Krypto: Women lead the way

It’s no secret that the crypto ecosystem has been – and still is – male-dominated, including on the investment side and the management side. Although there has been progress and progress for equality since the days of “crypto bros and their lambos”, much effort is still required.

The Future of Finances: Gen Z and how they relate to money

Looking to diversify in a bear market? Consider these 6 alternative investments

In fact, a prominent data point is that of the 378 venture-backed crypto and blockchain companies founded around the world between 2012 and 2018, only one had a female founding team, and only 8.2% had a combination of male and female founders, according to a Diversity in Blockchain Report.

Likewise, the lack of diversity is also present in other crypto areas, including academia and government.

Yet against that backdrop, some women have achieved leadership positions in various fields and are paving the way, including Securities and Exchange Commission (SEC) Commissioner Hester Peirce and Ark Invest’s Cathie Wood.

“I find it incredibly encouraging and inspiring to see powerful women making their mark in a space dominated by men. This is a reinforcement that of course there is a place for us in crypto,” said Diana Brown, head of people at Eco. “So far, a few inspiring women have achieved leadership positions and are guiding the way for us – a reminder that there is plenty of room for all of us. We get to create the experience we want in these early days of crypto.”

Hester Peirce: ‘Crypto Mom’

Peirce, an SEC commissioner since 2018, is also known as the “crypto mom.” She is a staunch crypto supporter and is often a dissenting voice on the SEC’s regulatory stance on the space.

Take our poll: How do you usually split the restaurant bill?

For example, in response to the SEC’s announcement in May that it would strengthen the unit responsible for protecting investors in crypto markets by adding 50 dedicated positions, Peirce tweeted: “The SEC is a regulatory agency with an enforcement division, not an enforcement agency. Why Are we leading with enforcement in crypto?”

While women are underrepresented in the crypto industry, it is even rarer to have a regulator who is female and also very pro-crypto, some observe.

“This is where Hester Peirce of the SEC comes in,” said Ming Duan, co-founder of Web3 bond market platform Umee. “It’s no surprise that the SEC and the crypto world have experienced tensions recently, and yet Hester has held his own and shown that a new perspective is needed towards new technologies, showing that there is plenty of room for the old system to adapt. and progress. I think that’s why everyone refers to her as the crypto mom.”

The industry really appreciates her diligent and good work, including smart suggestions like the safe harbor idea, Duan added.

In April 2021, Peirce proposed the safe harbor, which “seeks to give network developers a three-year grace period during which they may, under certain conditions, facilitate participation in and development of a functional or decentralized network, exempt from the registration provisions of the federal securities laws.”

Duan said this makes her “hopeful that more women will not only get into crypto, but also government, and Hester Peirce is really the role model for the latter.”

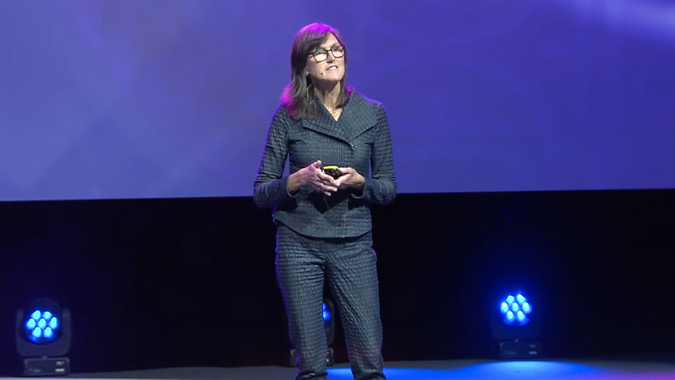

Cathie Wood: A positive force and visionary

Wood, CEO and CIO of Ark Invest, is known for his bold predictions and moves, as well as being a big fan of Bitcoin and being a visionary.

“We believe Bitcoin is the most profound application of public blockchains, the foundation of ‘self-sovereign’ digital money,” Ark wrote in a January report. “The Bitcoin protocol has enabled two other revolutions: the financial (DeFi) and internet (Web3) revolutions.”

According to Ark’s estimates at the time, the price of one Bitcoin could exceed $1 million by 2030.

While the crypto world has taken a downturn in recent months, Wood reiterated his prediction in April, telling Yahoo Finance: “I don’t think people believed me when I said that on stage last week at Bitcoin 2022. But I meant it.

“And a lot of people think, ‘OK, so you’re assuming that institutional investors are going to be big owners of Bitcoin.’ No, we’re not. However, we’re assuming that they’re going to move in gradually.”

Kayla Kroot, co-founder at Koii Network, a decentralized publishing protocol and Web3 library, said: “While ARK hasn’t had the best year, this can be said of so many forward-thinking ventures in any market; and, taking a step back, should We recognize what a positive force Wood has been on important technological breakthroughs through his investment knowledge.”

According to Kroot, Wood sees trends years ahead of the pack, and her early understanding of Bitcoin’s potential to transform the economy is a perfect example of her ability to predict trends.

“When all the naysayers told her that Bitcoin, and crypto as a whole, wasn’t worth much, she stuck to her instincts.” Kroot said. “And she has been proved right. Although the price of Bitcoin has declined this year, the crypto market and the technologies that support the industry are not going anywhere.”

In addition, Kroot said Wood has remarkable leadership skills and an innate ability to identify frontier technologies that will one day change the world.

“She is an inspiration not only to women in crypto, but to all women and beyond people who strive to be the best in their professional development,” Kroot added. “I think in five years we’ll look back and think how Wood was right about so many early technologies.”

More from GOBankingRates