Before you buy a phone, laptop or anything else, you want to make sure it works by testing it out; the same practice should be carried out in commerce. You must not use your trading strategy in the live market without testing whether it works or at least having an idea of the results it can produce, which is why you must backtest it.

What is backtesting?

Many new traders go through the cycle of developing a strategy that seems to work, using it for a while, and abandoning it after losing a number of trades. They then look for other strategies and repeat the cycle. As a result, many of them give up trading, believing that no one can be consistently profitable in the crypto market or that crypto trading is not for them.

So instead of going through the cycle of stopping using one trading strategy and choosing another when you start losing trades, you can test your strategy with data to see how it would have performed over time without risking any money. A positive result will help you have more confidence in such a strategy.

Backtesting allows you to assess the potential performance of your crypto trading strategy based on historical data. The idea is that whatever result a strategy produces on historical data is likely to repeat itself. A strategy that gives good results by testing it against historical data thus has a high chance of performing well in future market conditions and vice versa.

4 Reasons Why You Should Retest Your Trading Strategy

Below are some benefits of backtesting your trading strategy.

1. A zero risk strategy testing

You don’t have to risk your trading capital when testing your strategy. Instead of testing your trading strategy on a live trading account, backtesting is an ideal solution.

2. Refine your strategy

Backtesting reveals the strengths and weaknesses of your strategy. You can then use the information to adjust your strategy to your trading needs and personality type.

3. More confidence in your trading strategy

Backtesting allows you to try different marketing strategies to choose the best one. This practice will increase your confidence in your strategy, especially if it performs well across a large body of market data.

4. Get new ideas

Since the backtesting process exposes you to a lot of data, you are likely to see more repetitive trading patterns, making it possible to gain new trading ideas in the process.

Two ways to test your strategy

Backtesting your crypto strategy can either be done manually or automatically.

Manual Backtesting

Manually backtesting your strategy will require placing trades on the historical data yourself. To perform manual backtesting, you must perform the following steps.

- After opening an account with a trusted crypto exchange, open the chart layout for the desired asset.

- Backtesting requires a strategy. You also need to decide which tools and indicators you want to use. For example, your strategy could be to trade trend rebounds (either bearish or bullish) on BTCUSD on an hourly time frame after the price bounces off the 61.8% level using the Fibonacci retracement tool. The 61.8% Fibonacci level must also form a confluence with the trendline to validate the move.

- Since you now have a strategy, the next thing is to scroll back to where you want to start the backtest. In the case of BTCUSD, you can start from as far back as 2013. You can then look for trends on the one-hour chart to see the possibility of a trend continuation after a retracement that meets your stated requirements.

- When you see a relevant setup, you should use the tools and indicators you want to test on the chart. In this case, the Fibonacci retracement tool and the trend line. Then draw the diagram as you would have done if you were to change the move when it first happened. After doing so, move the chart forward from candlestick to candlestick to see the result. The idea is to move the chart forward slowly to see the outcome of the trade and then document the result.

- While writing down the result, you can keep scrolling to get new setups, use your trading tools to analyze them and move on to see what happened. Repeat this process until you have gone through a lot of data. Some platforms like TradingView allow you to play and pause the historical data automatically, so you don’t have to scroll yourself. You can also control the replay speed on the chart. This is available to the platform’s Pro, Pro+ and Premium users.

Manual backtesting can help you master the bad trading psychologies since you will be emotionally involved to some extent. The method also does not require you to have any coding skills.

On the flip side, manual backtesting is time-consuming as you have to analyze a lot of historical data to get your results. It is also easy to make mistakes when tracking past data or the results. Manual backtesting also becomes more tedious if you try to evaluate multiple time frames.

Automated Backtesting

This backtesting method helps you use technology to test whether your strategy is working, usually using coding to streamline the process. It allows you to test your strategies practically and faster over a long period of time. You can then use the generated data to determine if your strategy is adequate and what to adjust.

Automated backtesting works in the same way as manual backtesting does. You also need to choose a time frame, your trading asset and the strategy you want to test. The main difference is that you don’t need to set up every process, write down every order and calculate profit and loss yourself – they are all done automatically.

The main challenge with automated backtesting is that you may need to know how to code or at least have easy access to coding experts.

Disadvantages of backtesting your strategy

While it is always useful to test out your crypto trading strategy, there are some downsides.

Past success does not guarantee future results

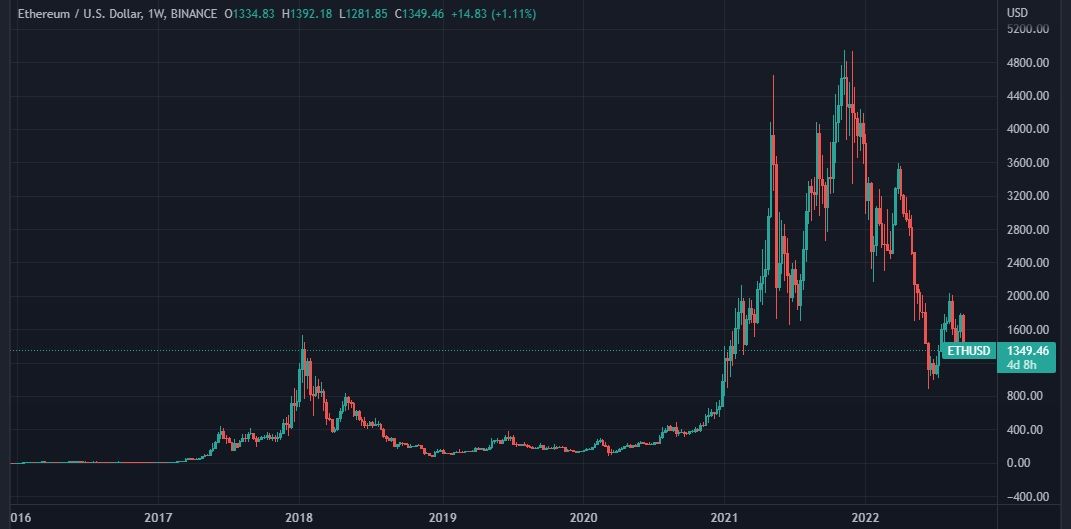

Adjusting and refining your strategy based on historical data results can affect effectiveness. Market conditions are constantly changing. Therefore, a strategy that worked well in the past may not work well in the future. It is also possible that the historical data you use is characterized by many unwanted market events, negative and positive emotions, etc.

For example, market conditions during the 2020 pandemic shutdown may not represent normal market conditions, and results obtained through such data may not be a good representation of market conditions in the future.

The crypto market is still new

The crypto market is relatively new and some tokens do not have enough data to test your strategy. Consider, for example, the Shiba Inu; you can only access charts and data from late 2020, which may not be enough to conclude any defined pattern.

The crypto market is also young and unstable, which makes it difficult to detect specific patterns like in the currency and stock markets. To a large extent, Bitcoin’s price still greatly influences the price of many other cryptocurrencies.

3 important tips about crypto backtesting

The following tips will be helpful when testing your strategy.

1. Don’t be selective with data

Make sure you use random data sets, not just sets that seem to favor your strategy. You shouldn’t cheat yourself by only using past data that makes your strategies look good. This practice will only set you up for failure when using real-time data.

2. Be thorough

There is no need to rush. Being thorough will help you spot any errors that causal backtesting may have missed. Leave no stone unturned. To be thorough, you need to use as much data as possible to see how your strategy works in different market situations.

3. You will never have a perfect strategy

All strategies have their flaws or times when they experience losing streaks. All you want to ensure is that whatever trading style you use will be profitable in the long run and produce the desired result. You also need to use some risk management practices to make this happen.

Choose your backtesting style

Backtesting can help your crypto trading strategy when executed correctly. When deciding which is best between manual and automated backtesting, you need to consider various factors such as how much time you have to backtest, your personality, etc.

Manual backtesting can be very time-consuming, and it can also lead to errors. On the other hand, automated backtesting is less cumbersome but requires technical knowledge to create it or access to experts who can create the necessary software. Nevertheless, the two ways of backtesting have proven reliable in many financial markets.

The information on this website does not constitute financial advice, investment advice or trading advice and should not be considered as such. MakeUseOf does not provide advice on any trading or investment matters and does not recommend that any particular cryptocurrency should be bought or sold. Always perform your own due diligence and consult a licensed financial advisor for investment advice.