Will ‘Short Squeeze’ Lead Bitcoin to Higher Heights?

The crypto market staged a recovery in the last couple of days. Large-cap coins traded mostly in the green during the aforementioned period. Bitcoin, on the other hand, was able to stay above the psychological $20k mark.

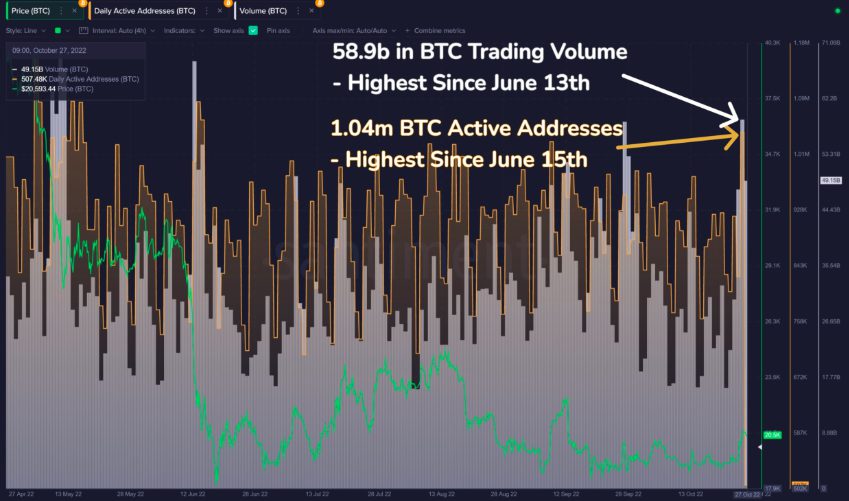

Interestingly, the largest crypto asset had the highest level of trading volume and address activity. Per Santiment, both of the aforementioned metrics hit 4-month highs a few hours ago and have hovered around their mid-June highs.

Bitcoin and its short squeeze

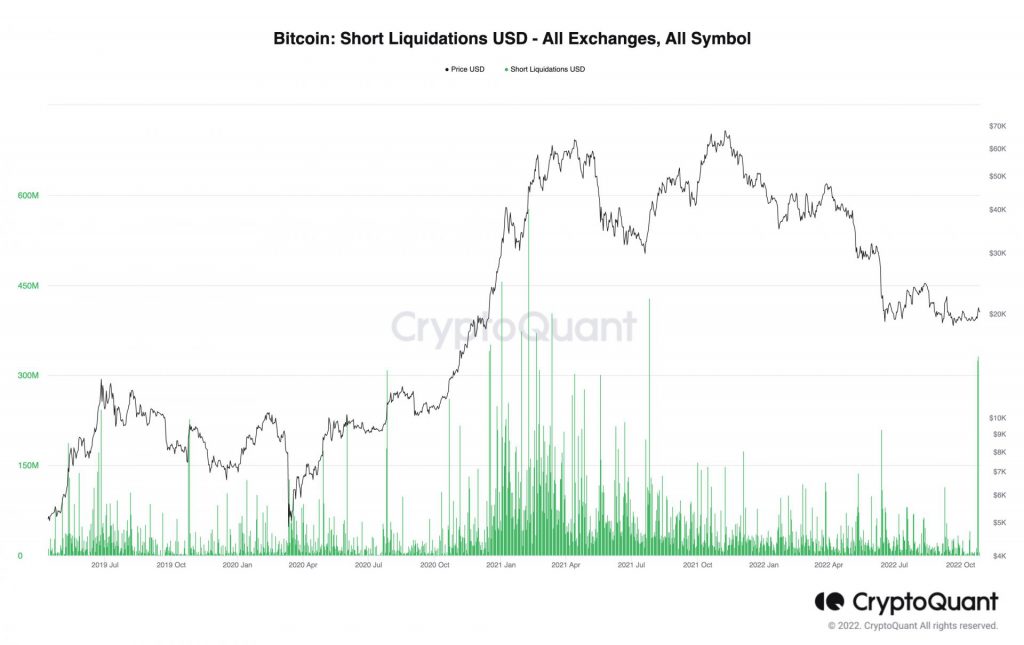

Despite the recent price rise, participants were seen betting against the price of Bitcoin and the market was dominated by short traders. With the valuation of the asset moving in the opposite direction of expectations, sellers were “squeezed” out of the market. Highlighting the unfolding scenario, CryptoQuant co-founder and CEO Ki Young Ju tweeted,

“BTC short squeezes occurred over the past two consecutive days. Short liquidations on all exchanges reached an annual high.“

Worth remembering that at the end of 2020, when participants put short positions on Bitcoin, they were mostly right in the $10-$20k range, after which the parabolic recovery materialized. As highlighted above, another short squeeze has already occurred, and while it has the potential to guide the asset’s price northwards, it warrants a rally right off.

For a parabolic recovery to take place, institutions will have to play a decisive role. However, as recently analyzed, the market has not yet ended the “apathetic period” that began in September, because the inflows are still quite meager.

Read more: Bitcoin, Altcoin Interest rate matches in October 2020

As a result, at press time, the market was again characterized by weakness. Bitcoin was trading at exactly $20,200 – the level that has resisted climbing higher since mid-September. Only if it breaks above the mentioned hurdle, it will be able to recognize yesterday’s and the day before’s highs around 100 MA each day.

If sellers continue to have a dominant hand, a revisit to $19.6k and $19.02k can be expected going forward.