This paper discusses: (a) an overview of the recent NFT landscape in Mainland China; and (b) the key issues to consider when issuing NFTs, launching an NFT platform or providing NFT-related services in Hong Kong.

1. Introduction

First things first – what is a “non-fungible token”?

Currently, there is no legal definition of “non-fungible token” or “NFT” under Hong Kong law. That said, the Financial Action Task Force (“FATF“)[1] describes an NFT (which is generally accepted in Hong Kong) as a digital asset, as:

- is digitally linked to a tangible collectible (eg, digital image, artwork, audiovisual file, video clip, avatar or gear from an online game, animation, physical collectible, etc.);

- is registered on a blockchain; and

- is not intended to be used as a payment or investment instrument, or otherwise backed by a fiat value or asset.[2]

The recent political statement[3] issued by the Government of the Hong Kong Special Administrative Region of the People’s Republic of China (“Hong Kong”) signals Hong Kong’s open and embracing attitude towards NFT-related businesses. The Hong Kong government also recognizes that additional opportunities can be realized in multiple use cases of virtual assets such as trading in digital art and collectibles.

With this clear vision and regulatory support taken by the Hong Kong government, we are observing a significant increase in the number of Mainland China-based companies expanding their NFT platforms and other relevant NFT-related businesses to Hong Kong. Their business expansion includes operating an NFT platform from, or marketing the platform in, Hong Kong. These NFT platforms typically offer the following key features:

- primary market: facilitate the issuance of NFTs based on:

- artwork (the creation of the artwork is done through collaboration with artists or owners of IP rights);

- social digital content (eg digital image, audiovisual file, video clip, music, etc.); and

- in-game assets (eg virtual avatars, player headshots or other virtual objects), which may be used in off-platform virtual reality games; and

- secondary market: (after the primary issuance) which facilitates subsequent NFT sales and NFT transfer to other secondary NFT marketplaces operating in or outside Hong Kong.

The current regulatory position in Hong Kong is that, generally, where an NFT is a “genuine digital representation of a collectible”[4]the activities related to it do not fall within the existing regulatory task under Hong Kong law.

This article discusses:

- an overview of the recent NFT landscape in Mainland China; and

- the most important issues to consider when issuing NFTs, launching an NFT platform or offering NFT-related services in Hong Kong.

2. An overview of the NFT landscape in Mainland China

2.1 General Prohibition of “Virtual Currencies” in Mainland China

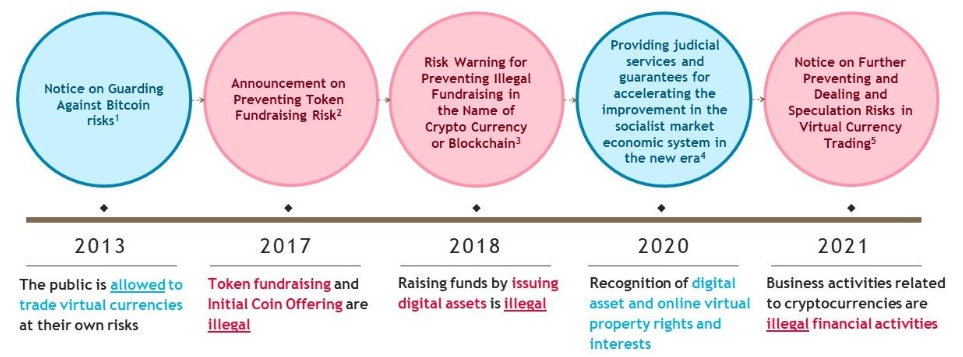

In order to understand the attitude and policy of the Chinese mainland authorities in virtual currencies, it is important to examine the regulatory developments over the past decade. In particular, the Chinese mainland authorities have shown an increasingly restrictive stance over time towards virtual currencies, as summarized in the timeline below.

- Available in:

- Available in:

- Available in:

- Available in:

- Available in:

The restrictive approach taken by the Chinese mainland authorities reflects the general trend of increased scrutiny of virtual currencies and their related activities targeting mainland Chinese residents. Importantly, the 2021 notice replaced the earlier 2013 notice and made it clear that virtual currencies such as Bitcoin, Ethereum and Tether issued by non-monetary authorities shall not and cannot circulate in the Mainland China market as currencies. All virtual currency related businesses are illegal financial businesses.

2.2 The ambiguity of the NFT landscape in Mainland China

Despite the strict ban on virtual currencies in Mainland China, NFTs are not explicitly included in the “virtual currency” category from the Chinese regulatory perspective. More often, NFTs are referred to as “digital collectibles” or “digital assets” rather than “tokens” in Mainland China to distinguish them from “virtual currencies” which are prohibited under current regulations in Mainland China.

Based on the assumption that NFTs are pure vehicles that “carry” corresponding digital content (such as images, videos, audio, etc.), there is a general understanding that NFT issuance and related activities do not explicitly fall within the scope of regulatory prohibitions in Mainland China. However, the unique properties of NFTs (including their irreplaceable, indivisible and tamper-proof nature) do not completely negate their nature as “tokens”. In the case where the NFT issuance and related activities have an impact on disrupting financial order, regulators in Mainland China may also deem such NFTs to be “virtual currencies” or “virtual currency derivatives” and regulate them accordingly.

Consistent with the restrictive approach taken by the Chinese government, the industry shares a similarly cautious view of NFT-related developments. On April 13, 2022, three industry self-regulatory associations, namely the National Internet Finance Association of China, the China Banking Association and the Securities Association of China, jointly issued the initiative to prevent financial risks related to NFTs, pointing out that NFTs, which an innovative application of blockchain technology, is exposed to risks related to speculation, money laundering and illegal financial activities. Against this background, the industry’s self-regulatory associations proposed to ban activities such as:

- the use of virtual currencies including Bitcoin, Ethereum and Tether as pricing and settlement instruments for the issuance and trading of NFTs;

- sharing ownership or bulk minting (ie to weaken the non-fungible properties of NFTs) to conduct initial coin offerings (“ICOs”) in disguise; and

- provision of services in relation to NFT transactions such as concentrated trading, continuous listed trading and trading under standardized contracts.

It is also noteworthy that if NFTs are minted in lots and methods such as “premium repurchase”, “value commitment” or “circulation transaction speculation” are used, NFT buyers can potentially recover their capital and may even profit from such NFT transactions as there is sufficient liquidity for the NFTs created in the market. In this case, the NFTs can be considered as financing tools and such NFT transactions can be characterized as “creating NFTs in batches to carry out ICO in a disguised form” and will then be subject to relevant financial laws and regulations.

Despite the absence of blanket bans (such as those on virtual currencies), we recommend using a cautious approach when designing the trading mechanism for NFTs (especially trading NFTs in the secondary market, which is currently prohibited in Mainland China) .[5] This approach is consistent with the general market understanding that NFTs are digital collectibles only, and any investment or speculative features (such as the lack or tradability of NFTs that may contribute to their perceived investment or economic values) should strictly adhere to other general rules for investment activities. in Mainland China, and don’t be encouraged.

With the evolving regulatory environment and the uncertainty of the regulatory approach to NFTs and virtual currencies in the Mainland China market (compared to the embracing attitude towards NFTs and virtual currencies in Hong Kong), we have recently observed increasing interest in the Mainland – China-based NFT operators in expanding their NFT-related businesses and operations to Hong Kong.

3. Important legal issues to consider when expanding China’s NFT platforms to Hong Kong

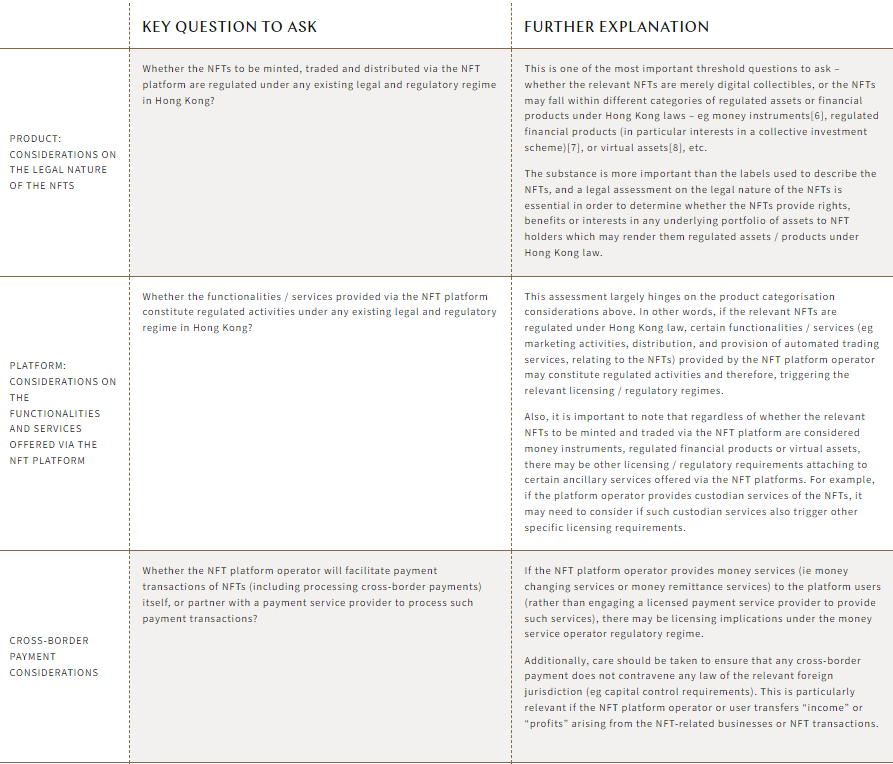

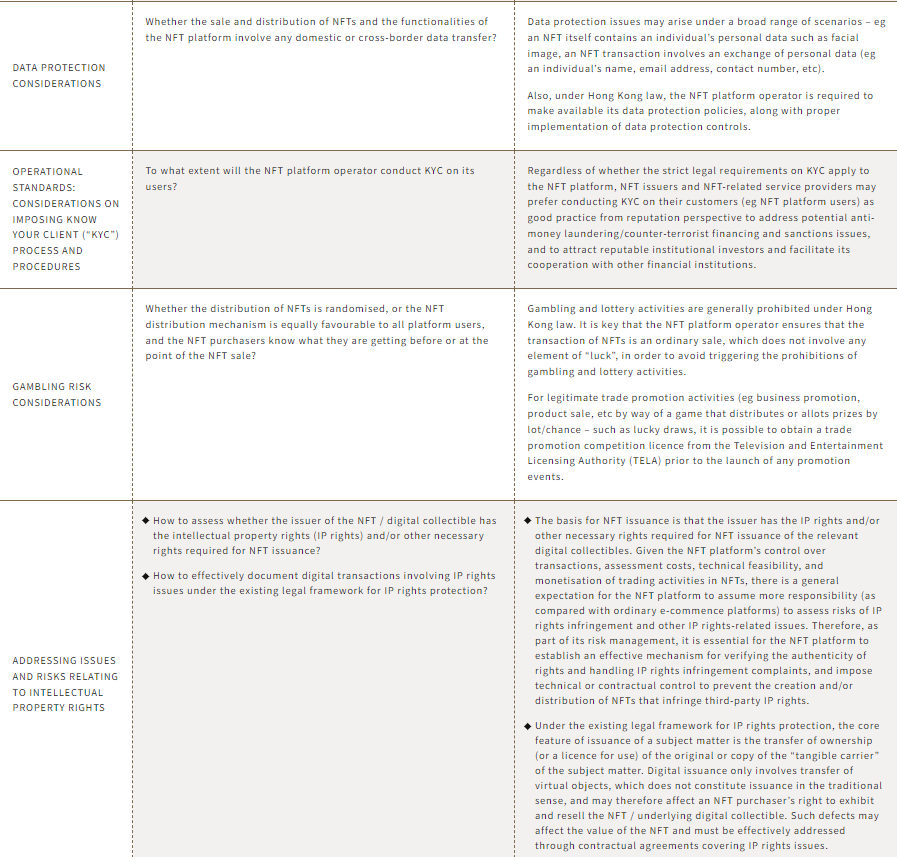

Despite the open and positive attitude towards NFT-related businesses from the local regulators in Hong Kong, any party interested in launching NFT platforms and related business in Hong Kong should take into account a number of legal and regulatory risks as summarized below.

Currently, there are no existing or pending NFT-specific laws or regulations in Hong Kong, and therefore NFTs are not regulated as a distinct asset class in Hong Kong. In other words, whether an NFT (and the relevant NFT platform) is regulated in Hong Kong largely depends on whether the offering of the NFTs and platform features trigger existing licensing/regulatory regimes under Hong Kong law.

Below we summarize the common questions related to NFTs and the key legal issues you should consider when issuing NFTs, launching an NFT platform or offering NFT-related services in Hong Kong.

The summary is only intended to cover some of the key issues to consider for NFT-related businesses. It is not intended to cover any legal or regulatory issues that may be involved in, or risks arising from, an issuance of NFTs, a launch of an NFT platform and the provision of NFT-related services in Hong Kong. It is also important to consider the commercial and practical aspects of the NFT-related business (e.g. whether the NFT platform operator / content contributors are entitled to “royalties”, etc.).