What impact does Jerome Powell have on the Bitcoin (BTC) price?

Bitcoin and other risk assets have been strongly driven by Federal Reserve Chairman Jerome Powell’s comments, thus affecting both investors and traders.

The global cryptocurrency market led by Bitcoin (BTC), the largest digital asset by market capitalization, has been affected by changes in monetary policy. The Fed recently stated that we could expect to raise interest rates by half a percentage point in December, leading to a surge in crypto prices.

So how have monetary policies become relevant to Bitcoin and how will they affect the price movement of digital assets going forward?

Bitcoin reacts to Powell’s speech

Over the past week, the cryptocurrency market remained volatile, but BTC and most altcoins managed to stay in the green after Powell’s speech. Bitcoin price saw a 3% rise and gained ground above the $17,000 mark.

BTC was trading at $17,318.69 at press time, showing 6.79% weekly gains. After Powell’s dovish remarks that the Federal Open Market Committee (FOMC) would most likely raise interest rates by 50 basis points (bps) rather than another 75 bps increase, this instilled some confidence among investors.

Powell’s encouraging signs around inflation and unemployment added to BTC’s bullish price momentum. The BTC price rose in line with the S&P 500, which saw a 3% increase. After four hikes of three-quarters of a percent to curb high inflation, Powell sounded optimistic about a half-percentage-point rate hike at his next meeting on December 14.

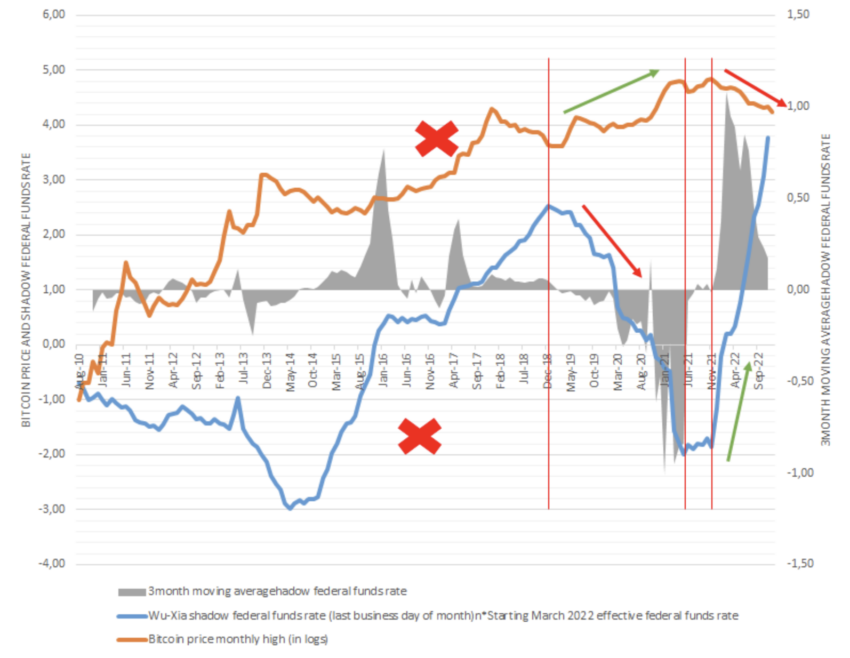

Crypto analysts have noted that since this cycle, monetary policy has become relevant to Bitcoin. The peak of the shadow federal funds rate on December 18 has more or less marked the bottom of the bear market.

Especially when the federal shadow funds rose sharply in December 2021, the Bitcoin bear market started.

One reason behind the high correlation BTC price has seen with regulatory guidelines may be the widespread use of Bitcoin in recent years. In addition, the same market maturation helps with the introduction of futures markets and institutional interest increasing at the macro level.

These reasons have made BTC more correlated to the traditional financial markets.

Unemployment and Bitcoin Correlation

In a recent video, analyst Benjamin Cowen pointed out that unemployment remains low despite the Fed rate hikes. Historically, moderation of increases has produced good results for risky assets.

Cowen expects that if Fed funds rates stay at 4%-5% by the end of the year, BTC could enter the new year with some bullishness. Bitcoin and other cryptocurrencies may rise on optimistic US jobs that inspire investors to take action in the market.

From a chain perspective, the bottom of the market could collide with a shadow federal funds rate.

Bitcoin Market Value to Realized Value (MVRV) also provides an interesting view of the BTC bottom. A recent CryptoQuant analysis showed that at the bottom of previous bear markets, the duration of the MVRV indicator indicated whether the price of Bitcoin was overvalued or undervalued.

MVRV has remained below one, as shown below.

- 2015: 300 days, lowest point: 0.6

- 2018: 134 days, lowest point: 0.69

- 2022: (currently ongoing) – 170 days, low: 0.74

One can expect MVRV to fall further if the bear market continues due to macro issues. Since the lowest point has still not been reached, it is challenging to say whether an absolute bottom has arrived.

For now, much of the BTC price action may depend on monetary policy changes in the macro market. Inflation and unemployment may play a key role in shaping BTC price action.

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action the reader takes on the information contained on our website is strictly at their own risk.