Why some banks and sports teams offer bitcoin savings plans

San Antonio community bank Vantage Bank takes a progressive stance on cryptocurrency. It recently participated in a secondary market municipal loan transfer registered on a blockchain, and CEO Jeff Sinnott, a former software engineer and chief information officer at Summit Bank, has explored partnerships with several crypto companies.

These moves in crypto got bank staff in on the action.

“As we started getting more and more into that space, all of a sudden we started having employees asking if they could invest in cryptocurrencies as a retirement plan,” said Eric Thompson, head of human resources at the bank, which has just over $3 . billions of assets.

Just then, Nydig, a crypto custody and technology company in New York, contacted him about the bitcoin savings plan it was developing, which invests a portion of each paycheck in the digital currency. Once enrolled, employees adjust their direct deposit allowances to send a portion of their after-tax paycheck to a bank account at Nydig’s bank partner, MVB Bank in Fairmont, West Virginia, which has just under $3 billion in assets. Nydig buys bitcoin with that money and stores it on behalf of the employee; the hope is that the user will get a good return. Thompson was immediately convinced.

“We were all on board,” he said. “It was in line with the feedback we received from our employees.” When Nydig launched its bitcoin savings plan in April, Vantage Bank was one of the first companies to offer it.

Since then, the New York Yankees, Houston Rockets, software company Q2 and MVB Bank in West Virginia have also started offering the bitcoin savings plan. These companies say they provide something employees want and that the offering helps them attract talent. They are aware of the volatility of bitcoin, but believe they can minimize the risk by educating employees about the investment and limiting the amount people can invest.

Recruitment tool

Thompson sees the bitcoin savings plan as a recruiting tool.

“Right now, I’m sure you’re very aware that there’s a war for talent,” he said. “It’s hard. One candidate we looked at asked what all our benefits were. I said we offer medical, dental, all that. One of his comments was, well, these are the same things I can get from anybody . What else can you do for me? And that’s where we can now say, hey, we have this bitcoin savings plan. This is something you’re not going to see with a lot of other employers.”

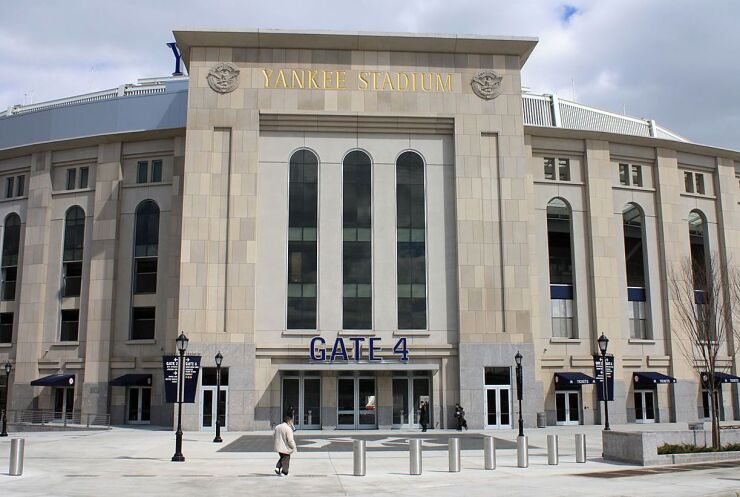

The Yankees, who signed Nydig to a multi-year deal in July, had a similar motive.

“Our partnership with Nydig to make bitcoin available to Yankees employees is about attracting and retaining the best talent across the industry,” said Aryn Sobo, vice president of human resources, employment and labor law for the Major League Baseball team.

A recent survey conducted by Nydig found that 36% of workers under the age of 30 want to be paid in bitcoin.

“We think there’s significant demand out there for this, especially among employees under 30 who are more tech-focused and spend a lot of their time, maybe even outside of work, on technology,” said Kelly Brewster, chief marketing officer at Nydig.

At Vantage Bank, employees have been so enthusiastic about using the bitcoin savings plan that the bank has had to rein them in a bit, Thompson said.

“Some staff asked, can I get paid in bitcoin?” Thompson recalled. “We wanted to be very clear that this was not a, you get paid in bitcoin, but this is a bitcoin savings program.”

It also had to ask employees not to put 100% of their paychecks into the program, and ultimately limited the amount employees could invest in it to 10% of each paycheck.

“We wanted to save them from themselves,” Thompson said.

All in all, close to 20% of the bank’s 450 employees have signed up, which Thompson considers a good adoption rate.

What about the risk?

There is always a chance that the price of bitcoin could drop precipitously or even reach zero.

“I would only invest in cryptocurrency at this point if it was money you could afford to lose,” said personal finance expert Suze Orman in a recent interview with American Banker. “If it was actually money that you wouldn’t need for a seriously long period of time, because we never know when the government might step in and regulate it.”

Someone can invest when bitcoin is worth $60,000 and see its value drop to $13,000, she said.

“As soon as people see their savings start to fluctuate, I think they’ll stop saving,” Orman said. “They’re going to be scared. Because the purpose of money is for you to be safe. And when you see your savings account go from $400 down to a hundred dollars, in your head, you’ve lost money. You never want to feel like you’ve lost money when it comes to saving.”

At Vantage Bank, “It’s something we’re thinking about,” Thompson said. The bank runs a financial literacy program with Merrill Lynch to help employees understand the risks and what else they can do to save.

Most people who use Vantage’s bitcoin savings plan put small amounts into it, he said.

“Some of them are using it as a test to get into bitcoin, because of the fact that there are no transaction fees,” Thompson said. Others who used an exchange like Coinbase to buy cryptocurrency and pay fees have switched to the bitcoin savings plan because it charges no fees, he said.

“Most of the people in the program have already experienced or used bitcoin somewhere else,” he said.

The bank publishes disclosures about the risks of investing in cryptocurrency on its intranet and talks about this during new investment orientation.

NYDIG sees investing a portion of each paycheck in bitcoin as relatively safe.

“With something that can be volatile at times like bitcoin, dollar-cost averaging, buying a little bit periodically over time at fixed intervals can dramatically reduce the volatility you experience,” Brewster said. “It smooths out bumps along the way. You don’t make a decision that now is a good time to buy, now is a good time to sell. This program is also not about day trading. This is really about saving and getting employees to make sure that they look at this with the right time horizon, that they think of this as something they put away for years, not necessarily months or weeks.”

In the future, Nydig may add employee rewards to the bitcoin savings plan.

“We’ve heard from many employers in many different industries, particularly in retail and hospitality, that they love the idea of being able to give an employee a performance reward or a reward for attendance, and to be able to do it in bitcoin,” Brewster said. “It’s a very exciting thing we’re working on right now.”