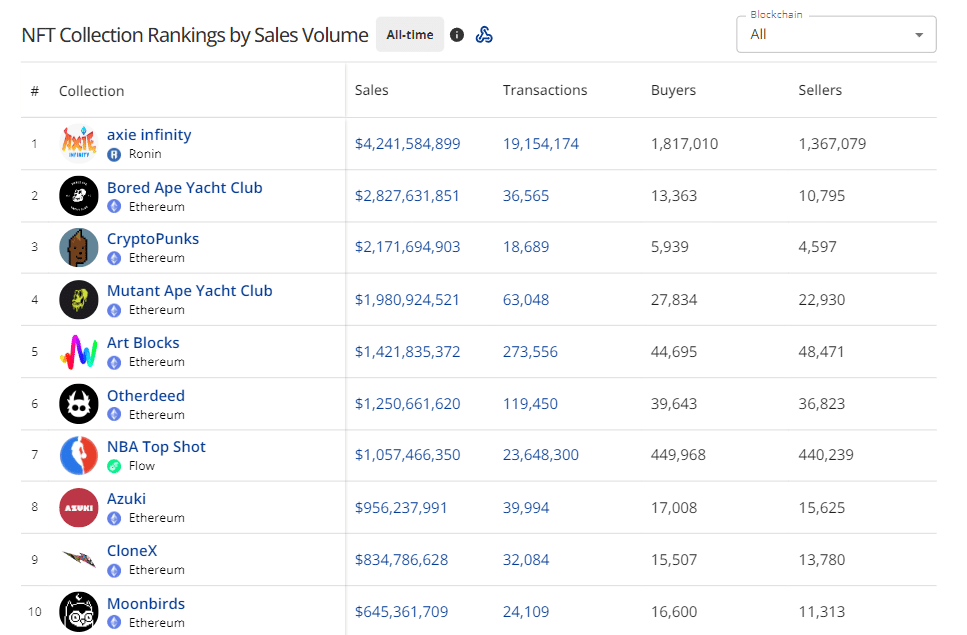

Finally, looking at the historical values (all-time), we see how Ethereum confirms itself as the leading blockchain for developing NFTssince almost all of the top 10 compilations of all time have been distributed and sold on this network.

In particular, the only non-Ethereum collection and the one with the highest sales is Axie Infinity, developed on the Ronin chain, with a volume of 4.24 billion dollars.

Next comes Bored Ape, confirming public interest in both the short and long term with $2.82 billion in sales, and the wildly popular Crypto Punks collection with 2.17 billion dollars.

The last 7 compilations in the top 10 include names like Mutant Ape Yacht Club, Art Blocks, Otherdeed, NBA Top Shot, Azuki, CloneX and Moonbirds.

Together, these names have sold in total 17.36 billion dollars. The highest selling NFT was Crypto Punk #5822, which sold for 23.2 million dollars a year ago.

Trending at the moment: Ordinals and non-fungible tokens on Bitcoin

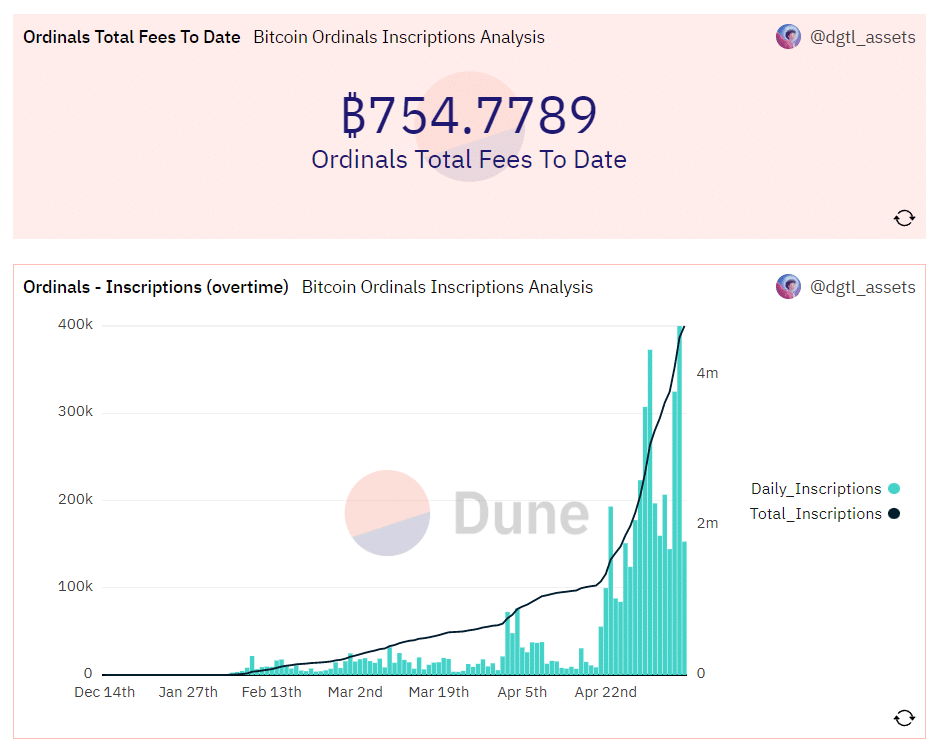

Beyond the volume of NFT sales data, it is very interesting to analyze the trend at the moment, namely Ordinals and inscriptions on the Bitcoin blockchain.

As most people know, the Bitcoin network does not support smart contracts like all modern blockchains, so it is impossible to issue fungible tokens and NFTs on it.

However, Ordinals, a protocol invented by Bitcoin Core developer Casey Rodarmor, has made it possible to create digital objects from the smallest units of Bitcoin, the Satoshi.

The trend seems to have exploded in recent days, with thousands of people creating NFTs and fungible BRC-20 tokens on top of Bitcoin.

In terms of non-fungible tokens alone, it has been more than 4.5 million registrations since February 2023, when word of the trend began to spread, with growth projected in the coming months.

Although this represents a major advance for the utility of the Bitcoin network, the Ordinaries inscriptions do not seem to be appreciated by many users, who have been forced to pay more than usual to use the blockchain, even if only to transfer BTC from one. wallet to another.

In this regard, on Sunday, May 7, Binance was forced to temporarily suspend BTC withdrawals (all other withdrawals remained open, including FIAT withdrawals) due to very heavy network congestion and hundreds of thousands of transactions stuck in the mempool waiting to be confirmed and added to a blockchain.

So while this trend may seem like a game changer for Bitcoin’s blockchain architecture and the prospects for future use, it must be weighed against the difficulties experienced on the user side.

Perhaps a solution would be to temporarily switch to the Lightning Network, which has now become an institution of the Bitcoin community, and reduce the amount of work which layer 1 is forced to process through off-chain calculation.

Unfortunately, a “single layer” solution for all web3 transactions seems disappointing for both Bitcoin and Ethereum, while the future is moving towards a differentiation of the areas where each team will compete, based on its own level of security, transparency and decentralization.

In the future it would be nice to see an interoperable platform able to automatically manage all kinds operation across chains through a unified solution, easy to use and suitable even for beginners, who unfortunately are unable to handle the complexities of the blockchain world.