The collapse of FTX is ultimately bullish for Bitcoin

Anthony Kwan/Getty Images News

The collapse of FTX (FTT-USD) from one of the world’s largest crypto exchanges to bankruptcy in just a few days has been disturbing. Despite its secrecy as a private company, FTX was seen as one of the few winners to walk away back to Q2 crash in crypto by making expandable headlines lines of credit to more troubled industry players. In fact, the events of the past week proved to be the proverbial last shoe to drop in crypto, sending prices to a new cycle low.

That said, we see some positives emerging in the outlook for Bitcoin (BTC-USD) which could consolidate its position as the “gold standard of crypto”. The fall of FTX is more a story based on possible misconduct and lack of regulatory compliance than a critique of the potential of digital assets. With this measure, nothing has changed in the long-term bullish case for BTC.

What can get lost in the discussion is that the decentralized public blockchain of Bitcoin remains as secure as ever, with trust in the protocol helping to confirm its role as a store of value and alternative asset. The setup here is that by getting past this short-term volatility, Bitcoin can enter the next bull market stronger.

The fall of FTX

With the details of the demise of FTX still playing out, the gist of the story has all the hallmarks of a classic bank run. Rumors swirling on social media about a liquidity crisis fueled a wave of withdrawals from the platform. FTX was forced to halt further transactions based on a lack of sufficient capital reserves. The situation worsened based on the group’s reliance on the funding FTT token (FTT-USD) which faced an accelerated selloff, losing more than $7 billion in value over a week.

Seeking Alpha

Disgraced CEO Sam Bankman-Fried tweeted about his misunderstanding of some high-level risk calculations, apparently based on bad ones internal marking of bank-related accounts, leaving a significant deficit in the spread with user margins. The latest update is simply that FTX and its more than 130 affiliates have filed for bankruptcy.

For us, the development came out of left field, in part because the crypto sector had built up a sense of stability over the past few months. There was no market volatility event that triggered the company’s apparent crisis. At the same time, there is a thought that this was the final capitulation that was necessary for the sector to reset and move on.

Everything is bad

The way we see the situation is that the real losers in 2022 are the ecosystem of centralized players and a group of crypto “altars” that have failed to live up to their hype. FTX and its FTT token is the latest, but let’s also remember some of the other failures this year like “Celsius network” (CEL-USD) which exposes the risk of “stablecoins” which terraUSD coin (UST-USD) and LUNA token (LUNC-USD) crashed.

There was also the collapse of crypto lender Voyager Digital (OTCPK:VYGVQ), which curiously was later bought by FTX in a fire sale for $51 million, down from a peak value of $1.5 billion. The wider sector has also been plagued by hacks and marketing scams.

Again, the important difference is that these groups and related alternative cryptocurrencies are not related to Bitcoin where trust in the security of its peer-to-peer blockchain network underpins its value. There may be other firms that fall and centralized exchange security will always be a concern, but the setup here is that Bitcoin may remain king of the hill.

Even as bitcoin bulls from the early 2020 run, one of the knocks on the upside price potential was that even with the supply cap of 21 million bitcoins, the universe of alternative cryptocurrencies was limitless. The allure to altars has always been this underlying hope that “maybe you missed Bitcoin’s run from under $1.00 to $10,000,” but that kind of return may be possible with the latest and greatest coin gimmick. That kind of thinking is likely to take hold in the future.

While some top-tier alts like Ethereum (ETH-USD), Litecoin (LTC-USD), Ripple (XRP-USD) and Cardano (ADA-USD) have their place with defined utility or unique applications, consider it over 9,000 other cryptocurrency examples with many questionable structures. In our view, the crypto bubble that appeared this year was in the atmosphere of tokens that were created only for speculative purposes. While we can debate which cryptos are “bad money driving out the good”, FTT and LUNA are just two examples that everyone can agree should not have existed.

Bullish on Bitcoin

The way we see it playing out is that more regulation is coming to the sector in an attempt to improve safety and financial transparency in the name of investor protection. Much of it will likely be aimed at crypto-finance or DeFi that often use a related token as a critical part of their blockchain infrastructure. The effect is likely to be fewer initial coin offerings going forward with higher thresholds, allowing the current sector leaders to take a larger share.

All these changes can be positive for Bitcoin because it has already established itself as the most important resource in the public blockchain space. Investors who recognize this dynamic will continue to position BTC higher up the sector hierarchy, as the target of institutional capital in the digital asset segment. In other words, an investment in BTC can be seen as having a better return to risk profile compared to other crypto-everything or especially over crypto-finance startups.

It is worth summarizing some of the high-level secular trends that support both the growing use of Bitcoin and its higher price in the long term. First, the concept of BTC being digital gold is alive and well. Like any other asset class, there are risks, but Bitcoin can play an important role in the context of a diversified portfolio for all investors.

The movement by high-profile institutional asset managers to facilitate the use of crypto has moved forward. Everyone from JPMorgan Chase & Co ( JPM ), Blackrock Inc ( BLK ) to Goldman Sachs ( GS ) offers crypto-related products and has worked to ease investor access and make crypto more legitimate. An important milestone in the regulatory framework has already moved forward as an important foundation in the US and globally.

Second, adoption is increasing. Over the past few years, BTC has proven to be an effective form of decentralized non-governmental money. Reports of consumers using bitcoin for international money transfers in emerging markets highlight its global appeal. Its ability to transcend the traditional economic system is useful to a large number of potential users. The collapse of FTX or any token does not change that.

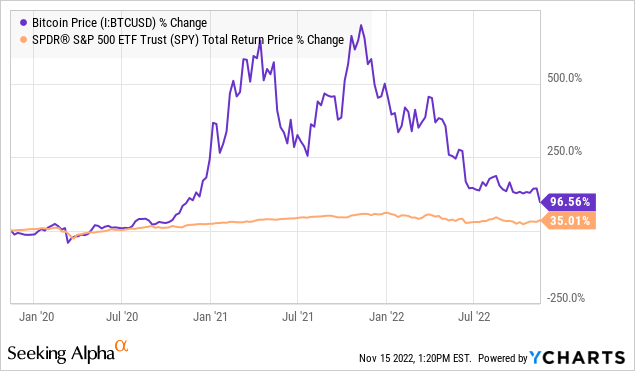

The bottom line here is that Bitcoin is here to stay and the outlook is possibly stronger than ever. As bad as the correction and extreme volatility has been, remember that BTC is still outperforming the S&P 500 (SPY) from pre-pandemic levels nearly 3 years ago. The last performance is relative. There are several blue-chip stocks that have fallen further percentage-wise from their 2021 highs.

BTC Price Forecast

We mentioned that we were surprised by the FTX news and that if ever there was a place for the bottom to fall out completely, this was it. By this measure, it is encouraging that BTC currently trading around $17,000 is off just a few points from the June lows, suggesting an underlying level of support, with long-term investors still holding on.

source: finviz.com

The next few weeks will be important in terms of the immediate fallout from the FTX bankruptcy. We want to avoid headlines from other major companies dropping on this matter, but recognizing the price action in the crypto sector will lead the story. Staying above last week’s low of $15,632 in BTC is a good first step. The biggest risk right now is an even bigger shoe dropping, which would point to some signs of a more structural weakness in crypto.

Fast forward, other macro indicators look more favorable. Prospects for falling inflation with stabilizing interest rates have already helped kick-start a pullback in the US dollar, which had been trading particularly strongly. A weaker USD should by definition be positive for all foreign currencies and cryptos like Bitcoin. In a scenario where risk sentiment improves in financial markets through 2023, supported by better-than-expected macro data, we believe Bitcoin as a high-beta trade will outperform the upside. The first target here will be $20k as a critical technical level to cross.