Micro strategy for paying operating expenses in Bitcoin

Yesterday, Micro strategy (NASDAQ: MSTR) filed its quarterly report to US Securities and Exchange Commission (SEC) that raised some eyebrows. In the report, the company stated that it may sell some of its Bitcoins (BTC) to cover operating expenses and fulfill its contractual obligations.

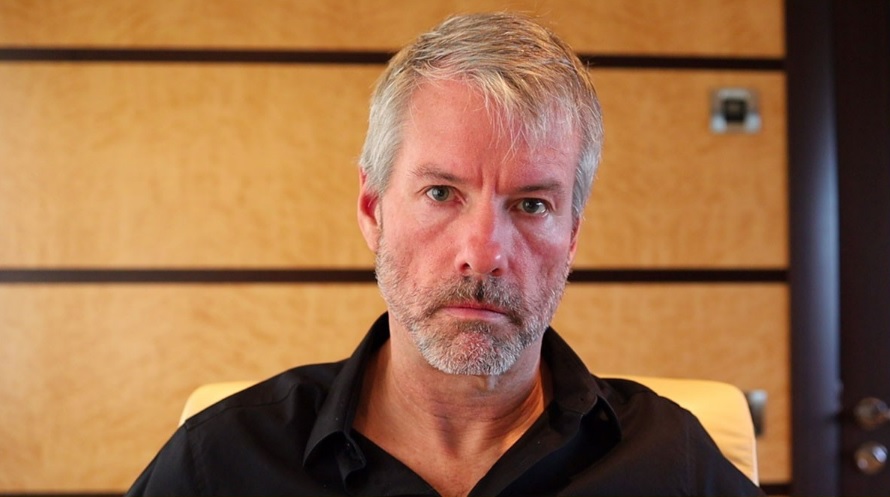

MicroStrategy’s BTC investment strategy is led by former CEO, Michael Saylor. Although the Company believes that it has sufficient funds to cover its working capital, capital expenditures and contractual obligations for the next 12 months, it does not expect that the cash generated by its business analytics software business will be sufficient to meet its long-term obligations. That’s where Bitcoin comes in.

MicroStrategy currently holds around 140,000 bitcoins and selling some of its BTC holdings could generate cash for the company if it is unable to refinance debt or find other sources of funding. In addition, the Company may have the option to liquidate its convertible bonds by issuing and selling the proceeds from the Class A shares, which may reduce cash liabilities.

It is important to note that MicroStrategy’s financial report was positive, despite the possibility of selling some of its BTC holdings.

In a press release, CEO Phong Le stated that the durability of the company’s platform and the strength of its customer base continue to drive revenue growth. Overall, MicroStrategy’s total revenue increased 2.2% to $121.9 billion in the third quarter, primarily driven by a 23.4% increase in product licensing and subscription services revenue.

In addition, the company strengthened its capital structure by reducing its debt and adding 7,500 bitcoins to its balance sheet, which, as mentioned, stands at 140,000 BTC. The gross margin for the first quarter of 2023 was 77.1%, with a gross profit of $94 million. Operating expenses fell 56.6% compared to the first quarter of 2022, and the operating loss was $20.3 billion – a staggering loss due to the fall in value of Bitcoin during the crypto winter.

If MicroStrategy decides to sell some of its BTC holdings, it won’t be the first time it has done so. In December 2022, the company sold 704 BTC to reduce the taxes it had to pay by selling at a loss and offsetting previous capital gains related to BTC activities. It seems to be going back to the well again.