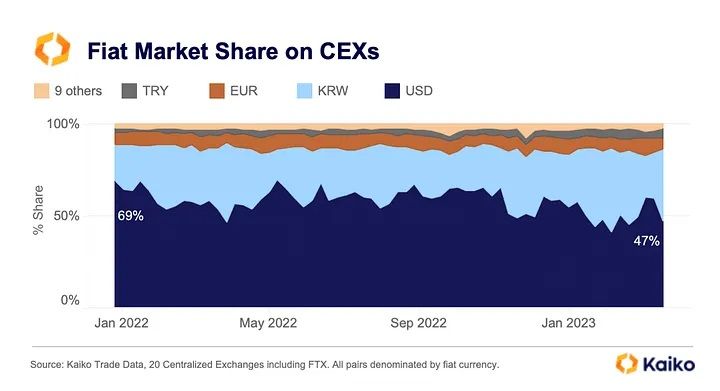

Trades denominated in US dollars fall to 47% on crypto exchanges

Fiat trading on dollar-denominated crypto exchanges has fallen from 69% to 47% in the past year, according to Kaiko. Meanwhile, the ratio between Bitcoin and Ethereum is at its highest since July 2022.

The US dollar takes a hit, as its fiat market share fell from 69% to 47% in just one year on centralized crypto exchanges (CEX).

US dollar market shares on crypto exchanges

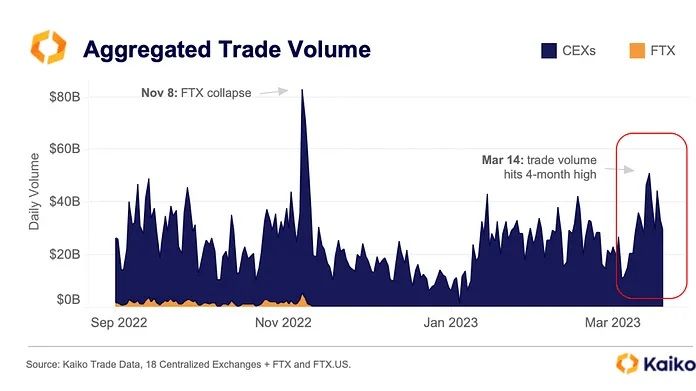

Kaiko, an institutional provider of cryptocurrency market data, talked about Bitcoin’s trading volume and price increase in a report. The market’s largest asset passed the $28,000 mark and continues to show strong momentum.

Kaiko notes that crypto trading volume hit a 4-month high of $51 billion on March 14, based on information from the 18 most liquid crypto exchanges. The previous peak came during the FTX collapse when trading volumes reached $80 billion.

However, one concern that Kaiko points out is low liquidity. The company stated that “liquidity remains thin” and that there is a “2% market depth for the BTC-USD and BTC-USDT pairs hit 10-month lows in the wake of Silvergate’s collapse.”

Stablecoins dominate usage on CEXs, and Kaiko believes that several events have led to excitement in this sector. As it stands, 78% of all trades on centralized exchanges are denominated in stablecoins, while only 19% of trades are denominated in fiat currencies.

An interesting point to note is that dollar usage has dropped from 69% to 47% in terms of usage. Meanwhile, the Korean won is showing good signs, being the second most popular fiat-denominated trading currency at 39%.

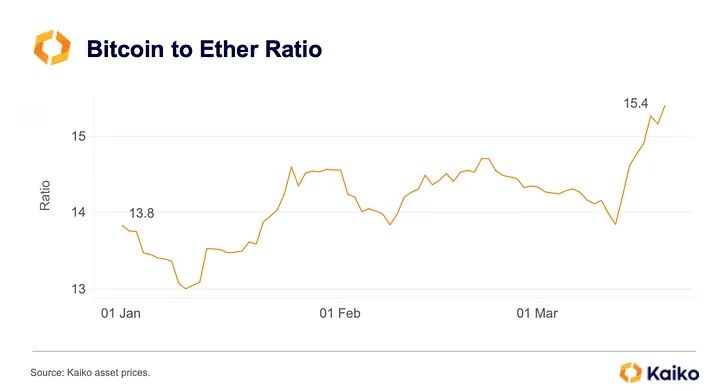

Record high Bitcoin to Ethereum ratio since July 2022

Kaiko’s report has many other interesting statistics that show where the market is headed. One of the more notable highlights is that the Bitcoin to Ethereum ratio is the highest since July 2022. This points to how strongly Bitcoin is outperforming the rest of the market. Since March 12, BTC is up 31% compared to ETH, which is up 18%.

While Ethereum has upgrades in the pipeline that could positively impact its price, regulatory challenges and decisions by exchanges are weighing it down. For example, Kraken recently announced that it would shut down its ETH staking service. A US attorney general also claimed that ETH is a security.

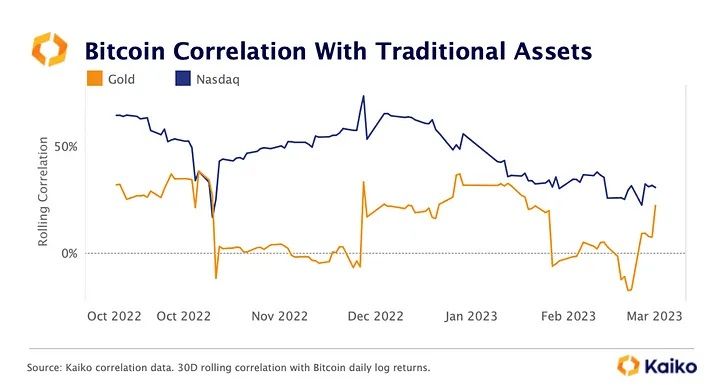

Declining Correlation Between Bitcoin and Stocks

Another interesting development noted by Kaiko is that Bitcoin’s correlation with stocks is falling. The 30-day rolling correlation between the asset and tech stocks was around 30% last week, but recently BTC has outperformed stocks in both absolute and risk-adjusted terms.

These figures prove that Bitcoin is resilient and a viable choice during periods of global economic turmoil. So far, the movement in the crypto market seems to confirm that, although investors will have to wait and see.

Disclaimer

BeInCrypto has reached out to the company or person involved in the story for an official statement on the latest development, but has yet to hear back.