Varos bank charter milestone, more corporate cards and BNPL under a microscope • TechCrunch

Welcome to The Interchange! If you received this in your inbox, thank you for signing up and your declaration of confidence. If you are reading this as a post on our site, please register here so that you can receive it directly in the future. Each week, I’ll take a look at the hottest fintech news from the previous week. This will include everything from funding rounds to trends to an analysis of a particular space to hot takes on a particular company or phenomenon. There’s a lot of fintech news out there, and it’s my job to stay on top of it—and make sense of it—so you can stay up to date. — Mary Ann

First, I have to say that this past week was one of the busiest fintech news weeks I’ve experienced in a long time. Whew. So.much.going on. Although I obviously couldn’t cover everything, I tried to fit as much as I could into this newsletter.

Before we get into the various news stories from the past week, let’s talk about bank charters.

For the unfamiliar, according to Investopedia: “A chartered bank is a financial institution (FI) whose primary roles are to accept and secure cash deposits from individuals and organizations, as well as to lend money. Chartered bank specifications vary from country to country. But generally, a chartered bank in operation has obtained some form of government permission to do business in the financial industry. A chartered bank is often associated with a commercial bank.”

In 2020, digital bank Varo became the first-ever all-digital nationally chartered US consumer bank – meaning it received approval from the Office of the Comptroller of the Currency to become a actual bank, as opposed to working with one as most digital banks do.

It was a bold and risky move. So I spoke to Varo CEO and founder Colin Walsh to find out if it was worth it. His answer? 100%.

To read my full interview with Walsh about how things have gone since, go here.

The business cards keep coming

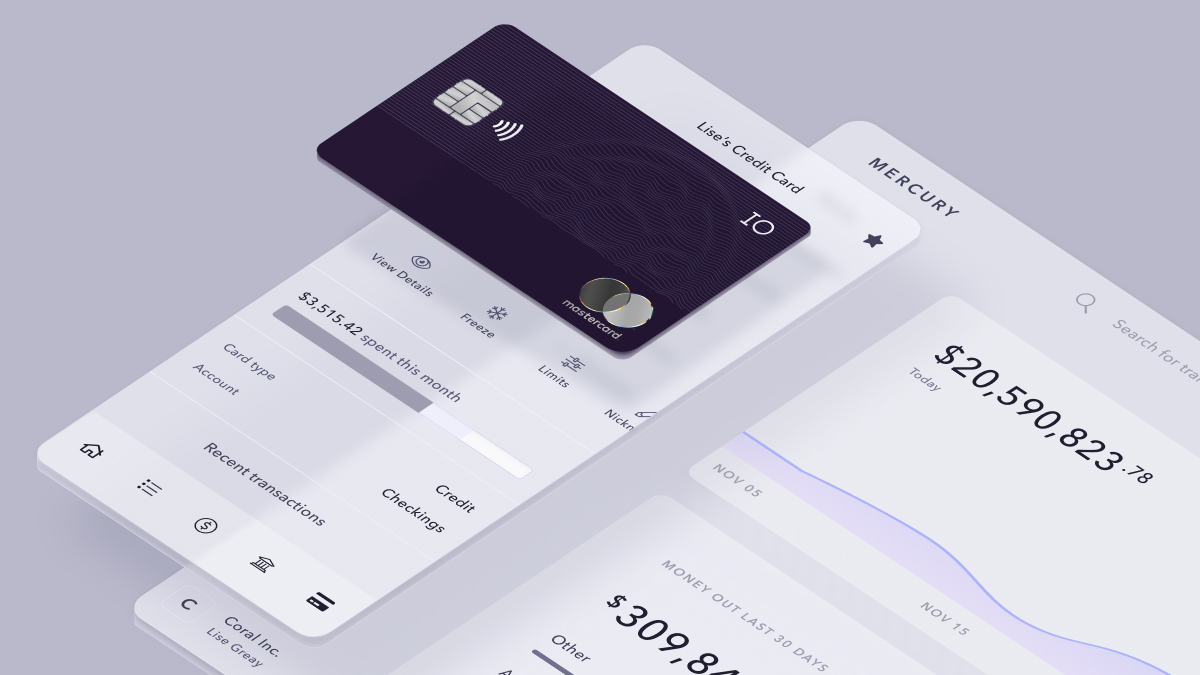

Mercury announced last week that it was launching a new business credit card. Via email, a spokesperson told me that the IO Mastercard is designed to help startups scale their businesses. “It’s straightforward 1.5% cashback on everything, no personal credit check and the first step to qualify for the card is to have just $50,000 in a Mercury account.”

The company added that a business credit card has been one of the most requested features from customers since Mercury launched in 2019. In fact, Mercury considered launching with a credit card as its first product, but instead chose to start with setting up a bank account instead. since “every founder needs a bank account to run his business… and [they] is the ideal foundation for building multiple financial functions.” Admittedly, the move is an attempt to carve out its own space against the likes of Brex and Ramp.

Meanwhile, European fintech Payhawk announced that it is launching in the US with a focus on corporate customers. As part of this move, it is also launching its – you guessed it – first credit card product in the US. The move follows what a spokesperson describes as “a big year” for the company: Over the past 12 months, it has increased revenue by over 520%. The company achieved unicorn status after raising a $215 million Series B round.

We’re not done yet! Centerwhich was co-founded by former Concur CEO and co-founder Steve Singh and launched its own corporate card and expense software offering aimed at small and medium-sized businesses, recently shared that over the past year it tripled its customer base ” while retaining 94% of existing customers” and doubled their business size. This is particularly interesting because many of the existing business card players often point to Concur as a player they are trying to replace.

Of course, these companies join a slew of others in the US that already offer corporate cards, including – but not limited to – Brex, Ramp, Airbase, Mesh Payments and Rho.

Image credit: Mercury

Weekly news

Adyen announced on September 15 that it has become the first fintech to partner with Cash tap (block) to offer Cash App Pay, a mobile payment method, to its US customers. Adyen said their businesses will give customers a way to pay with their Cash App balance or linked debit cards. Cash App COO Owen Jennings said in a written statement: “As the first financial technology platform outside of the Square ecosystem to launch Cash App Pay, we look forward to seeing the value this partnership brings to our customers and Adyen’s businesses.” An Adyen spokesperson told me via email: “The partnership will give Adyen enterprise customers access to over 80 million active customers who make up one-third of Millennial and Gen Z consumers in the US. Their customers, in turn, will be provided with another convenient, seamless way to pay at checkout that fits their unique financial needs and habits.”

Speaking of Blockthe company formerly known as (and still sometimes goes by) The square announced last week that its entire ecosystem of more than 35 products and services is now available in Spanish for sellers in the United States. This means millions of Latin American-owned businesses in the US will have the ability to use Square in English or Spanish, “including key products like Square Banking to unlock access to financial services and Square for Restaurants to enable seamless, bilingual communication between front and employees of the house.”

While we are on the subject of payments, Goldman Sachs and Modern Treasury announced that they are working together “to accelerate the transition to embedded payments, helping mutual customers embed and scale payments into products.” By email, a Goldman Sachs spokesperson told me the partnership furthers “Goldman’s efforts to better serve middle-market companies that have long wanted to bank with Goldman.” In a written statement, Eduardo Vergara, head of product and sales at Goldman Sachs Transaction Banking, said, “Embedding payments into software products is increasingly the way of commerce, and by partnering with Modern Treasury, we are creating new opportunities for clients to seamlessly leverage our payment capabilities within their own platforms.”

In others Goldman Sachs news, Bloomberg reported that the investment banking and finance giant “is embarking on its biggest round of job cuts since the start of the pandemic.” The publication cited people with knowledge of the matter as saying that Goldman “plans to eliminate several hundred roles starting this month.”

Buy now, pay later made headlines several times last week. First, the Associated Press reported that (unsurprisingly and sadly) while “Americans have grown fond of ‘buy now, pay later’ services … the ‘pay later’ part is becoming increasingly difficult for some borrowers.” Meanwhile, TechCrunch’s Kyle Wiggers reported that US Consumer Financial Protection Bureau (CFPB) On September 15, “issued a report suggesting that companies such as Klarna and Afterpay, which allow customers to pay for products and services in installments, must be subject to stricter oversight.” Meanwhile, Confirm CEO Max Levchin told Bloomberg Law in an interview: “We have chosen to do a good part of what the report called for. We have always seen this as a lending business subject to all lending rules and regulations.”

Proptechs continue to take a hit. Marketplace for residential property Sundae last week carried out its second layoff this year. About 28% of the team – mostly sales and support staff – were laid off. More specifically, around 106 employees were let go. I reached out to the company for confirmation and a spokesperson told me via email that “Sundae is focused on creating a more streamlined customer experience so we can get offers to sellers even faster. The market remains volatile and we saw layoffs as an opportunity to to use data and technology to streamline our approach and improve the customer experience. We also saw these decisions as an opportunity to build a longer runway.” I covered the company’s 2021 increase here.

In more uplifting staff news, For — a payment processor that aims to make it easier for merchants to accept SNAP EBT payments online — revealed that Kristina Herrmann is joining the company in the new role of chief business officer. She joins Forage after nearly 16 years at Amazon, where she most recently built out and led the company’s underserved populations team as founder and CEO. Earlier this year, I wrote about how Ofek Lavian left his role as Instacart’s head of payments to join Forage. Today, he serves as the startup’s CEO.

FIS has launched Worldpay for Platforms, a built-in finance solution aimed at small and medium-sized businesses. Businesses using the offering, FIS told me via email, “eliminate the need for SMBs to pay separate partners to help with card issuance, cash advances or faster access to cash flow.” This obviously has implications for companies like Stripe or Plaid, or other integrated products that target the small business market.

ICYMI: Revolut recently announced a new online payment feature, Revolut Pay, which “allows consumers to pay at an online checkout with just one click.”

See TechCrunch

For LatAm payment orchestration startups, market fragmentation is a blessing in disguise

The Linus Foundation announces the OpenWallet Foundation to develop interoperable digital wallets

YC Batch shows that the founders are still optimistic about fintech

Image credit: Feed/Kristina Herrmann, business manager

Financing and M&A

See TechCrunch

Ratio bags $411M in equity, credit for flexible subscription payment models

Kenyan insurtech Turaco maintains 1 billion user goal as it raises $10 million in funding

Denim, a fintech platform for freight brokers, raises $126 million in equity and debt

Allocations have just been valued at $150 million to help private equity funds lure smaller investors

Payall lands $10M in 16z-led seed round to help banks facilitate more cross-border payments

Rent-to-own fintech startup Kafene raises $18 million to take on BNPL

Southeast Asian fintech Fazz raises $100 million in Series C to serve businesses of all sizes

Nigerian financial management app for sellers. Kippa receives USD 8.4 million in new funding

Fintech startup Power flexes its credit card muscle after $316M equity, debt injection

Indian fintech Cred will invest in lending partner Liquiloans

And other places

Alternative platform for managing resources Ethic bags $50M

Composer raises $6M for automated investment platform

Redfin CEO, DoorDash co-founder invests in new startup, Far Homes, building a portal for Mexico real estate

German software company Candis raises $16 million to expand AP automation

Splitit drives installment-as-a-service growth with $10.5 million in funding

PortX launched as new entity by ModusBox and secures $10 million in new funding

JPMorgan Chase is buying payments fintech Renovite to help it battle Stripe and Block

Whew. It was a lot, and if this week was any indication, the fourth quarter is going to be crazy. I’m heading out now in an attempt to update this weekend. Hope you do the same! See you next week! xoxoxo Mary Ann

In case you’ve been hiding under a rock and haven’t heard, TechCrunch Disrupt is coming to San Francisco on the 18th-20th. October! I would certainly like to see you there. Use code INTERCHANGE to get 15% off (excludes online and expo), or just click here.