Stocks Jump 2%, Bitcoin Close to Touching $29,000 – Trustnodes

The Nasdaq is up more than 2% on an all-green day as a new acronym enters the lexicon: Buy The Effing Pivot (BTFP).

The official one is called the bank term funding program (BTFP) of the Federal Reserve Banks, otherwise known as non-QE.

In explaining non-QE, that is, issuing loans to commercial banks without considering losses in the value of the collateral, the chairman of the Federal Reserve Banks said it is not QE because their goal is not to lower lending rates.

The intention of launching quantitative easing through borrowing bonds was to lower their interest rates and thus the lending rates of commercial banks to get liquidity going again, he said.

BTFP is instead loans, he said, and so it’s not QE, but everyone else thinks it’s because at the end of the day loans are basically money printing, as that’s how fiat works, and loans that value your house at $1 million when the market says it’s worth $100,000, money printing is on the margins of potentially insolvent entities, in which case the Fed won’t get the money back to make it print the taxpayers.

Fortunately we can see how much they print but delayed because this is the paper system and we have to trust them to tell the truth because there have been no audits by the Fed and they don’t have a blockchain where we do the audits.

They lent out $300 billion last week. The data for how much they have lent since will be out later today at 4:30pm EST when the Fed releases its balance sheet when we can see how much non-QE has been added.

The market can also reprice another type of pivot. Powell said they expect interest rates to be at 5.1% by the end of the year if the economy grows — or doesn’t grow — as projected.

Interest rates are currently at 5%, so interest rate hikes are over. Maybe they’ll increase it a little more by 10 basis points, but the hike, hike, hike we’ve had for months now is in the past.

Powell also said no rate cut this year, but they expect rates to be 4.3% next year, so rate cuts are coming, and even lower to 3% the year after.

As markets like to look ahead, the big question is whether we have had the recession in the asset space, although the economy has not yet and may well soon.

Whether assets are not catapulting, but have been at the forefront, and so we need to assess what the situation will be like in 9 months, not now, after the economy ends the full recession, if it has one.

That’s the pricing in theory, that the potential for recession has been known and that stocks fell, but for months there has been a debate about when the Fed will stop and that they say they will is new, something that may not have been priced in .

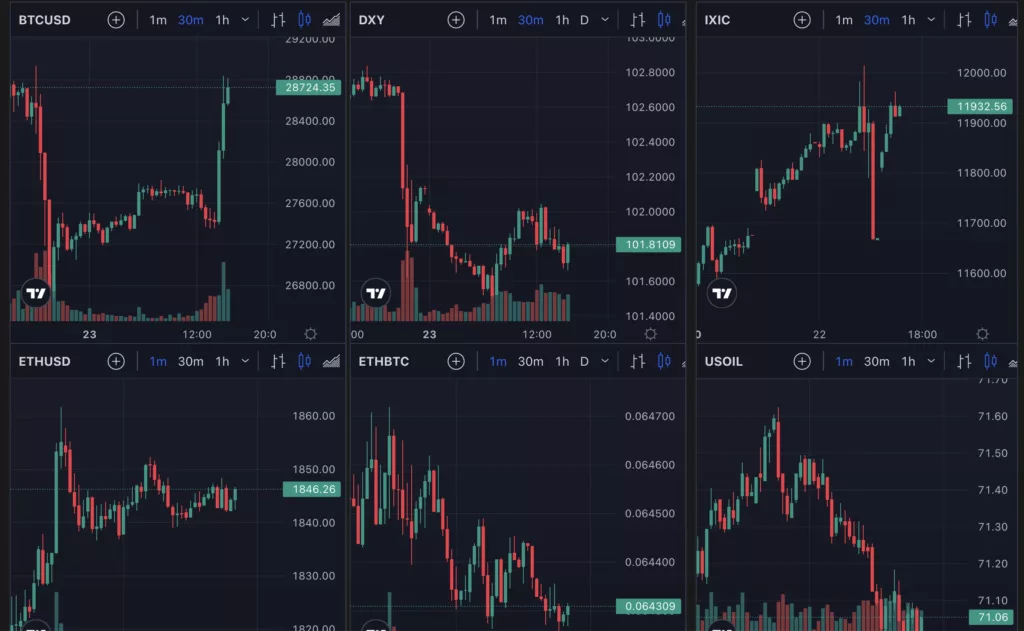

That’s a potential explanation for today’s move with bitcoin rallying to almost touch $29,000 again after dipping below $27,000, showing some strength as the crypto sits just below $30,000.

Some now expect it to reach $50,000, but perhaps short, and some even say it could reach a new all-time high – the latter being analysts at trading houses.

It would be very surprising, $50,000 would not, but bitcoin is back in the game and many are happy with just that.