Nu Holdings: Blazing Fintech Growth with Outstanding Execution (NYSE:NU)

gorodenkoff

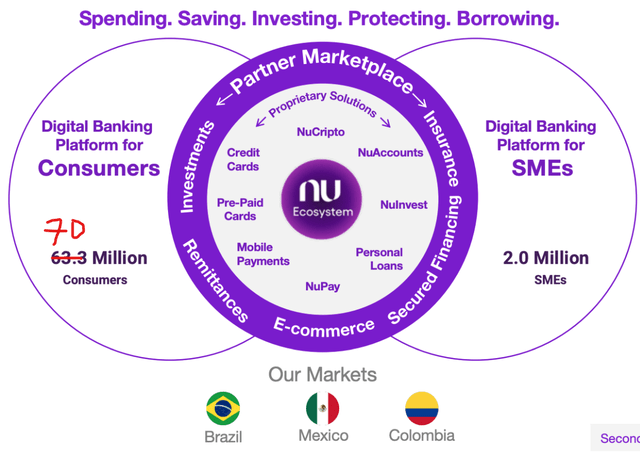

Nu Holdings (NYSE:NOW) also known as “Nubank” is the largest fintech bank in Latin America and the sixth largest financial institution in the region. The company just announced a record quarter with revenue growth of over 170% year over year. In my previous post on Nu Holdings, I outlined the possibility for this stock to “bang unbanked” in Latin America. As of this post, the stock is up ~14% in premarket trading after this outstanding quarter. As an additional data point, Warren Buffett’s investment conglomerate Berkshire Hathaway bought $1 billion worth of stock in the first half of 2022, at an average price of ~ $9.38 per share. The stock is trading cheaper than this price at the time of writing. Therefore, in this post, I will break down the company’s financials and valuation for the third quarter. For details on the company’s business model, check out my previous mail, the image below also helps to give you an idea of what this financial “super app” does. I have updated the consumer customer column to 70 million as the business is growing rapidly.

Nubank business model (investor day presentation)

Solid third quarter

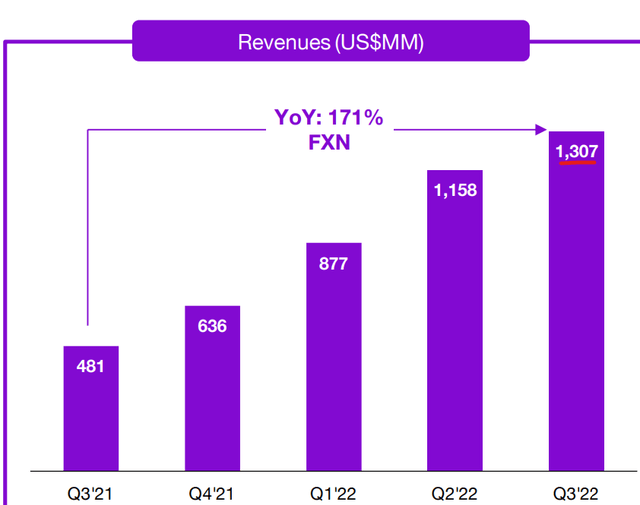

Nu Holdings generated solid financial results for the third quarter of 2022. Revenue was $1.3 billion, which was up a whopping 171% year-over-year and beat analyst estimates by $120 million (FX Neutral).

Income (Q3.22)

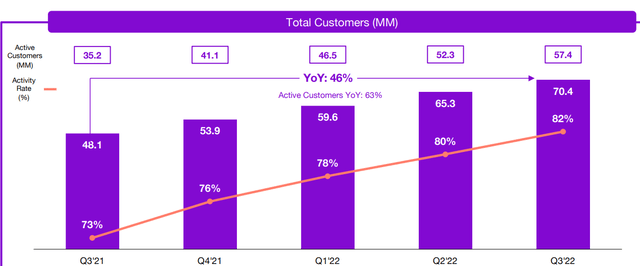

Top line revenue growth was driven by two main factors; customer growth and average revenue per user growth. The company added 5.1 million customers quarter-over-quarter, bringing its total to over 70 million, up 46% year-over-year. The beauty of this growth in customers is that it has been achieved mainly through organic channels, thus achieving a bottom-line customer acquisition cost. This is not unprofitable growth like you see in many growth companies when they overpay for user acquisition in hopes of generating long-term profits. Nu Holdings is also seeing faster growth in countries such as Mexico and Colombia, with these countries driving 500,000 new customers in the quarter.

Nu Holdings focuses on increasing user “activity rates” as inactive users don’t really generate much cash flow for the business. The company has achieved upward growth in activity rates which have increased from 73% in Q3.21 to 82% by Q3.22, [orange line below].

Users Nu Holdings (Q3.22 report)

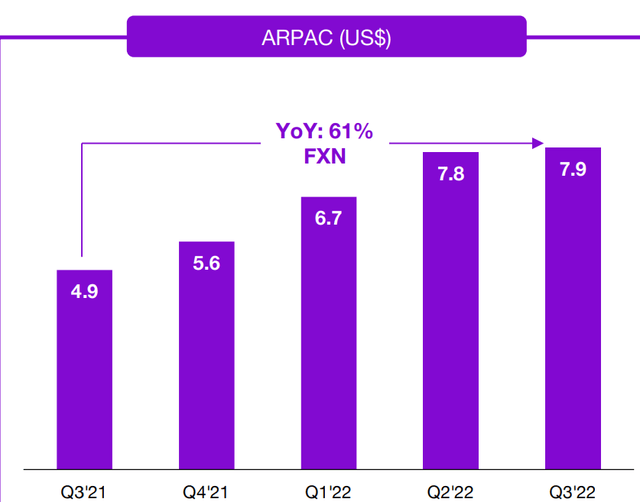

Nubank achieves this growth in activity through its ecosystem of products that help users “spend, save, invest, protect and borrow”. This also helps to increase the average income per active customer [ARPAC] which is up 61% year over year to $7.9. The active customers are also divided into different cohorts, and using a “land and expand” approach, the company has increased the ARPAC for its mature cohorts to $22, which is astounding. This ARPAC can be further expanded with partner programs and increased cross-selling across both credit and non-credit products.

ARPAC (Q3.22)

Nubank’s card business has seen a big boost in purchase volumes which are up a rapid 75% year-on-year to $21.2 billion [FX-Neutral]. The vast majority of credit card customers come from existing customers that Nubank then resells, as discussed earlier. Nubank has calculated that after a customer has been with the bank for 24 months, their average credit card spend typically triples, which is astonishing.

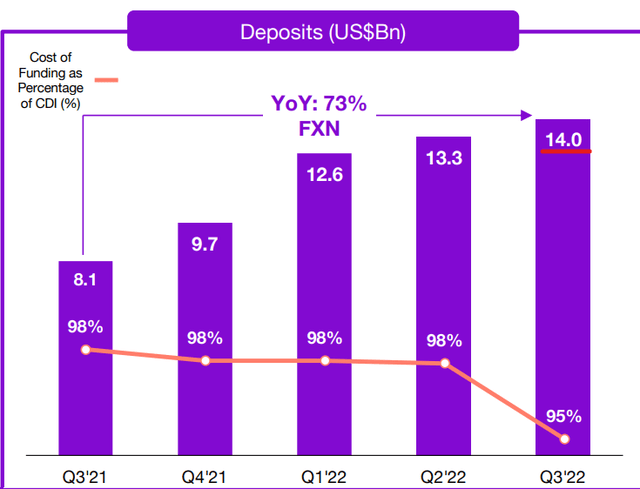

The company’s consumer finance portfolio, which brings together both credit cards and personal loans, grew a rapid 83% year-over-year to $9.7 billion. Total deposits increased by a rapid 73% year over year to $14 billion, as the consumer increases their savings in the bank, mainly due to customer growth, the macroeconomic environment and new deposit products.

For example, Nubank launched “Money Boxes” an investment targeting tool that aims to create customized deposits linked to goals. The product launched in mid-September and had a massive 1.7 million customers sign up within the first 2 weeks. Given that Nubank has a customer base of over 70 million, the product can increase deposits across the entire customer group over a longer period.

Deposits (Q3.22)

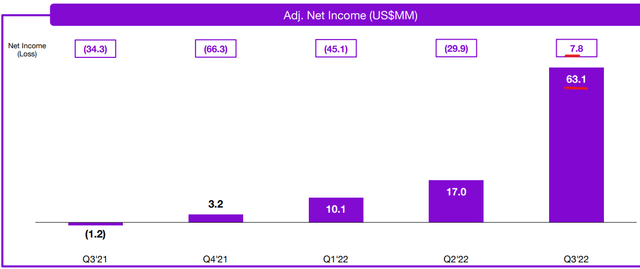

The company has gradually increased the efficiency of its platform, thanks to economies of scale. This resulted in net income going from negative $34.3 million in Q3.21 to positive $7.8 million by Q3.22. On an adjusted basis, net income has increased from negative $1.2 million in Q3.21 to positive $63.1 million by Q3.22.

Net income (Q3.22)

Nu Holdings is in a strong capital position with 4 times the minimum regulatory capital requirement in the countries it operates. In addition, the business has a loan-to-deposit ratio of 25%, which is fantastic. The business has $3.5 billion in loans, with total deposits four times this at $14 billion.

Advanced valuation

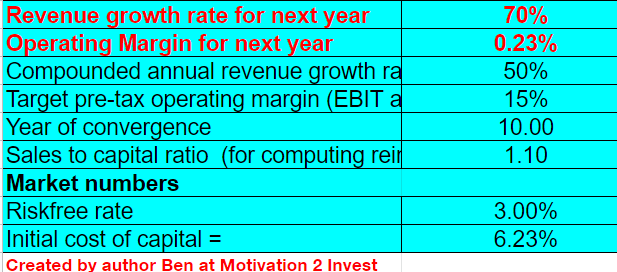

Valuing Nu Holdings is quite challenging as the business has become more complex thanks to its number of financial instruments. But using my discounted cash flow model I think we can get a good idea of the value. In this case, I’ve kept my revenue projections the same as my previous model. I have predicted 70% revenue growth for the next year and 50% revenue growth over the next 2 to 5 years.

Nubank share assessment 1 (created by author Ben at Motivation 2 Invest)

I have predicted that the business will continue to grow its operating margin to 15% over the next 10 years. I expect this to be driven by continued high operating efficiency, new products and increased cross-selling.

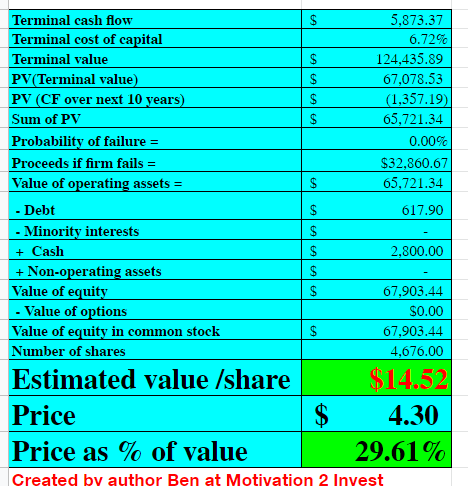

Nubank share assessment 2 (created by author Ben at Motivation 2 invest)

Given these factors, I get a fair value of $14.52 per share, the stock is trading at $4.30 at the time of writing and is therefore deeply undervalued, by ~70%.

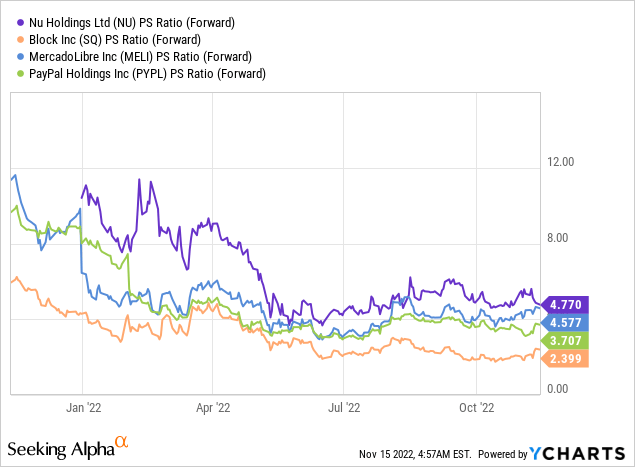

As an additional data point, Nubank is trading at price to sell = 4.77 which is cheaper than early 2022 levels of over 8. I noticed that the company is trading at a slightly higher value than other fintech apps like Block (SQ) ( PS = 2.4) and PayPal (PYPL), PS = 3.7. However, these businesses are not growing revenues at anywhere near the rate Nubank is, nor do they have as much exposure to the growing Latin American market.

Risks

Decline/decrease in payments

Brazil has a fairly high inflation rate of 6.47%, this is on a downward trend after the central bank has raised interest rates over 12 times. However, many analysts predict stagnant growth for Brazil and slowing exports at least next year. In general, poor economic conditions lead to lower consumption and thus lower revenues for fintech.

Final thoughts

Nu Holdings is a huge company that is running strong and growing fast. The business increases revenues, profits, customers and engagement while continuing to launch new products. The stock is undervalued due to macroeconomic uncertainty and also rather low profitability, although in the long term this looks to be a winner in Latin America.