The Creator CEO Panel – The information

There’s a new financial powerhouse in town: content creators. But creators have a unique profile that is currently underserved and different from other small businesses. Creators span all ages, are global by default, and need to be paid faster to create content at a viral rate – all of which opens up new opportunities for banks and fintech solutions.

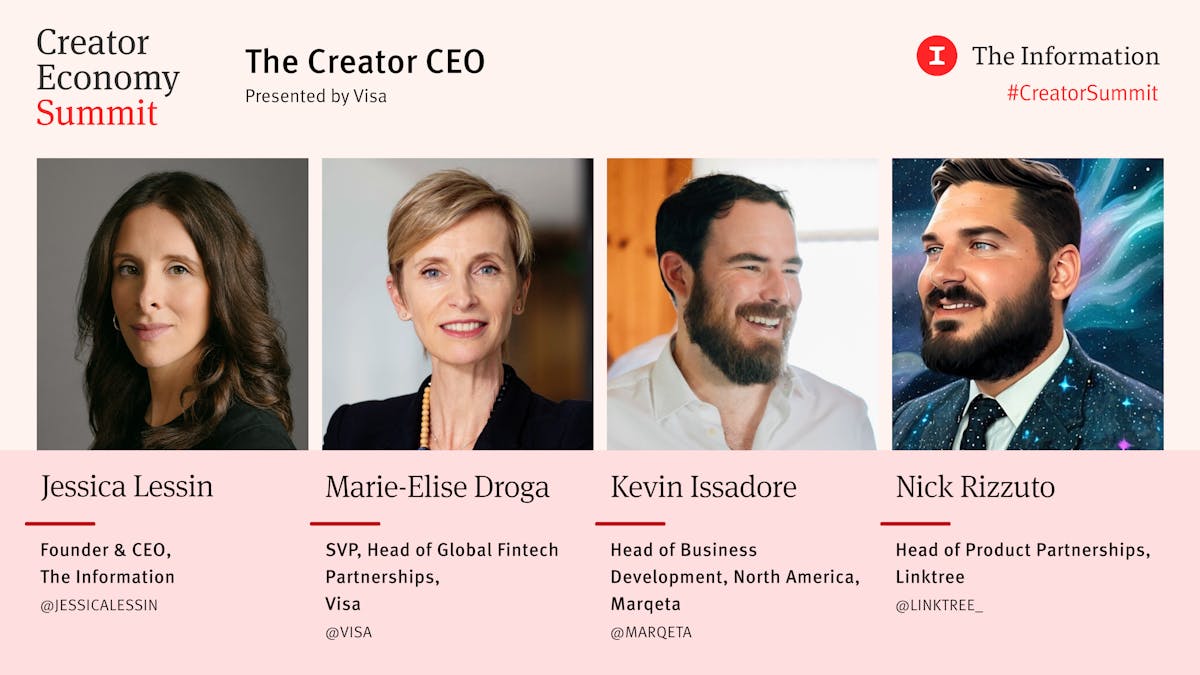

Jessica Lessin, founder and CEO of The Information, explored this during The Information’s 2023 Creator Economy Summit with three key panelists:

Marie-Elise Drogasenior vice president, head of global fintech partnerships, Visa

Kevin Issadore, Head of Business Development, North America, Marqeta

Nick Rizzuto, Head of Product Partnerships, Linktree

What sets creators apart from other small and medium-sized businesses?

Lessin started the discussion by asking about the differences between creative trade and e-commerce. Marie-Elise Droga from Visa was the first to take on the question. “I think the main thing that separates traditional e-commerce from social commerce is the community engagement. Buyers who engage with creators want a part of the brand. They want to support the creator. It’s a fan-based type of engagement, which we don’t really look somewhere else.”

Kevin Issadore added: “At Marqeta, we do payment processing. So I’m thinking about how I can track those payments. How do you make sure that the same financial services and access that’s available to your traditional SMBs filters through to the creative economy? »

Nick Rizzuto of Linktree – a platform that enables creators to easily share more than one link from various social media bios – added his POV: “What’s different about creator commerce is that the average creator is on at least seven platforms. They need a way to bring it together for sales and to understand their customers. That’s where we focus on the Linktree site. You also see curation as trade within the creative economy. They lead others to decide whether or not to buy. It is as valid a form of commerce as selling your own goods and services.”

Creative power rises

Lessin steered the discussion towards the recent expansion of this new market. They agreed that the pandemic was a major driver of growth, and Rizzuto pointed out that one in four Americans now identify as a creator. Droga said one of the unique segments of creators are those who are particularly young: “If you’re a young social creator, not even 18, you’re potentially making thousands of dollars a month. You can’t get a bank account based on that source of income, so your income has to go into your mum and dad’s bank account. Not a good feeling, right?”

Fintech opportunities abound

Young creators are just one of the many groups reshaping the way creators think

get payed. Droga sees these boundaries for creators as a great opportunity for fintech innovation. “We are just beginning to understand how vast and diverse the needs of this socio-economic group are. They live in the moment, and they need tools to have quick access to capital, payable almost immediately, to keep their business viral. It’s this disconnect between today’s payments infrastructure, which is geared towards slow-moving businesses versus the needs of this highly agile community that needs everything now. There is an extraordinary space for fintech to make a difference, to create tools and user experiences.”

Sharing Droga’s excitement, Issadore said: “What are the traditional financial services that you might have in a standard corporate job or even an SMB? How do you translate a hundred thousand dollars that you earn on a creator platform into a line of credit? It’s really hard to do today. There is a huge opportunity to provide a better economic platform for these creators.”

The creator market is open to solutions

Visa has already started creating a multi-tiered product specifically for creators, with the help of partners like Linktree. But what Droga is thinking about is putting the controls back in the hands of the creators. “I wish they had more choices,” she said. “Right now it’s the platform’s way or the highway.” Instead, she wants creators to have more choices about how they want to be paid, where they want the money to go (directly to their bank account or mobile wallet) and whether they want to be paid in. their local currency.

The creative economy is incredibly ripe for innovation, and that’s what fintech companies are particularly good at: taking a case of need with complex problems and offering elegant, simple solutions. Soon, creators will be able to bring Tik Tok dances, fashion finds and Instagram-famous recipes straight to a banking solution made for them.

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/thenational/I3VGATIAYBLNZ5DWOVKUYJAHFI.jpg)