Bitcoin Analysis BTC is falling, but the long-term outlook remains positive

Bitcoin takeaways

- Last week’s big breakout in Bitcoin and Ethereum is being tested with drops today.

- Bitcoin has at least 4 long-term bullish catalysts.

- Ethereum’s successful “Shapella” upgrade has de-risked the staking process, potentially clearing the way for a major reduction in ETH supply.

It’s been a whirlwind few weeks for major crypto assets.

Between general “risk on” trading and last week’s successful “Shapella” upgrade to Ethereum, Bitcoin and Ethereum both hit their highest levels since last summer above $30K and $2K respectively Just as traders were getting comfortable with last week’s big breakout, today has brought a round of selling to the room, raising questions about whether the recent rally is legitimate or just a “fakeout breakout.”

Bitcoin Analysis: Four Bullish Long-Term Catalysts

Looking at the world’s largest crypto assets first, Bitcoin’s outlook remains positive on a long-term basis for 4 reasons:

First, Bitcoin saw its biggest quarterly gain (+70%) in two years last quarter, signaling strong buying pressure after the Q4 2022 washout below 18K.

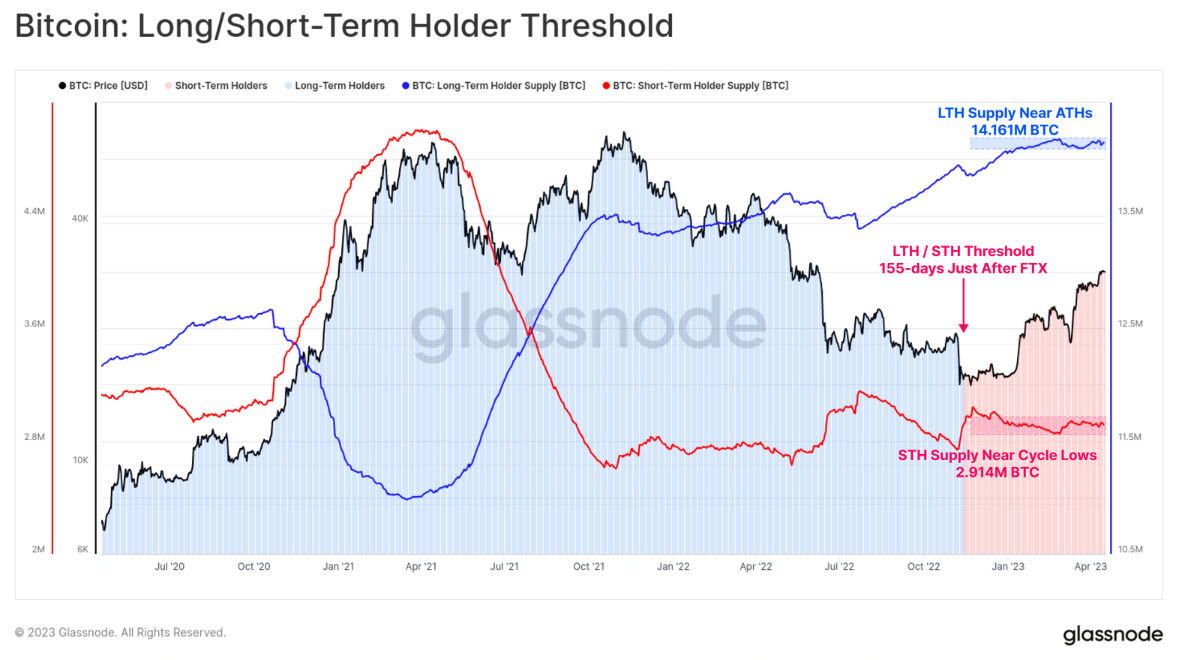

Second, long-term holders used this time to accumulate the cryptocurrency, marking a classic “accumulation phase” shift from weak hands to strong hands. These so-called Risk Astleys (because they’re “never going to give you”, get it?) now have record amounts of Bitcoin at over 80% of the outstanding supply. This supply has essentially exited the market and sets the stage for the next bull cycle.

Source: Glassnode

Third, with the next Bitcoin halving now about a year away, we are entering a historically bullish time for the crypto market that could last for the next two years.

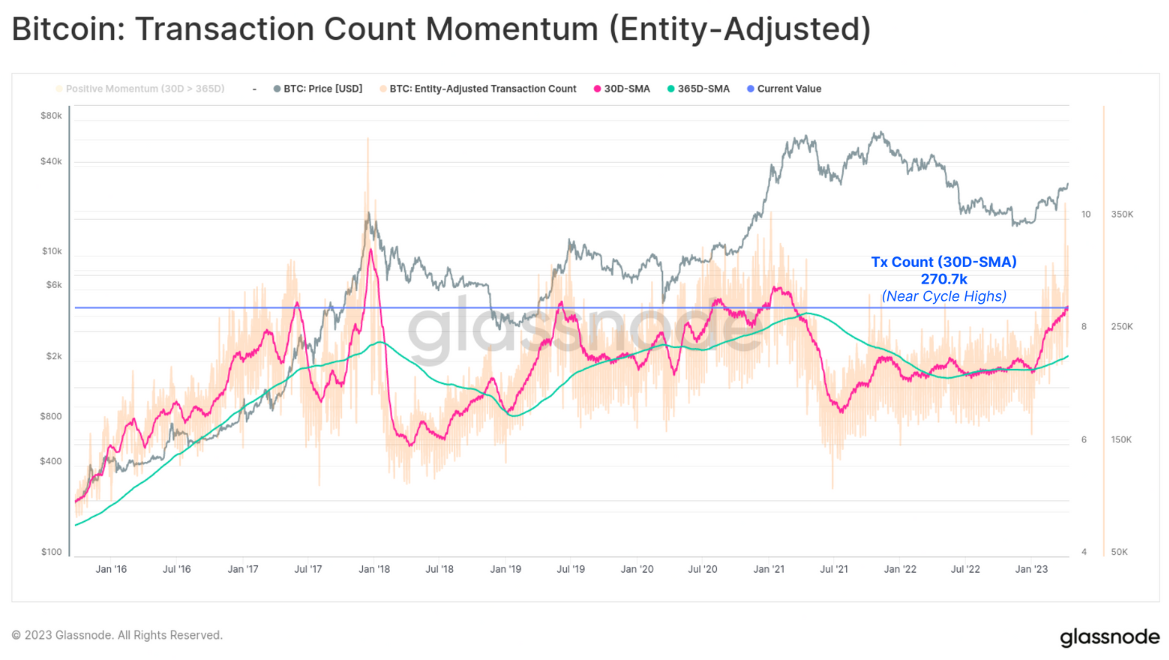

Finally, and arguably for the first time in its existence, Bitcoin has found a use beyond commerce. Similar to NFTs on other chains, “Inscriptions” or “Ordinals” now allow Bitcoin enthusiasts to enter data on the Bitcoin blockchain. By increasing the demand for blockspace beyond just trading demand, there is now greater interest in using the blockchain, increasing fees and security. As the chart below shows, daily Bitcoin transactions historically run at levels only near euphoric peaks in price:

Source: Glassnode

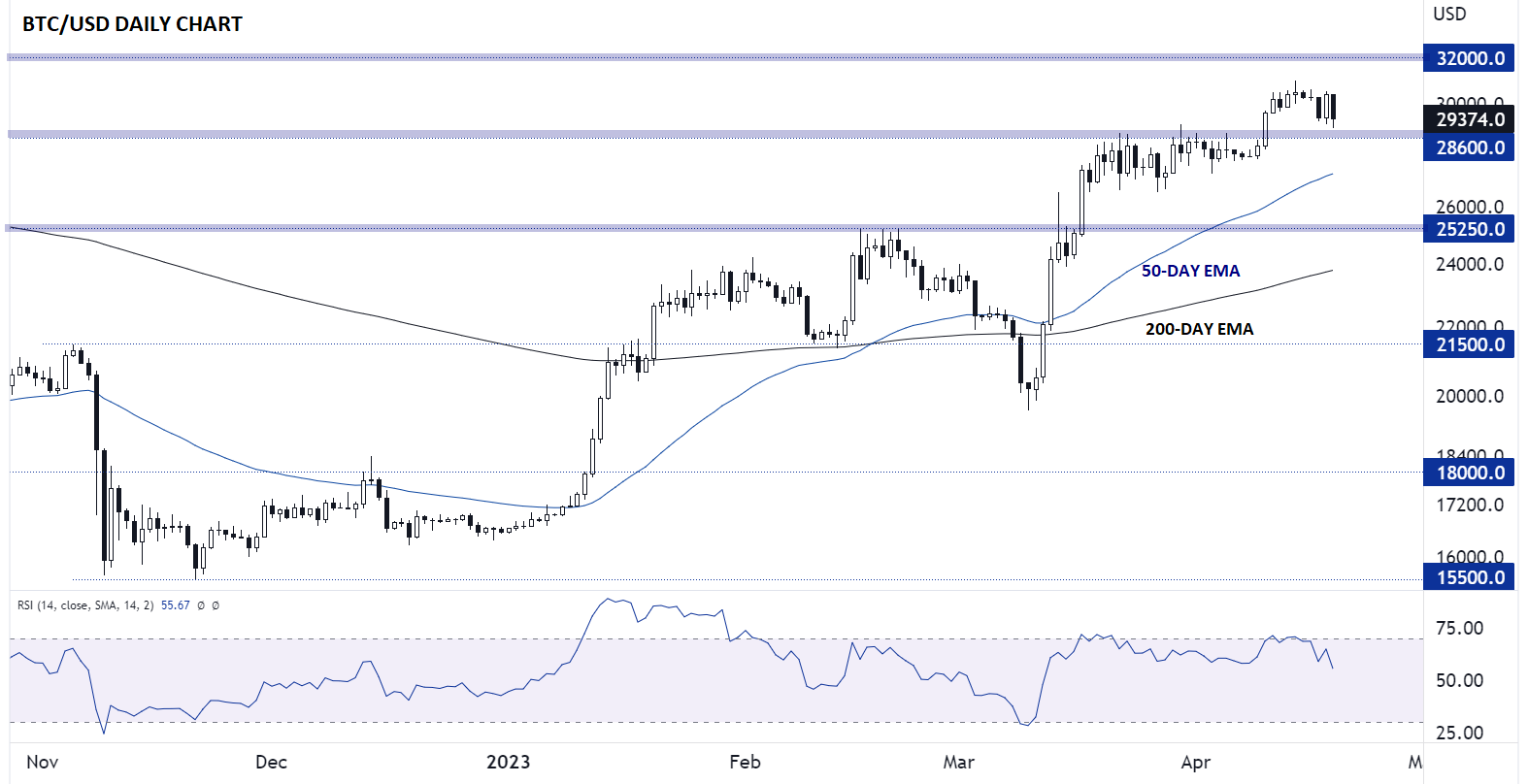

From a technical perspective, Bitcoin is still holding above the key previous resistance support at $28.6K, despite today’s dip. While we wouldn’t be surprised to see today’s decline extend towards that level, long-term accumulators may look set to enter before we see too steep a fall given the rising 50- and 200-day EMAs.

Source: TradingView, StoneX. This product may not be available in all regions.

Ethereum Analysis: Smooth ‘Shapella’ May Lead to Lower Long-Term Supply

Compared to his older brother, the long-term outlook for Ethereum is potentially even more bullish. Heading into last week’s “Shapella” upgrade, many analysts expected waves of selling to hit the world’s second-largest crypto asset as the stakers backing the network could finally sell their previously locked-up ETH.

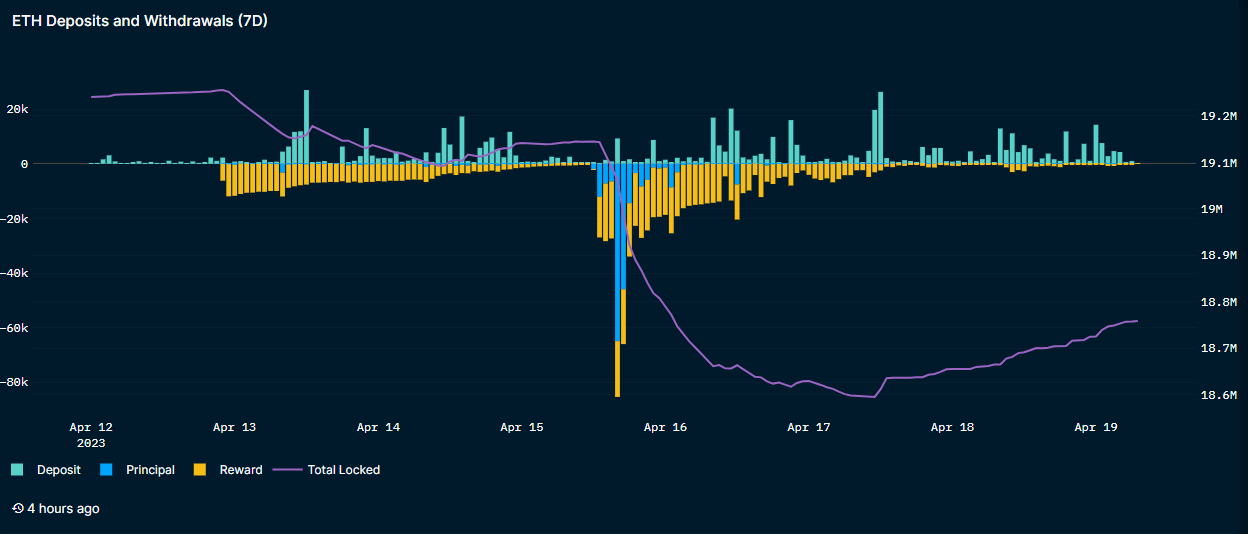

While logical, there is at least one major problem with that theory so far: strikers don’t sell a lot. In fact, net stake redemptions only lasted a few days, and since the beginning of this week, ETH holders have been increasing net input activity:

Source: Nansen

In a way this makes sense as it is now objectively less risky to bet Ethereum as it is now relatively easy to withdraw your money if needed (ie staking ETH now less liquidity risk than it was at the beginning of last week). As the chart below shows, Ethereum runs well below other proof-of-stake chains in percentage of supply staked, and if it picks up in the coming weeks, it will provide a consistent reduction in supply that could further support prices:

Source: StakingRewards

In terms of near-term price action, ETH/USD is testing its previous breakout level of 2000, and a break below that could point to a deeper retracement. Although we see that decline in the short term, the aforementioned “tokenomics” for the Ethereum ecosystem should entice buyers and put a floor under price, with initial support near $1,800where the 50-day EMA coincides with a key level of previous resistance.

Source: TradingView, StoneX. This product may not be available in all regions.

— Written by Matt Weller, Global Head of Research

Follow Matt on Twitter @MWellerFX