NFT dominance on Ethereum drops to just 8.3% as interest remains low

Data shows that NFT transaction dominance on Ethereum has now dropped to just 8.3%, as interest around the market has remained low.

NFT dominance on Ethereum Falls, while Stablecoins pick up more share

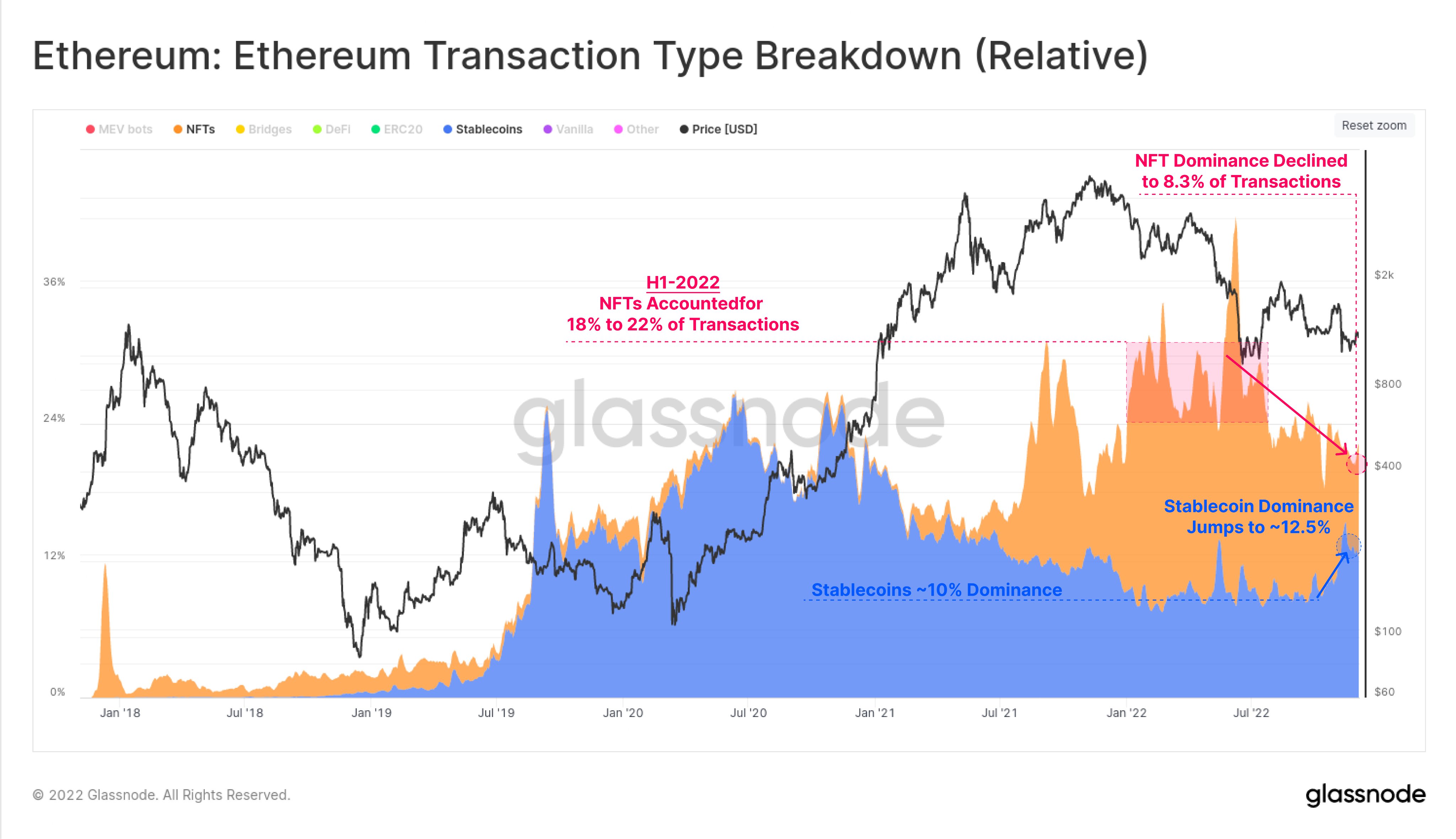

According to data from research firms in the chain Glass nodenon-fungible tokens accounted for 18% to 22% of total transactions on ETH in the first half of 2022.

The “dominance” here refers to the percentage of the total transactions taking place on the Ethereum blockchain that a certain type of token occupies.

ETH is a network that hosts a very rich ecosystem of applications, thanks to its smart contracts. Some of the popular on-chain constructs include stablecoins, NFTs, Decentralized Finance (DeFi) apps, and ERC20 tokens.

Here’s a chart showing how the dominance of two of these applications, non-fungible tokens and stablecoins, has changed over the past few years:

Looks like stablecoins have gained more dominance in recent weeks | Source: Glassnode on Twitter

As you can see in the graph above, NFTs thrived on the Ethereum blockchain during the first half of this year, accounting for around 18% to 22% of all transactions that occurred on the network.

During the same period, the dominance of all stablecoins on the blockchain hovered around a value of around 10%.

However, with the start of the second part of 2022, things started to change for the previously booming non-fungible token market.

The long and deep sector-wide bear market resulted in the fading of investor interest around NFTs, which manifested itself as a steep decline in the dominance of these tokens on the Ethereum blockchain.

Following this decline in the percentage of digital collectibles related transfers occurring on the network, the dominance of these tokens is now only 8.3%.

While the NFTs went through a decline, the stablecoins managed to hold their own and move mostly sideways, until the FTX crash came along, which actually resulted in an increase in the dominance of the combined stablecoin market.

Now, stablecoins contribute to around 12.5% of the total transactions taking place on Ethereum, more than the dominance of the non-fungible token market.

ETH price

At the time of writing, Ethereum’s price is hovering around $1.2k, up 6% in the last week. Over the past thirty days, the crypto has accumulated 23% in losses.

Below is a chart showing the trend in the price of the coin over the last five days.

The value of the crypto seems to have not displayed much movement during the last few days | Source: ETHUSD on TradingView

Featured image from Andrey Metelev on Unsplash.com, charts from TradingView.com, Glassnode.com